Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 1, 2021, Gustav Corp. and Gabby Limited merged to form Blossom Inc. A total of 700,000 shares were issued to complete the merger.

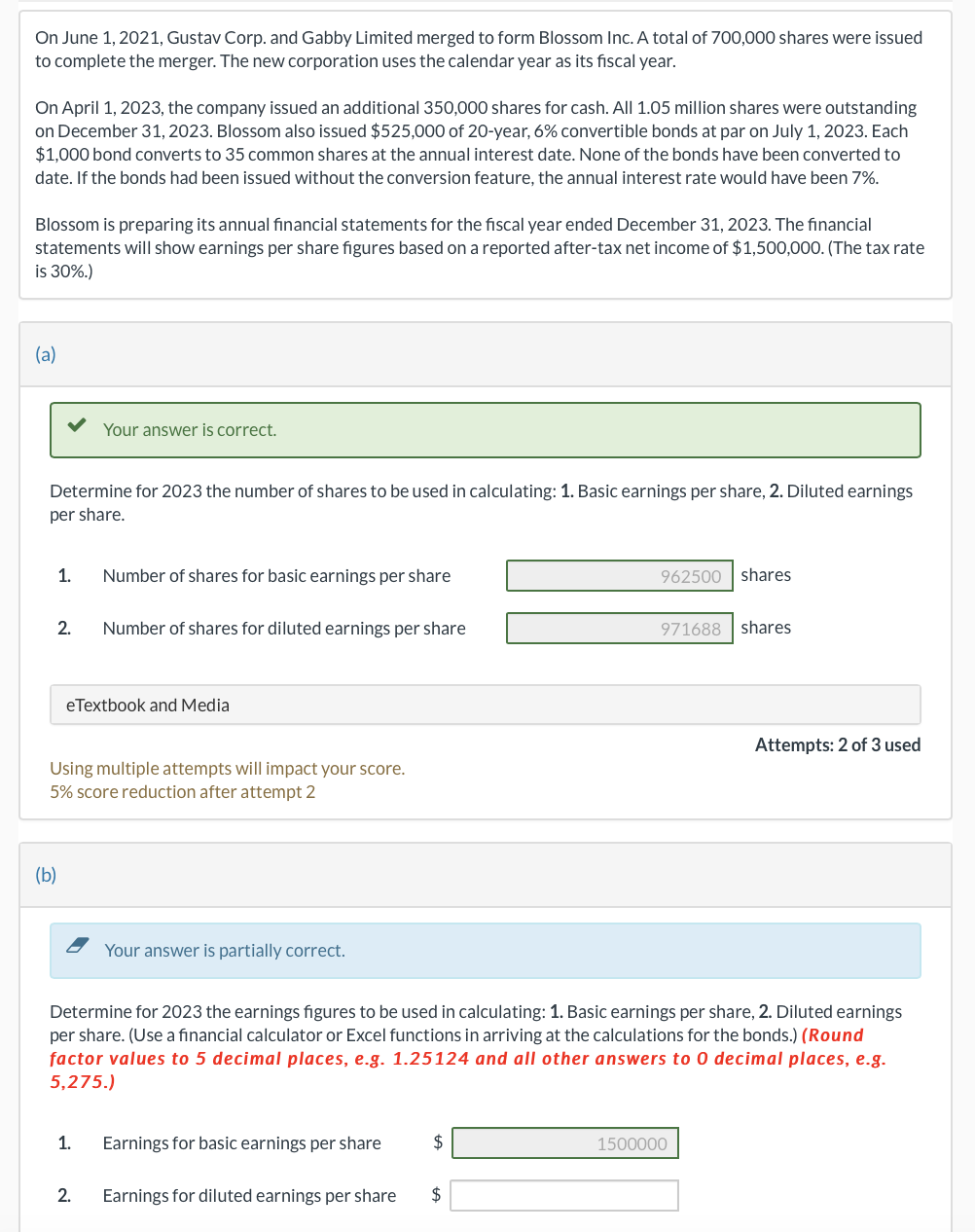

On June 1, 2021, Gustav Corp. and Gabby Limited merged to form Blossom Inc. A total of 700,000 shares were issued to complete the merger. The new corporation uses the calendar year as its fiscal year. On April 1, 2023, the company issued an additional 350,000 shares for cash. All 1.05 million shares were outstanding on December 31,2023 . Blossom also issued $525,000 of 20-year, 6% convertible bonds at par on July 1, 2023. Each $1,000 bond converts to 35 common shares at the annual interest date. None of the bonds have been converted to date. If the bonds had been issued without the conversion feature, the annual interest rate would have been 7%. Blossom is preparing its annual financial statements for the fiscal year ended December 31, 2023. The financial statements will show earnings per share figures based on a reported after-tax net income of $1,500,000. (The tax rate is 30%. (a) Determine for 2023 the number of shares to be used in calculating: 1. Basic earnings per share, 2 . Diluted earnings per share. 1. Number of shares for basic earnings per share 2. Number of shares for diluted earnings per share shares shares eTextbook and Media Attempts: 2 of 3 used Using multiple attempts will impact your score. 5% score reduction after attempt 2 (b) Your answer is partially correct. Determine for 2023 the earnings figures to be used in calculating: 1 . Basic earnings per share, 2 . Diluted earnings per share. (Use a financial calculator or Excel functions in arriving at the calculations for the bonds.) (Round factor values to 5 decimal places, e.g. 1.25124 and all other answers to 0 decimal places, e.g. 5,275.) 1. Earnings for basic earnings per share $ 2. Earnings for diluted earnings per share $

On June 1, 2021, Gustav Corp. and Gabby Limited merged to form Blossom Inc. A total of 700,000 shares were issued to complete the merger. The new corporation uses the calendar year as its fiscal year. On April 1, 2023, the company issued an additional 350,000 shares for cash. All 1.05 million shares were outstanding on December 31,2023 . Blossom also issued $525,000 of 20-year, 6% convertible bonds at par on July 1, 2023. Each $1,000 bond converts to 35 common shares at the annual interest date. None of the bonds have been converted to date. If the bonds had been issued without the conversion feature, the annual interest rate would have been 7%. Blossom is preparing its annual financial statements for the fiscal year ended December 31, 2023. The financial statements will show earnings per share figures based on a reported after-tax net income of $1,500,000. (The tax rate is 30%. (a) Determine for 2023 the number of shares to be used in calculating: 1. Basic earnings per share, 2 . Diluted earnings per share. 1. Number of shares for basic earnings per share 2. Number of shares for diluted earnings per share shares shares eTextbook and Media Attempts: 2 of 3 used Using multiple attempts will impact your score. 5% score reduction after attempt 2 (b) Your answer is partially correct. Determine for 2023 the earnings figures to be used in calculating: 1 . Basic earnings per share, 2 . Diluted earnings per share. (Use a financial calculator or Excel functions in arriving at the calculations for the bonds.) (Round factor values to 5 decimal places, e.g. 1.25124 and all other answers to 0 decimal places, e.g. 5,275.) 1. Earnings for basic earnings per share $ 2. Earnings for diluted earnings per share $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started