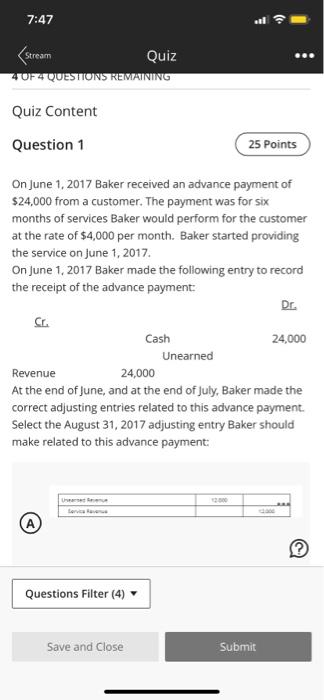

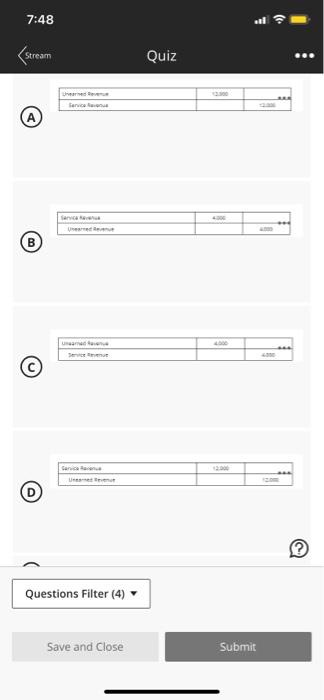

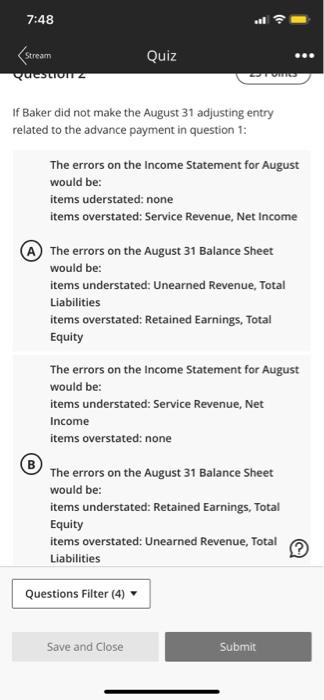

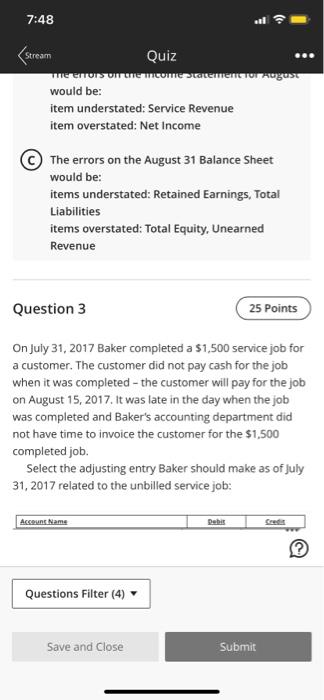

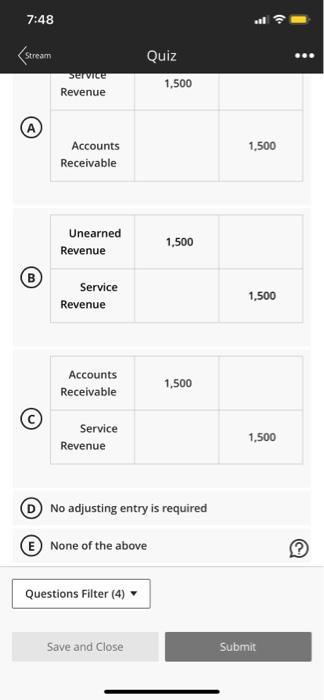

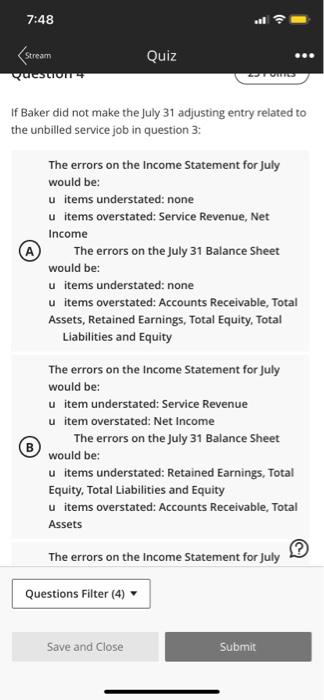

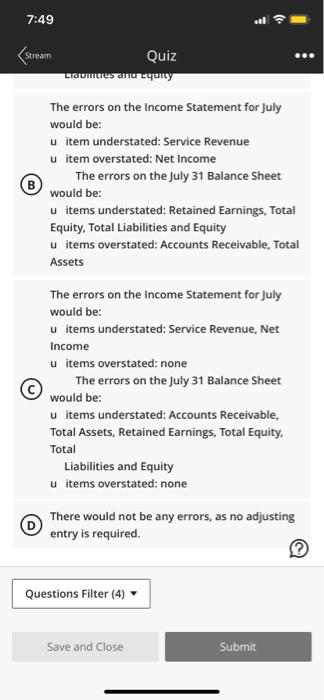

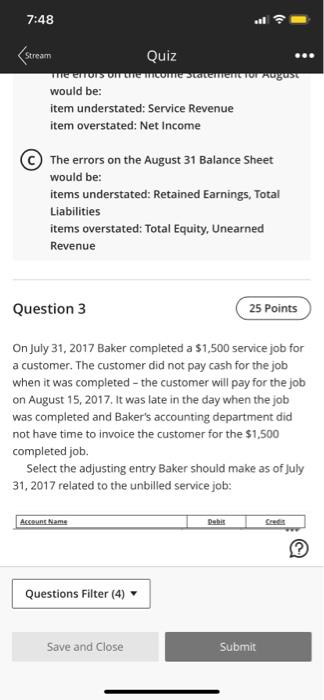

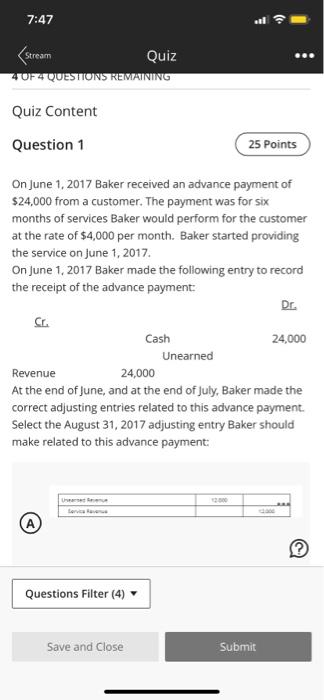

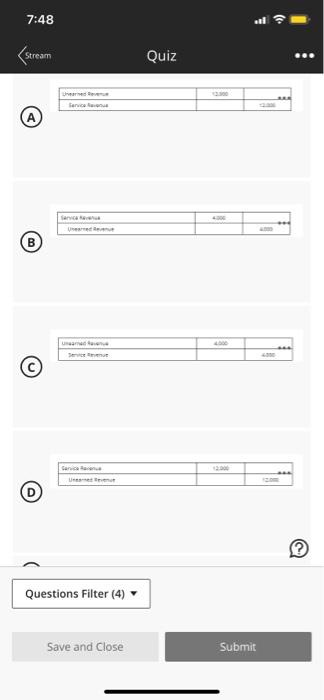

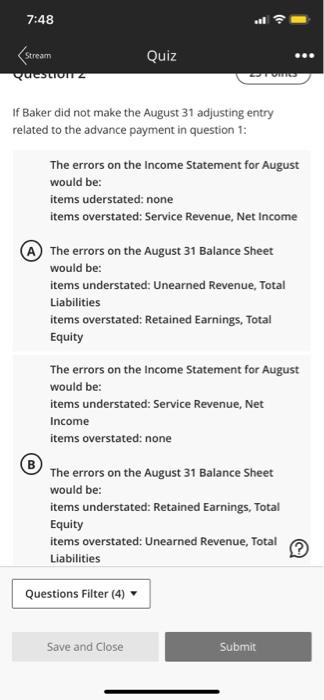

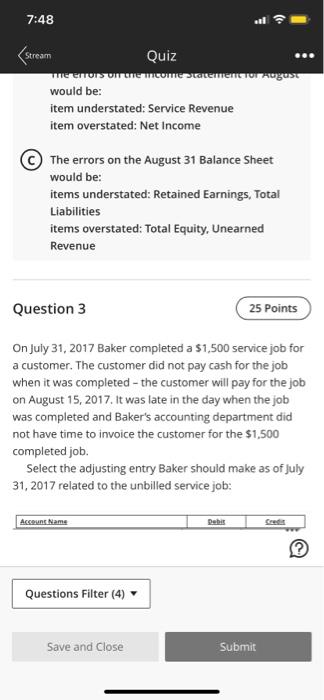

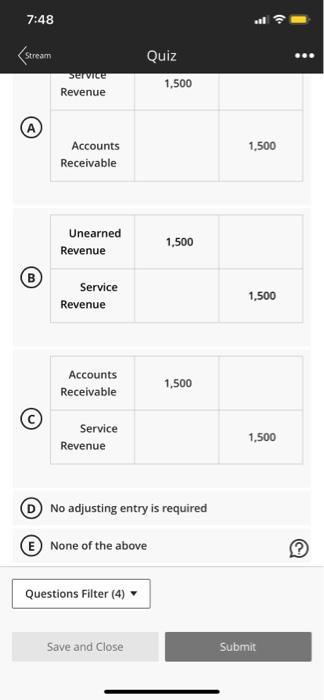

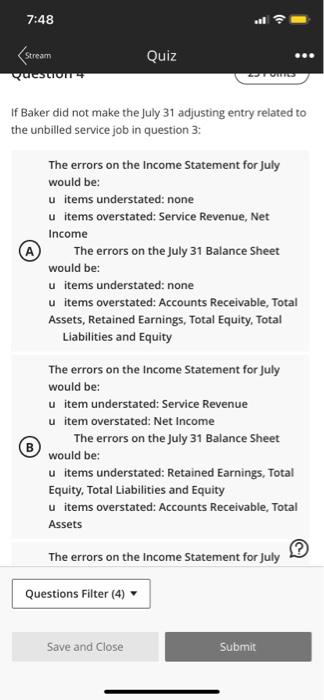

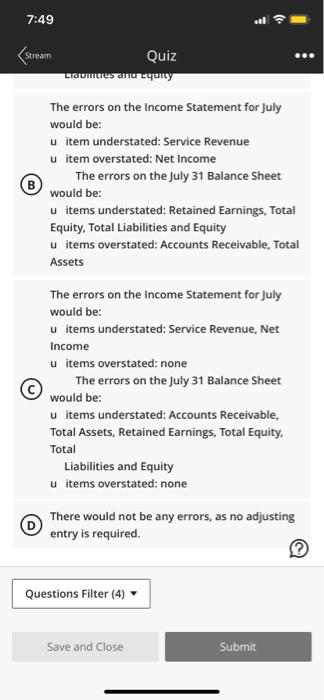

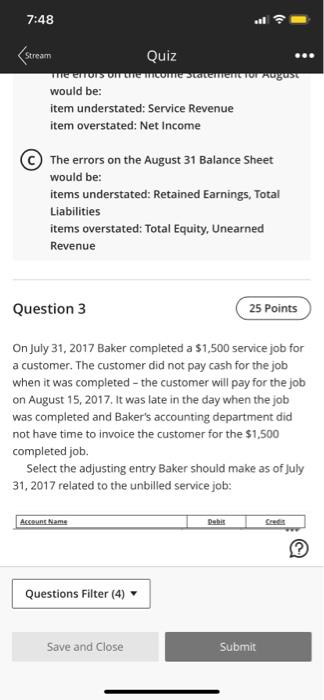

On June 1, 2017 Baker received an advance payment of $24,000 from a customer. The payment was for six months of services Baker would perform for the customer at the rate of $4,000 per month. Baker started providing the service on June 1, 2017. On June 1, 2017 Baker made the following entry to record the receipt of the advance payment: At the end of June, and at the end of July, Baker made the correct adjusting entries related to this advance payment. Select the August 31, 2017 adjusting entry Baker should make related to this advance