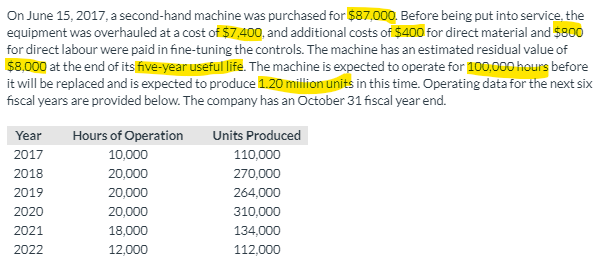

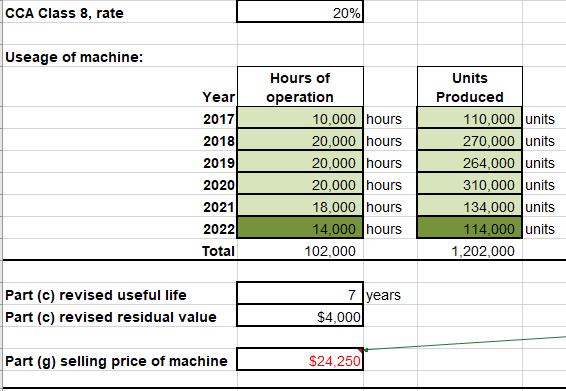

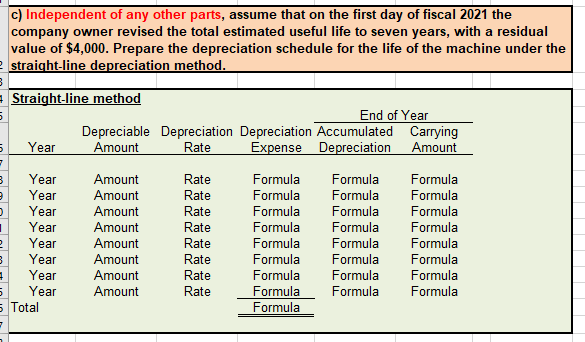

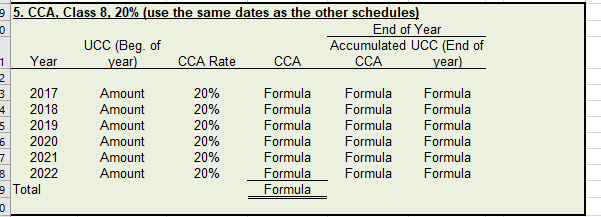

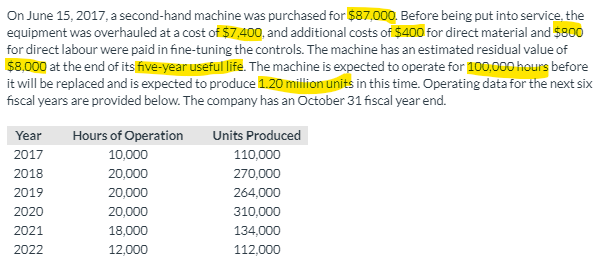

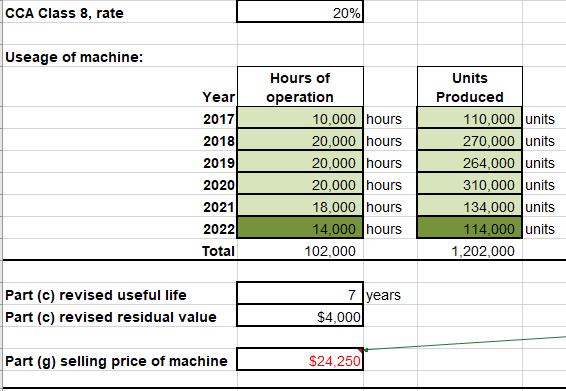

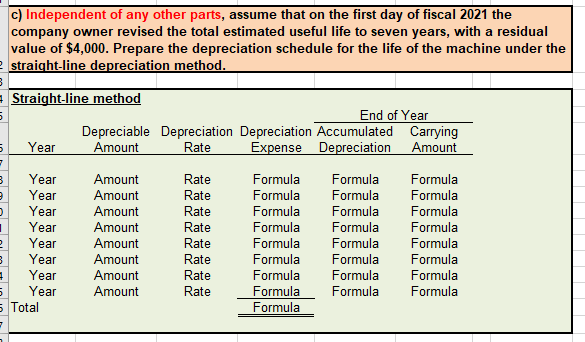

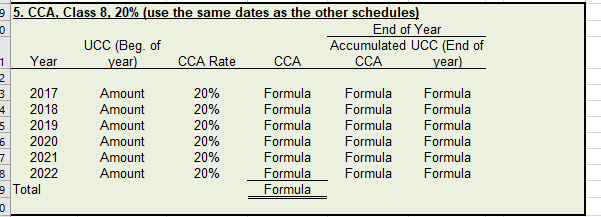

On June 15, 2017, a second-hand machine was purchased for $87,000. Before being put into service, the equipment was overhauled at a cost of $7,400, and additional costs of $400 for direct material and $800 for direct labour were paid in fine-tuning the controls. The machine has an estimated residual value of $8,000 at the end of its five-year useful life. The machine is expected to operate for 100,000 hours before it will be replaced and is expected to produce 1.20 million units in this time. Operating data for the next six fiscal years are provided below. The company has an October 31 fiscal year end. Year 2017 2018 2019 2020 2021 2022 Hours of Operation 10,000 20,000 20,000 20,000 18,000 12,000 Units Produced 110,000 270.000 264,000 310,000 134,000 112,000 CCA Class 8, rate 20% Useage of machine: Year 2017 2018 2019 2020 2021 2022 Total Hours of operation 10,000 hours 20,000 hours 20,000 hours 20,000 hours 18,000 hours 14,000 hours 102,000 Units Produced 110,000 units 270,000 units 264,000 units 310,000 units 134,000 units 114,000 units 1,202,000 Part (c) revised useful life Part (c) revised residual value 7 years $4,000 Part (g) selling price of machine $24,250 c) Independent of any other parts, assume that on the first day of fiscal 2021 the company owner revised the total estimated useful life to seven years, with a residual value of $4,000. Prepare the depreciation schedule for the life of the machine under the straight-line depreciation method. 3 Straight-line method End of Year Depreciable Depreciation Depreciation Accumulated Carrying 5 Year Amount Rate Expense Depreciation Amount - 3 Year Amount Rate Formula Formula Formula Year Amount Rate Formula Formula Formula Year Amount Rate Formula Formula Formula Year Amount Rate Formula Formula Formula 2 Year Amount Rate Formula Formula Formula 3 Year Amount Rate Formula Formula Formula Year Amount Rate Formula Formula Formula 5 Year Amount Rate Formula Formula Formula 5 Total Formula 0 CCA 9 5. CCA, Class 8, 20% (use the same dates as the other schedules) End of Year UCC (Beg. of Accumulated UCC (End of 1 Year year) CCA Rate CCA year) 2 3 2017 Amount 20% Formula Formula Formula 4 2018 Amount 20% Formula Formula Formula 5 2019 Amount 20% Formula Formula Formula 6 2020 Amount 20% Formula Formula Formula 7 2021 Amount 20% Formula Formula Formula 8 2022 Amount 20% Formula Formula Formula 9 Total Formula