Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 1, 2013, May and Nora formed a partnership. May is to invest assets at fair values. She is to transfer her liabilities

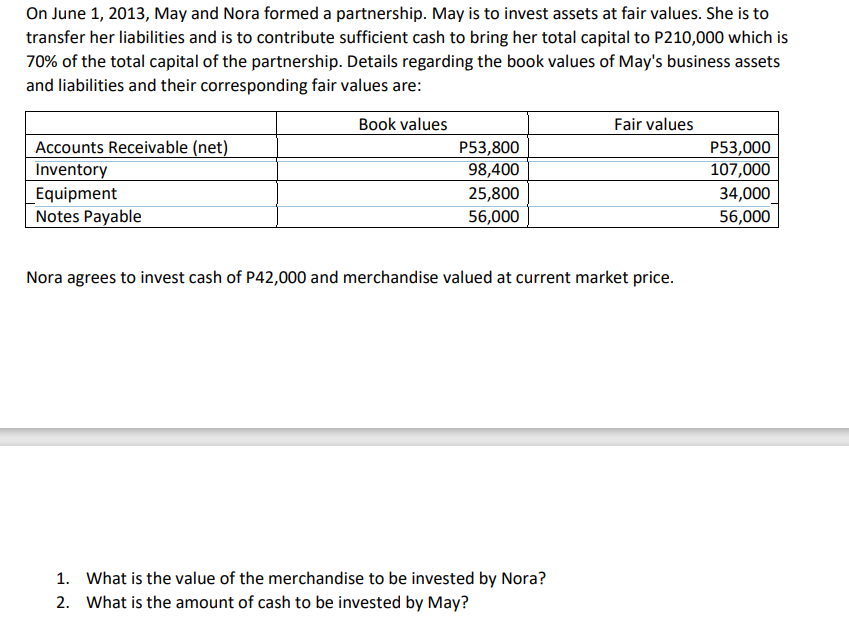

On June 1, 2013, May and Nora formed a partnership. May is to invest assets at fair values. She is to transfer her liabilities and is to contribute sufficient cash to bring her total capital to P210,000 which is 70% of the total capital of the partnership. Details regarding the book values of May's business assets and liabilities and their corresponding fair values are: Book values Accounts Receivable (net) Inventory Equipment Notes Payable P53,800 98,400 25,800 56,000 Fair values Nora agrees to invest cash of P42,000 and merchandise valued at current market price. 1. What is the value of the merchandise to be invested by Nora? 2. What is the amount of cash to be invested by May? P53,000 107,000 34,000 56,000

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine the value of the merchandise to be invested by Nora we need to calculate the total fair ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started