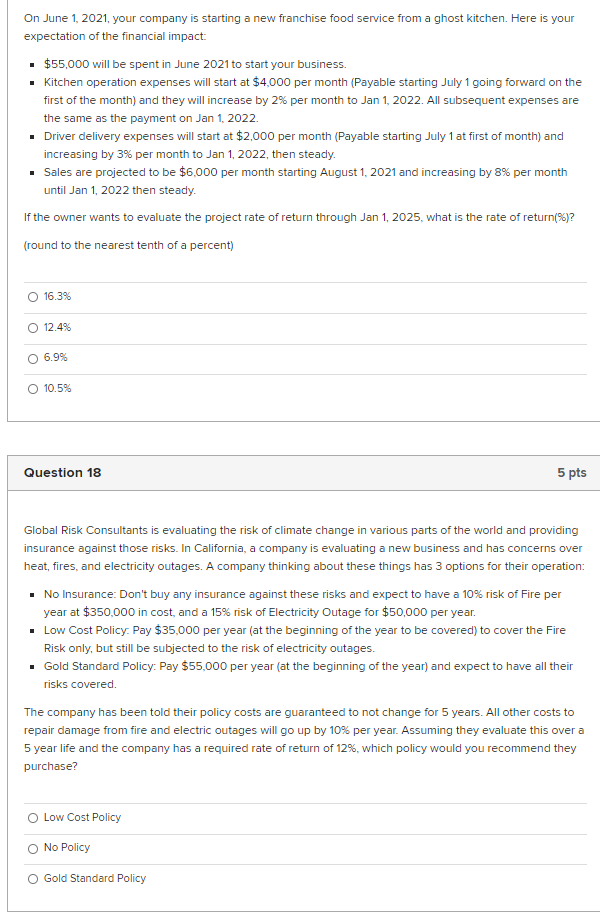

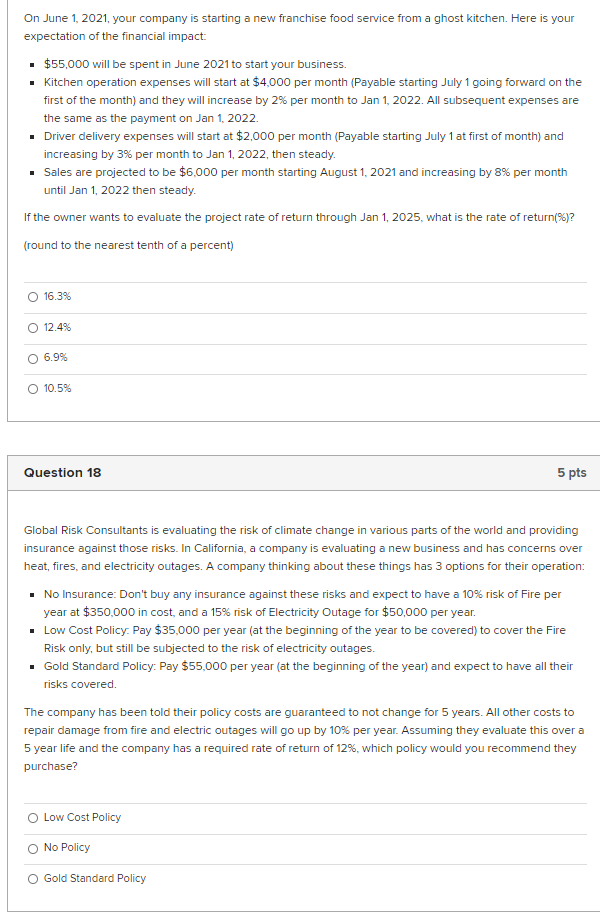

On June 1, 2021, your company is starting a new franchise food service from a ghost kitchen. Here is your expectation of the financial impact: $55,000 will be spent in June 2021 to start your business. Kitchen operation expenses will start at $4.000 per month (Payable starting July 1 going forward on the first of the month) and they will increase by 2% per month to Jan 1, 2022. All subsequent expenses are the same as the payment on Jan 1, 2022. Driver delivery expenses will start at $2,000 per month (Payable starting July 1 at first of month) and increasing by 3% per month to Jan 1, 2022, then steady. Sales are projected to be $6,000 per month starting August 1, 2021 and increasing by 8% per month until Jan 1, 2022 then steady. If the owner wants to evaluate the project rate of return through Jan 1, 2025, what is the rate of return(%)? (round to the nearest tenth of a percent) O 16.3% O 12.4% 6.9% 10.5% Question 18 5 pts Global Risk Consultants is evaluating the risk of climate change in various parts of the world and providing insurance against those risks. In California, a company is evaluating a new business and has concerns over heat, fires and electricity outages. A company thinking about these things has 3 options for their operation: No Insurance: Don't buy any insurance against these risks and expect to have a 10% risk of Fire per year at $350,000 in cost, and a 15% risk of Electricity Outage for $50,000 per year. Low Cost Policy. Pay $35,000 per year (at the beginning of the year to be covered) to cover the Fire Risk only, but still be subjected to the risk of electricity outages. Gold Standard Policy: Pay $55,000 per year (at the beginning of the year) and expect to have all their risks covered. The company has been told their policy costs are guaranteed to not change for 5 years. All other costs to repair damage from fire and electric outages will go up by 10% per year. Assuming they evaluate this over a 5 year life and the company has a required rate of return of 12%, which policy would you recommend they purchase? Low Cost Policy No Policy O Gold Standard Policy