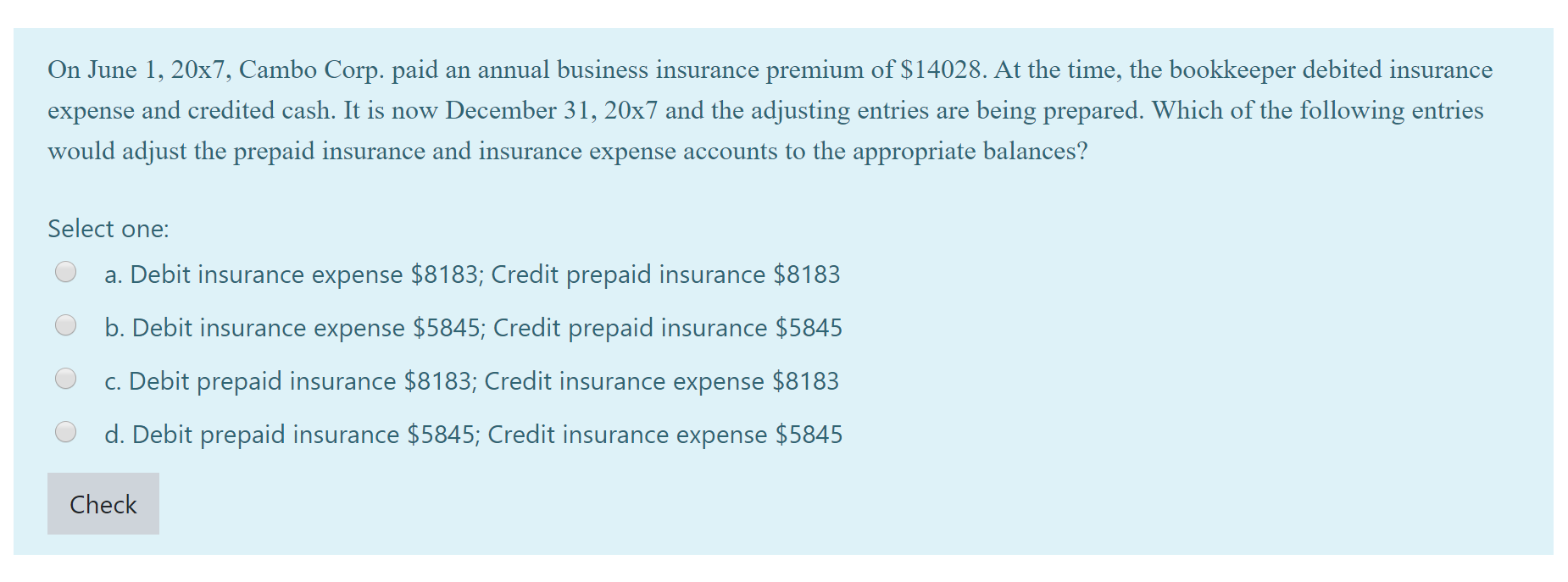

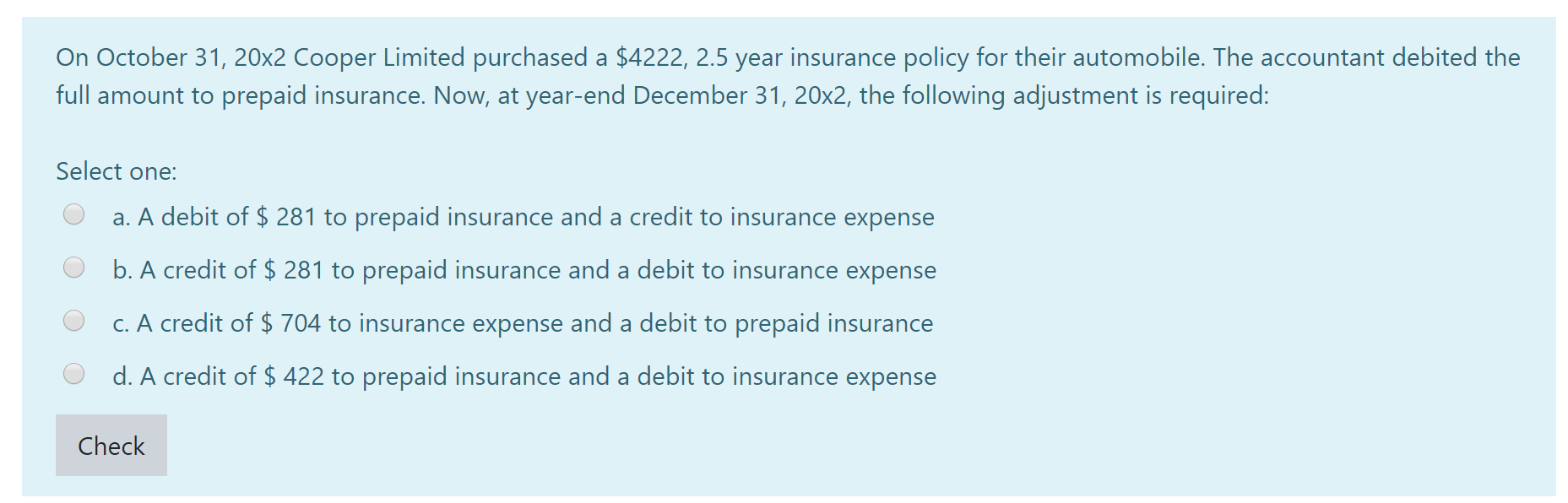

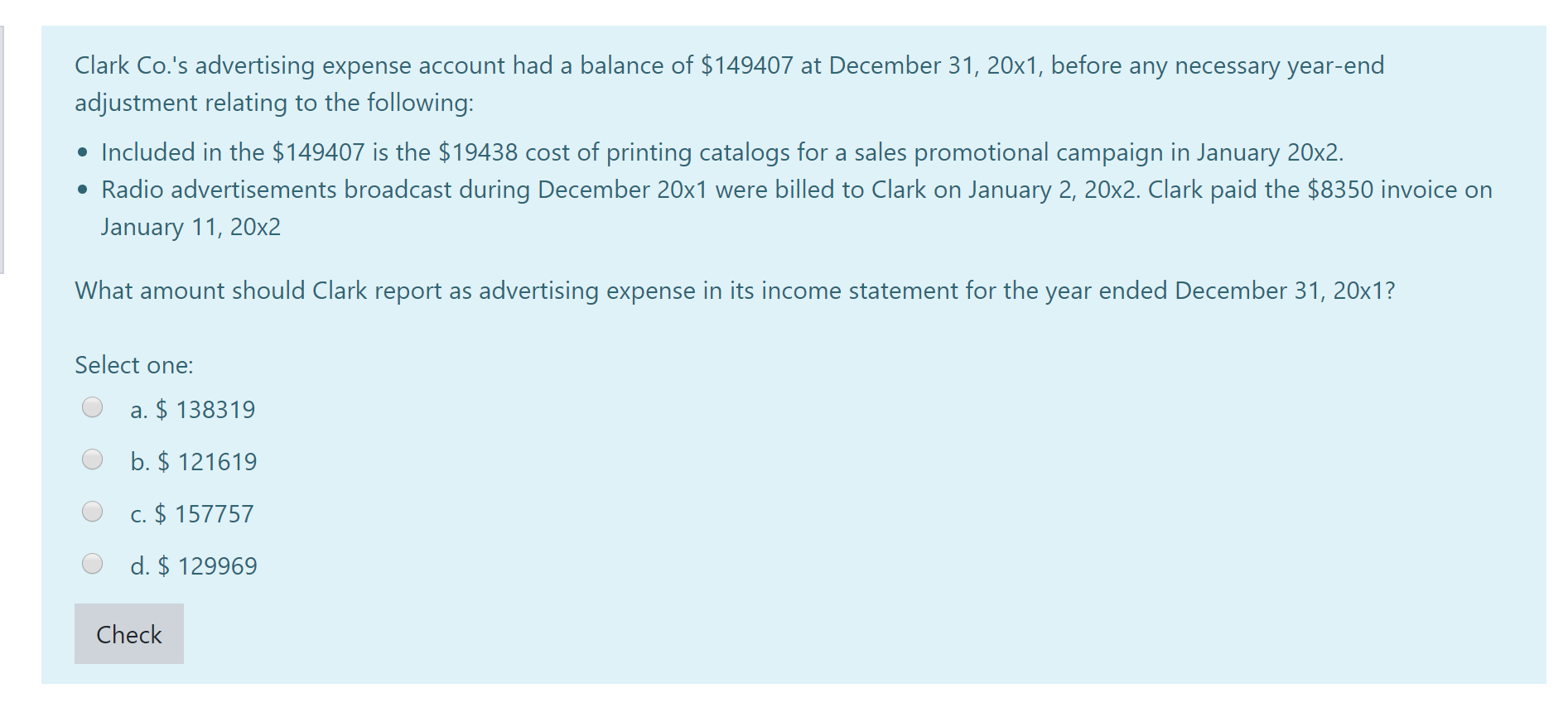

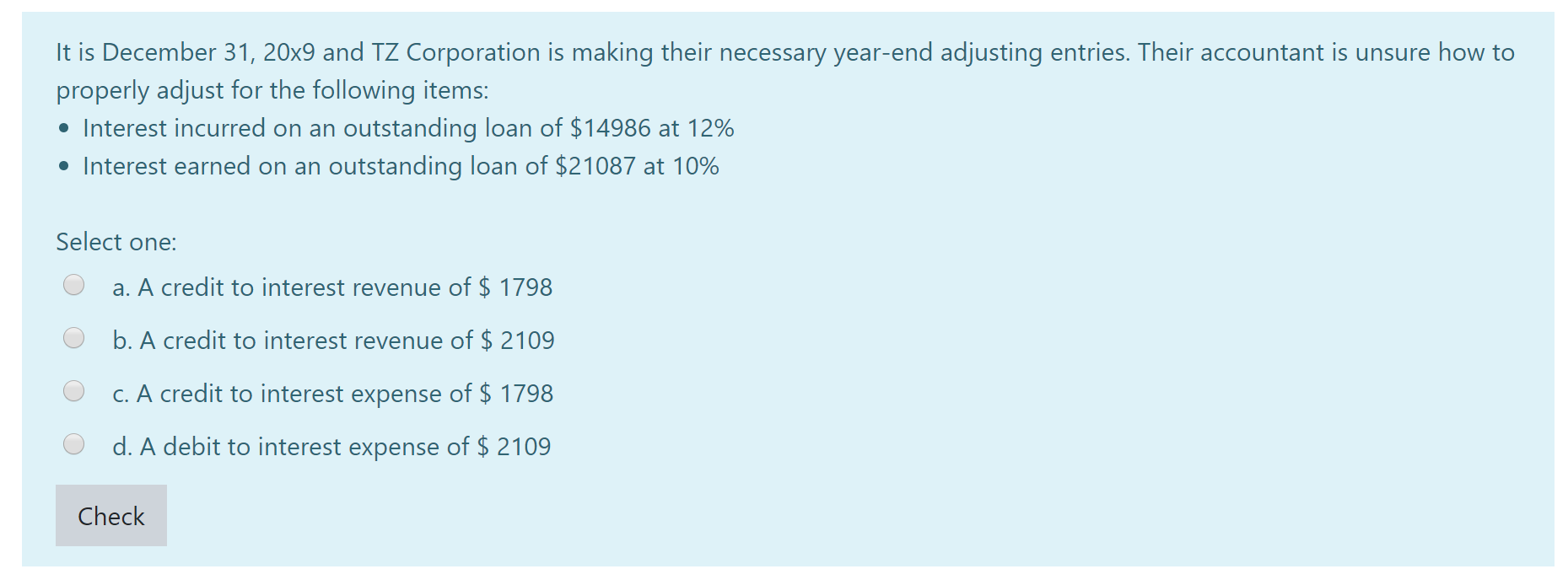

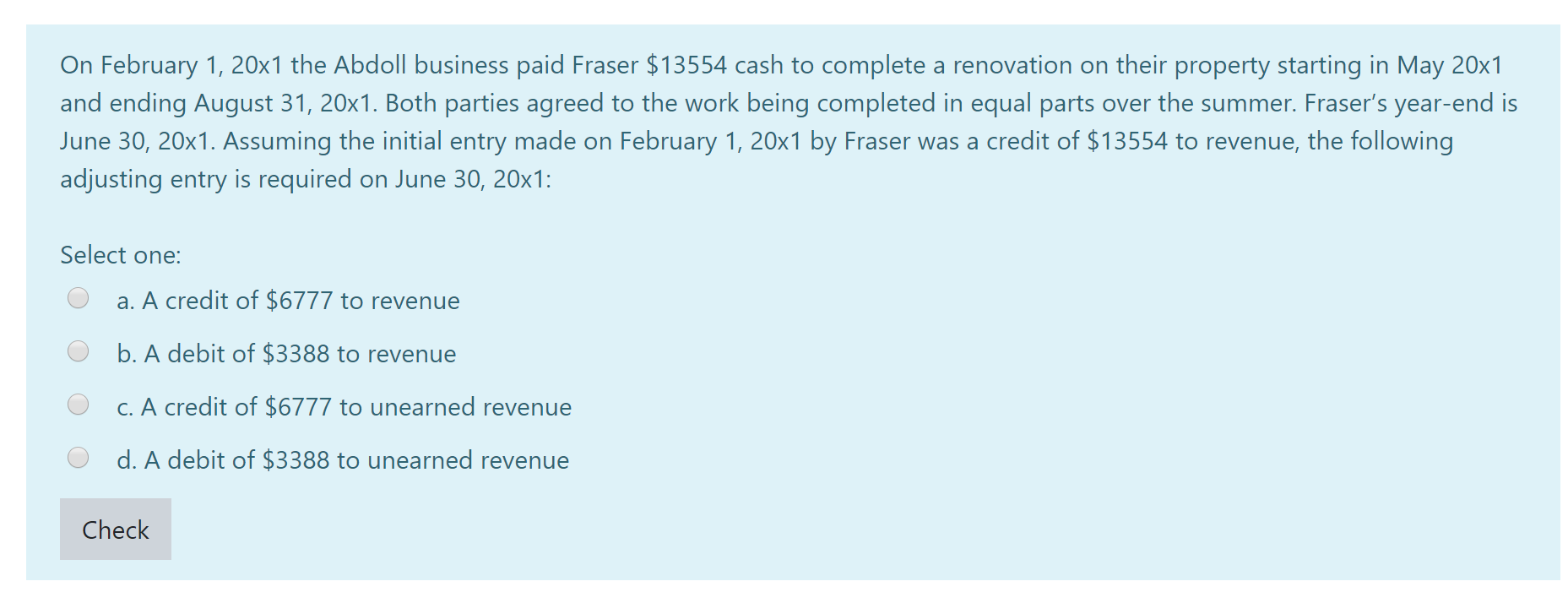

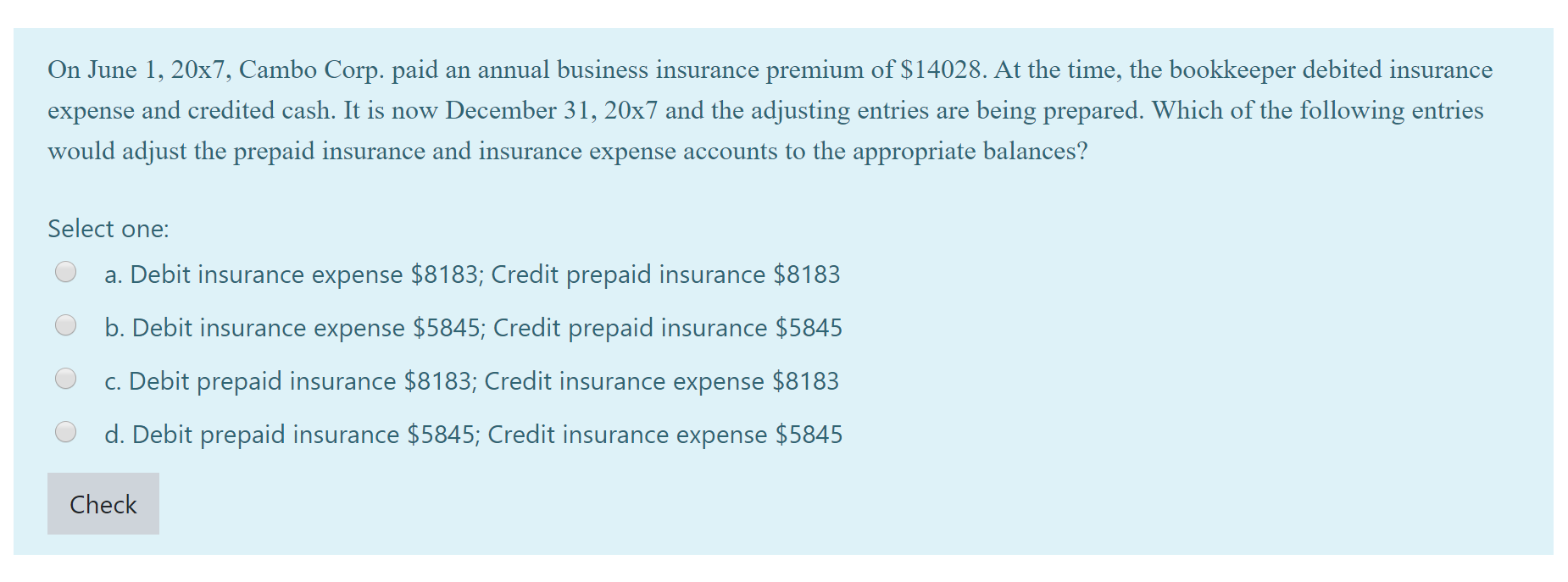

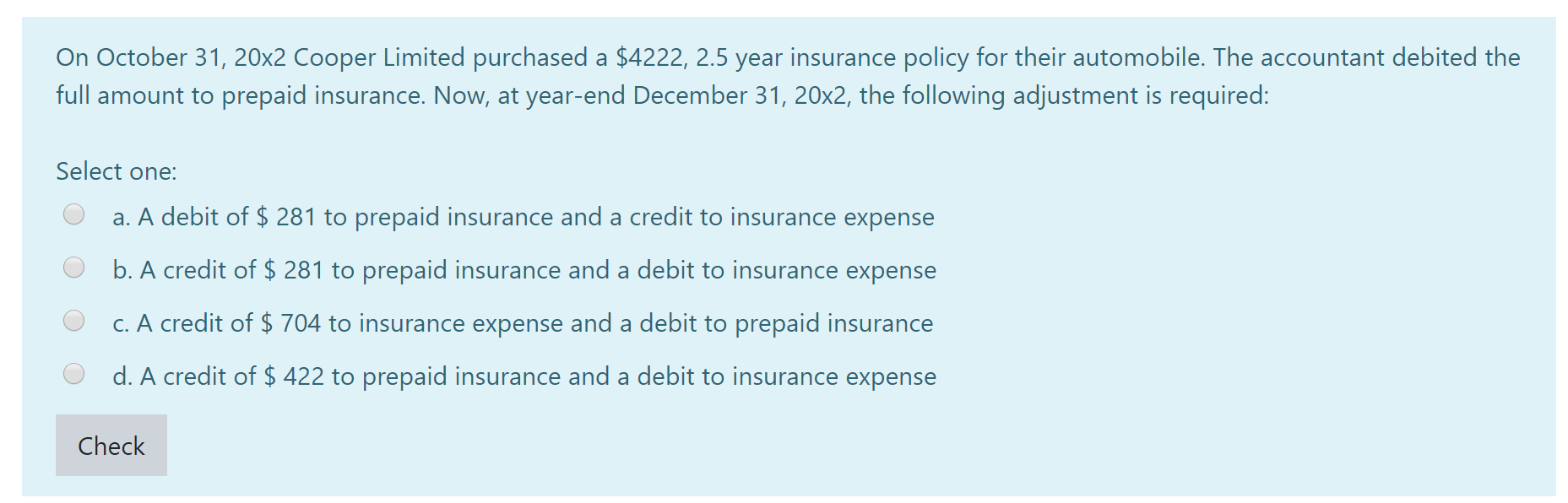

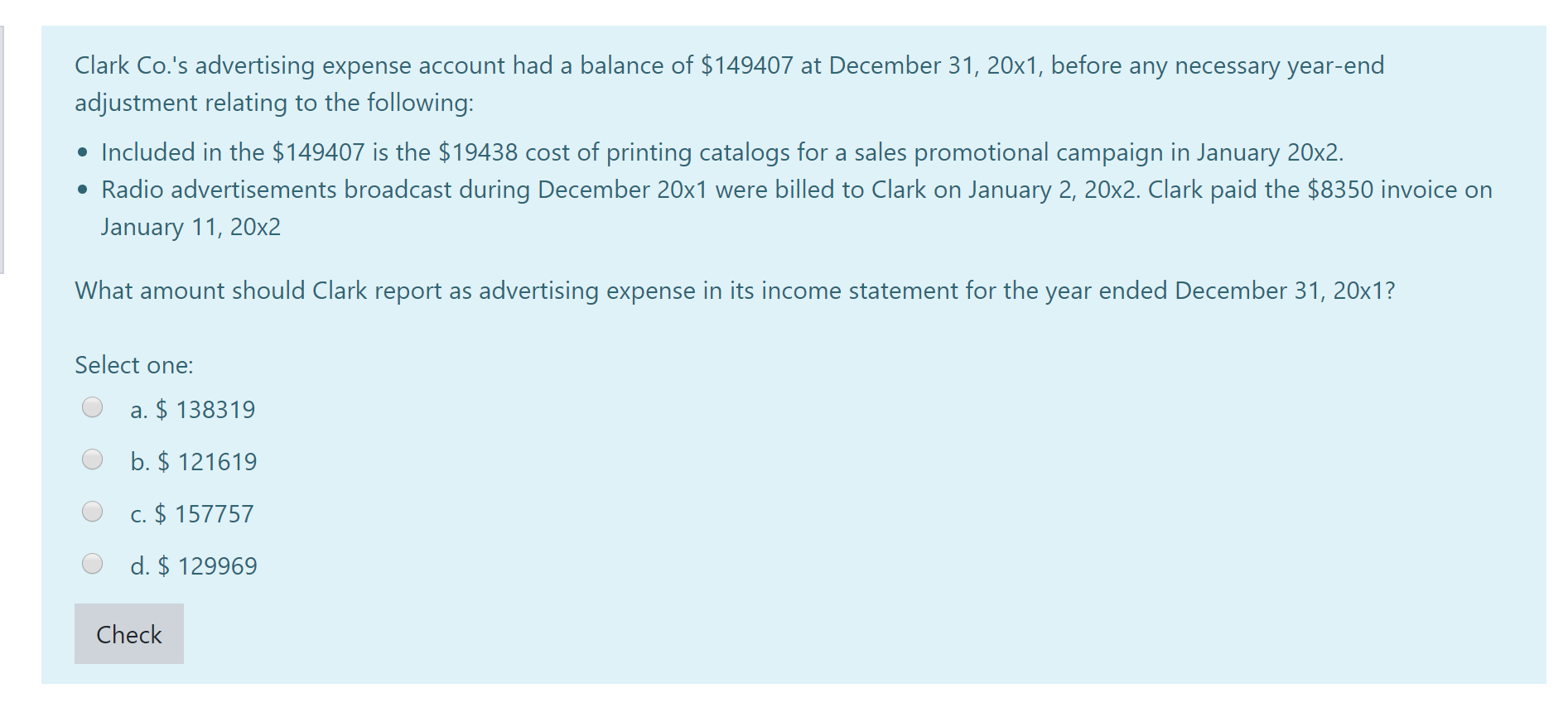