payment: 7:48 stream Quiz (A) (B) (c) (D) Questions Filter (4) Save and close Submit If Baker did not make the August 31 adjusting entry related to the advance payment in question 1: The errors on the Income Statement for August would be: items uderstated: none items overstated: Service Revenue, Net Income (A) The errors on the August 31 Balance Sheet would be: items understated: Unearned Revenue, Total Liabilities items overstated: Retained Earnings, Total Equity The errors on the Income Statement for August would be: items understated: Service Revenue, Net Income items overstated: none (B) The errors on the August 31 Balance Sheet would be: items understated: Retained Earnings, Total Equity items overstated: Unearned Revenue, Total Liabilities would be: item understated: Service Revenue item overstated: Net Income (C) The errors on the August 31 Balance Sheet would be: items understated: Retained Earnings, Total Liabilities items overstated: Total Equity, Unearned Revenue Question 3 On July 31, 2017 Baker completed a $1,500 service job for a customer. The customer did not pay cash for the job when it was completed - the customer will pay for the job on August 15, 2017. It was late in the day when the job was completed and Baker's accounting department did not have time to invoice the customer for the $1,500 completed job. Select the adjusting entry Baker should make as of July 31,2017 related to the unbilled service job: D) No adjusting entry is required If Baker did not make the July 31 adjusting entry related to the unbilled service job in question 3 : The errors on the Income Statement for July would be: u items understated: none u items overstated: Service Revenue, Net Income The errors on the July 31 Balance Sheet would be: u items understated: none u items overstated: Accounts Receivable, Total Assets, Retained Earnings, Total Equity, Total Liabilities and Equity The errors on the Income Statement for July would be: u item understated: Service Revenue u item overstated: Net Income The errors on the July 31 Balance Sheet B) would be: u items understated: Retained Earnings, Total Equity, Total Liabilities and Equity u items overstated: Accounts Receivable, Total Assets The errors on the Income Statement for July The errors on the Income Statement for July would be: u item understated: Service Revenue u item overstated: Net Income The errors on the July 31 Balance Sheet B) would be: u items understated: Retained Earnings, Total Equity, Total Liabilities and Equity u items overstated: Accounts Receivable, Total Assets The errors on the Income Statement for July would be: u items understated: Service Revenue, Net Income u items overstated: none The errors on the July 31 Balance Sheet would be: u items understated: Accounts Receivable, Total Assets, Retained Earnings, Total Equity. Total Liabilities and Equity u items overstated: none There would not be any errors, as no adjusting entry is required. would be: item understated: Service Revenue item overstated: Net Income (C) The errors on the August 31 Balance Sheet would be: items understated: Retained Earnings, Total Liabilities items overstated: Total Equity, Unearned Revenue Question 3 On July 31, 2017 Baker completed a $1,500 service job for a customer. The customer did not pay cash for the job when it was completed - the customer will pay for the job on August 15, 2017. It was late in the day when the job was completed and Baker's accounting department did not have time to invoice the customer for the $1,500 completed job. Select the adjusting entry Baker should make as of July 31,2017 related to the unbilled service job