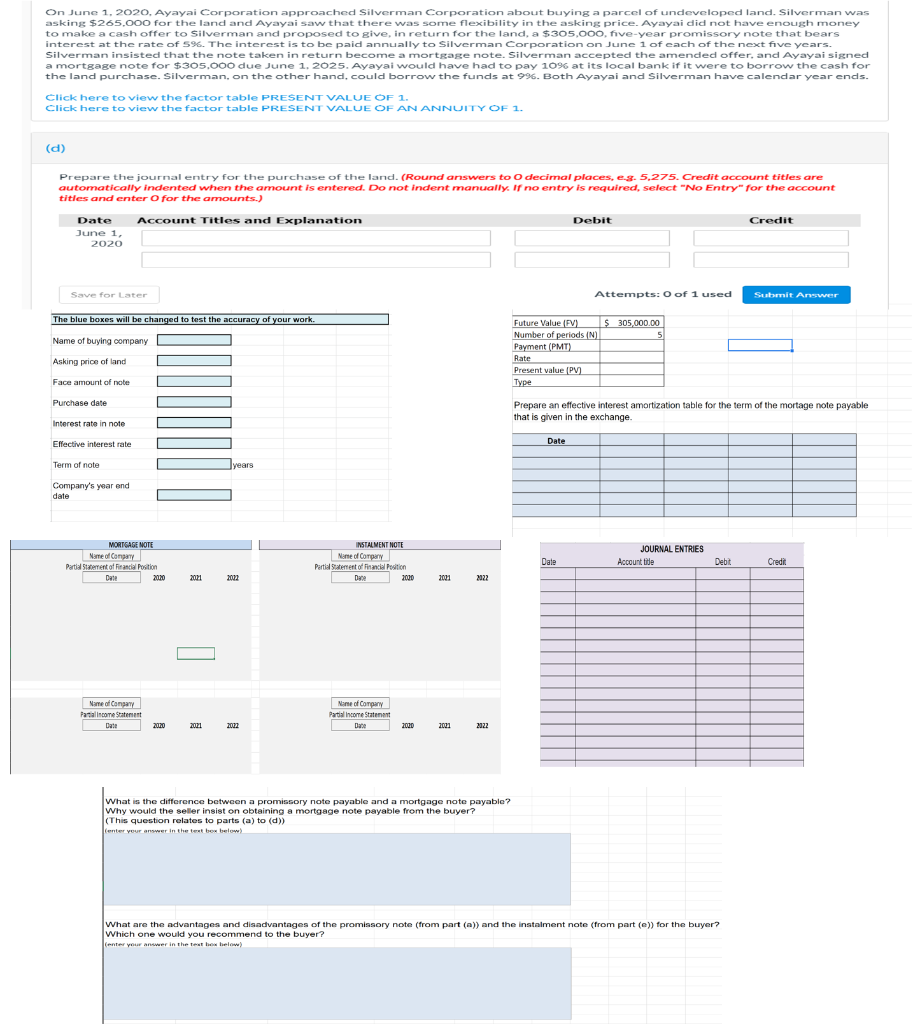

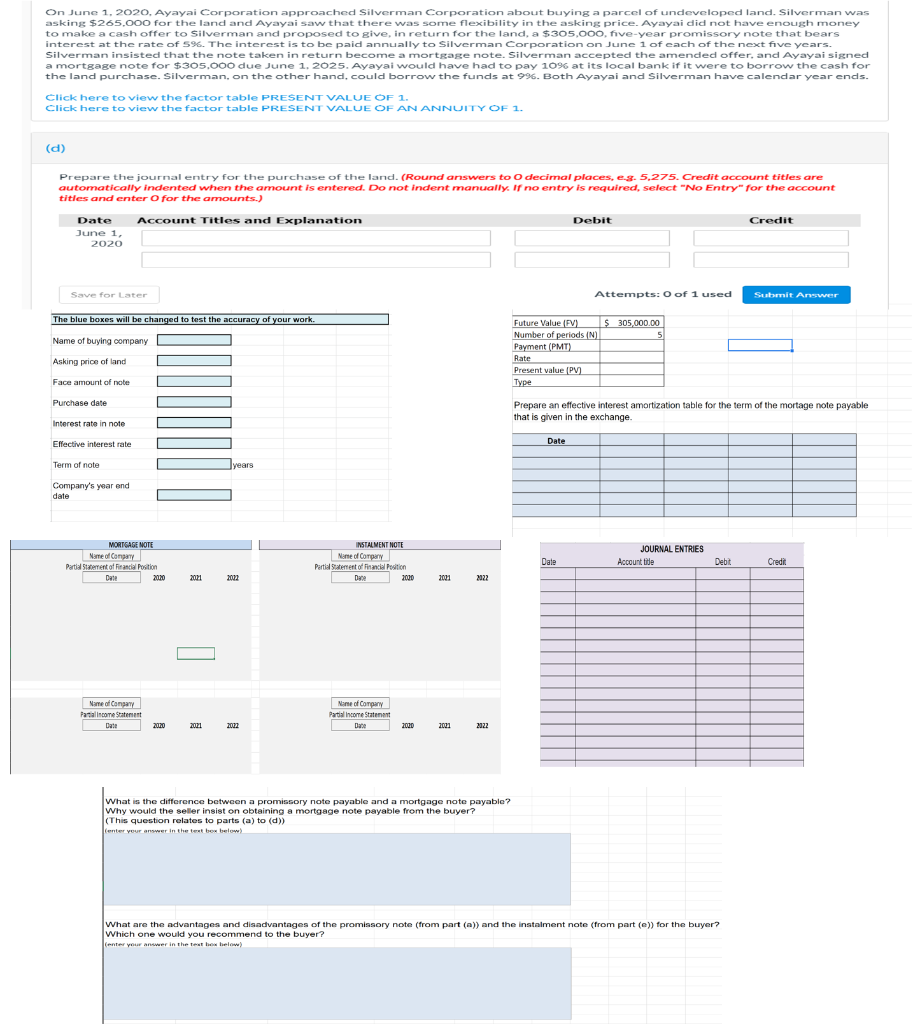

On June 1, 2020, Ayayai Corporation approached Silverman Corporation about buying a parcel of undeveloped land. Silverman was asking $265.000 for the land and Ayayai saw that there was some flexibility in the asking price. Ayayai did not have enough money to make a cash offer to Silverman and proposed to give, in return for the land, a $305,000, five-year promissory note that bears interest at the rate of 596. The interest is to be paid annually to Silverman Corporation on June 1 of each of the next five years. Silverman insisted that the note taken in return become a mortgage note. Silverman accepted the amended offer, and Ayayai signed a mortgage note for $305.000 due June 1, 2025. Ayayai would have had to pay 10% at its local bank if it were to borrow the cash for the land purchase. Silverman, on the other hand, could borrow the funds at 996. Both Ayayai and Silverman have calendar year ends. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. . (d) Prepare the journal entry for the purchase of the land. (Round answers to O decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Date June 1, 2020 Save for later Attempts: O of 1 used Submit Answer The blue boxes will be changed to test the accuracy of your work. Name of buying company Future Value (PV) $ 305,000.00 Number of periods (N) 5 Payment (PMT) Rate Present value (PV) Type Asking price of land Face amount of note Purchase date Prepare an effective interest amortization table for the term of the mortage note payable that is given in the exchange. Interest rate in note Effective interest rate Date Term of note Jyears Company's year and date MORTGAGE NOTE Name of Company Partial Statement of Financial Position Dele 20120 INSTALMENT NOTE Name of Company Partial Statement of Finance Position Date 2000 JOURNAL ENTRIES Accountide Dale Debt Credit 2011 2002 2001 2022 Name of Company Partial income Statement Date Name of Company Partial income Statement Date 2020 2021 2022 2020 2001 2022 What is the difference between a promissory note payable and a mortgage note payable? Why would the seller insist on obtaining a mortgage note payable from the buyer? (This question relates to parts (a) to (d)) center your answer in the test box below) What are the advantages and disadvantages of the promissory note (from part (a)) and the instalment note (from part (e)) for the buyer? Which one would you recommend to the