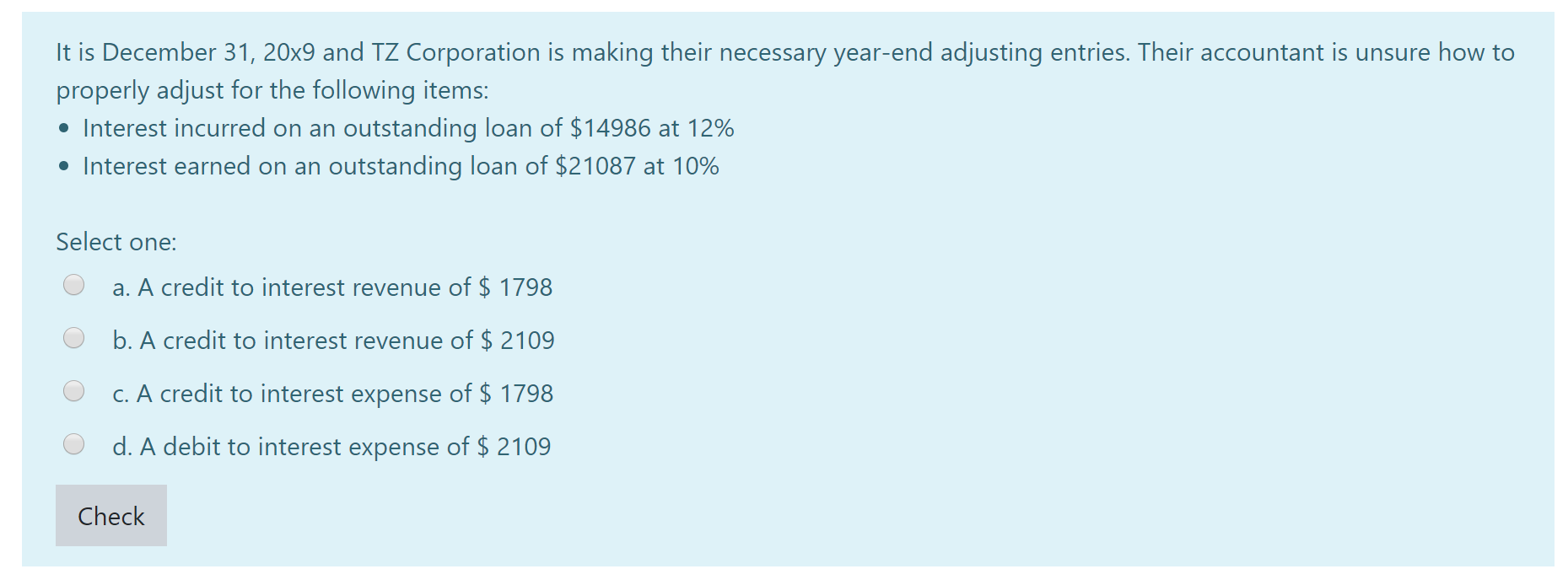

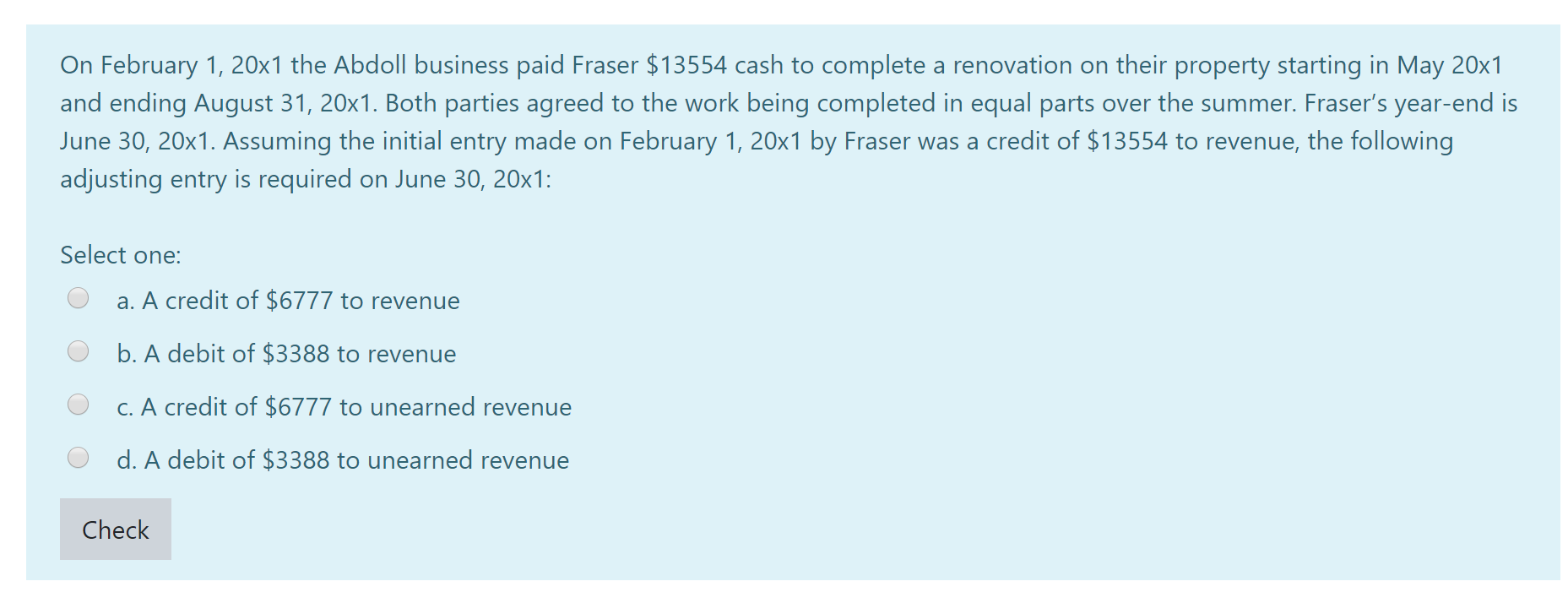

On June 1, 20x7, Cambo Corp. paid an annual business insurance premium of $14028. At the time, the bookkeeper debited insurance expense and credited cash. It is now December 31, 20x7 and the adjusting entries are being prepared. Which of the following entries would