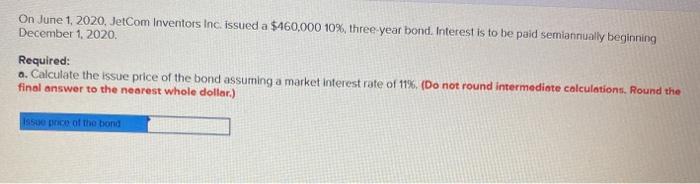

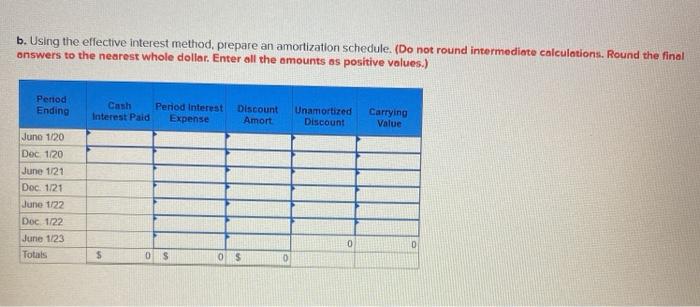

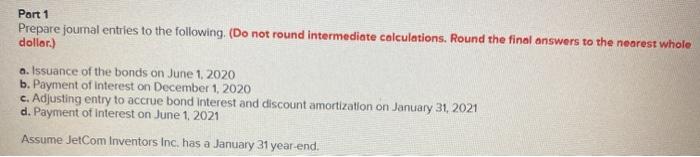

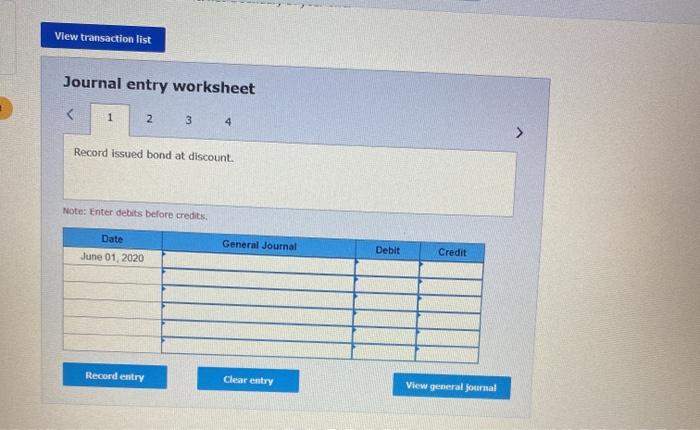

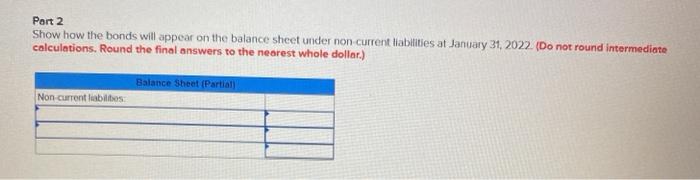

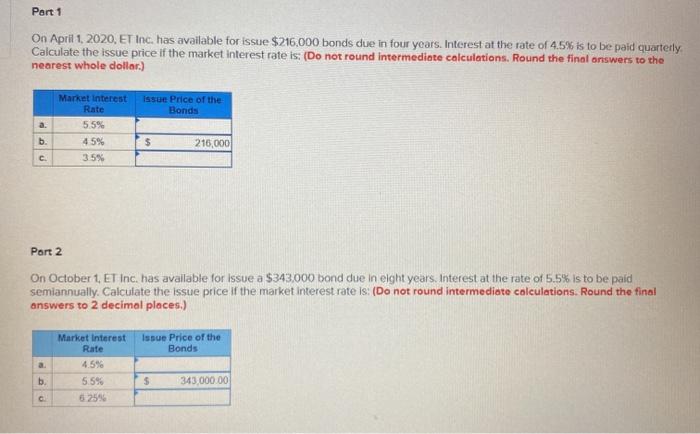

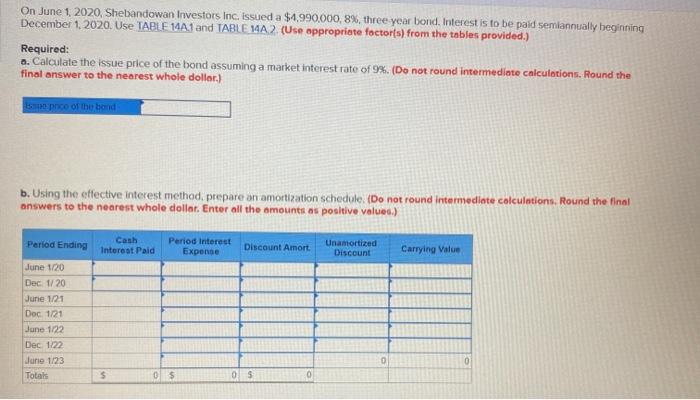

On June 1, 2020, JetCom Inventors Inc. issued a $460,000 10%, three year bond. Interest is to be paid semiannually beginning December 1, 2020 Required: a. Calculate the issue price of the bond assuming a market interest rate of 11%. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar) 1950 of the bond b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) Period Ending Cash Period interest Interest Paid Expense Discount Amort Unamortized Discount Carrying Value June 1/20 Dec 1/20 June 1/21 Doc. 1/21 June 1/22 Doc 1/22 June 1/23 Totals 0 0 S 0 $ 0 $ Part 1 Prepare journal entries to the following. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar) a. Issuance of the bonds on June 1, 2020 b. Payment of interest on December 1, 2020 c. Adjusting entry to accrue bond Interest and discount amortization on January 31, 2021 d. Payment of interest on June 1, 2021 Assume JetCom Inventors Inc. has a January 31 year-end. View transaction list Journal entry worksheet 1 N 3 4 Record issued bond at discount Note: Enter debits before credits Date June 01, 2020 General Journal Debit Credit Record entry Clear entry View general Journal Part 2 Show how the bonds will appear on the balance sheet under non current liabilities at January 31, 2022. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Balance Sheet (Partial Non-current liabilities: Part 1 On April 1, 2020, ET Inc. has available for issue $216,000 bonds due in four years. Interest at the rate of 4.5% is to be paid quarterly Calculate the issue price if the market interest rate is: (Do not round intermediate calculations. Round the final answers to the nearest whole dollar) issue Price of the Bonds a. Market interest Rate 5.5% 45% 35% b $ 216,000 C Part 2 On October 1, ET Inc. has available for issue a $343.000 bond due in eight years. Interest at the rate of 5.5% is to be paid semiannually. Calculate the issue price if the market interest rate is: (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Issue Price of the Bonds Market Interest Rate 4.5% 5.5% b. $ 343,000.00 C On June 1, 2020, Shebandowan Investors Inc. issued a $4.990,000,8%, three year bond. Interest is to be paid semiannually beginning December 1, 2020. Use TABLE 14A1 and TABLE 14A 2. (Use appropriate foctor(s) from the tables provided.) Required: a. Calculate the issue price of the bond assuming a market interest rate of 9%. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Se poco of the bood b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar. Enter all the amounts as positive values.) Period Ending Cash Interest Paid Period interest Expense Discount Amort Unamortized Discount Carrying Value June 1/20 Dec 1/20 June 1/21 Dec 1/21 June 1122 Dec 1122 Junie 1123 Totals 0 0 $ 0$ 05