buyer? enter your answer in the text hos helow) On June 1, 2020, Ayayai Corporation approached Silverman Corporation about buying a parcel of undeveloped land. Silverman was asking $265.000 for the land and Ayayai saw that there was some flexibility in the asking price. Ayayai did not have enough money to make a cash offer to Silverman and proposed to give, in return for the land, a $305,000, five-year promissory note that bears interest at the rate of 596. The interest is to be paid annually to Silverman Corporation on June 1 of each of the next five years. Silverman insisted that the note taken in return become a mortgage note. Silverman accepted the amended offer, and Ayayai signed a mortgage note for $305.000 due June 1, 2025. Ayayai would have had to pay 10% at its local bank if it were to borrow the cash for the land purchase. Silverman, on the other hand, could borrow the funds at 996. Both Ayayai and Silverman have calendar year ends. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. . (d) Prepare the journal entry for the purchase of the land. (Round answers to O decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Date June 1, 2020 Save for later Attempts: O of 1 used Submit Answer The blue boxes will be changed to test the accuracy of your work. Name of buying company Future Value (PV) $ 305,000.00 Number of periods (N) 5 Payment (PMT) Rate Present value (PV) Type Asking price of land Face amount of note Purchase date Prepare an effective interest amortization table for the term of the mortage note payable that is given in the exchange. Interest rate in note Effective interest rate Date Term of note Jyears Company's year and date MORTGAGE NOTE Name of Company Partial Statement of Financial Position Dele 20120 INSTALMENT NOTE Name of Company Partial Statement of Finance Position Date 2000 JOURNAL ENTRIES Accountide Dale Debt Credit 2011 2002 2001 2022 Name of Company Partial income Statement Date Name of Company Partial income Statement Date 2020 2021 2022 2020 2001 2022 What is the difference between a promissory note payable and a mortgage note payable? Why would the seller insist on obtaining a mortgage note payable from the buyer? (This question relates to parts (a) to (d)) center your answer in the test box below) What are the advantages and disadvantages of the promissory note (from part (a)) and the instalment note (from part (e)) for the buyer? Which one would you recommend to the buyer? enter your answer in the text hos helow)