adjust the prepaid insurance and insurance expense accounts to the appropriate balances? Select one: O a. Debit insurance expense $8183; Credit prepaid insurance $8183 O b. Debit insurance expense $5845; Credit prepaid insurance $5845 O c. Debit prepaid insurance $8183; Credit insurance expense $8183 O d. Debit prepaid insurance $5845; Credit insurance expense $5845 Check Clark Co.'s advertising expense account had a balance of $149407 at December 31, 20x1, before any necessary year-end adjustment relating to the following: Included in the $149407 is the $19438 cost of printing catalogs for a sales promotional campaign in January 20x2. Radio advertisements broadcast during December 20x1 were billed to Clark on January 2, 20x2. Clark paid the $8350 invoice on January 11, 20x2 What amount should Clark report as advertising expense in its income statement for the year ended December 31, 20x1? Select one: O a. $ 138319 b. $ 121619 O O c. $ 157757 O d. $ 129969 Check It is December 31, 20x9 and TZ Corporation is making their necessary year-end adjusting entries. Their accountant is unsure how to properly adjust for the following items: Interest incurred on an outstanding loan of $14986 at 12% Interest earned on an outstanding loan of $21087 at 10% Select one: O a. A credit to interest revenue of $ 1798 O b. A credit to interest revenue of $ 2109 O O c. A credit to interest expense of $ 1798 d. A debit to interest expense of $ 2109 Check On February 1, 20x1 the Abdoll business paid Fraser $13554 cash to complete a renovation on their property starting in May 20x1 and ending August 31, 20x1. Both parties agreed to the work being completed in equal parts over the summer. Fraser's year-end is June 30, 20x1. Assuming the initial entry made on February 1, 20x1 by Fraser was a credit of $13554 to revenue, the following adjusting entry is required on June 30, 20x1: Select one: O a. A credit of $6777 to revenue O b. A debit of $3388 to revenue O c. A credit of $6777 to unearned revenue O d. A debit of $3388 to unearned revenue Check