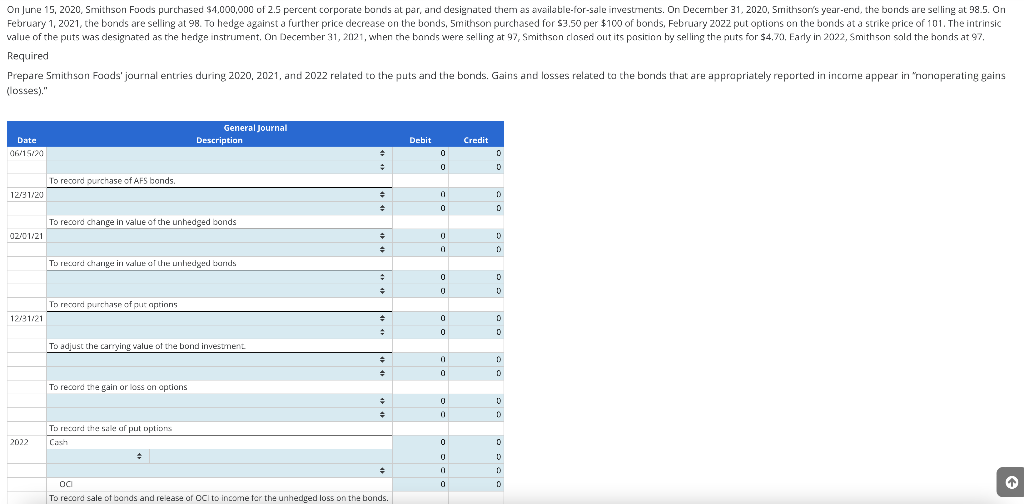

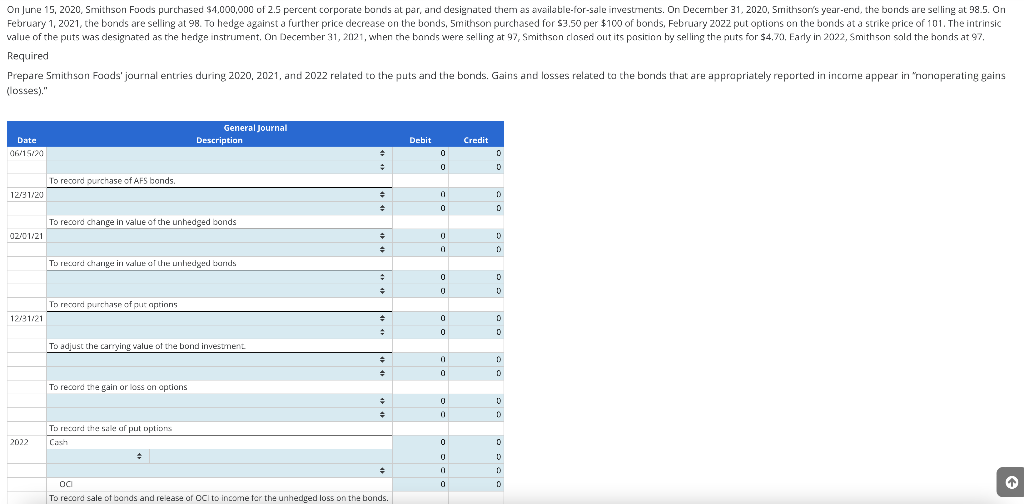

On June 15, 2020, Smithson Foods purchased $4,000,000 of 2.5 percent corporate bonds at par, and designated them as available-for-sale investments. On December 31, 2020, Smrithson's year-end, the bonds are selling at 98.5. On February 1, 2021, the bonds are selling at 98. To hedge against a further price decrease on the bonds, Smithson purchased for 53.50 per $100 of bonds, February 2022 put options on the bonds at a strike price of 101. The intrinsic value of the puts was designated as the hedge instrument, On December 31, 2021, when the bands were selling at 97, Smithson clased out its position by selling the puts for $4,70, Early in 2022, Smithson sold the honds at 97, Required Prepare Smithson Foods' journal entries during 2020, 2021, and 2022 related to the puts and the bonds. Gains and losses related to the bonds that are appropriately reported in income appear in nonoperating gains (losses)." General Journal Description Debit Credit Date 06/15/20 . 0 0 0 To record purchase of AFS bonds 12/31/20 D 0 * 0 To record change in value of the unhedged bonds 02/01/21 D 0 0 D To recarci change in value of the unhedged bands 0 0 D 2 0 To recarci purchase of our options 12/21/21 0 0 0 0 To adjust the carrying value of the bond investment + 0 D 0 0 To record the gain or loss an options - 0 To read the staf pul options Cash 2022 0 0 0 0 U D 0 OC To record sale of brands and release of Ocito income for the unhedged loss on the bonds. On June 15, 2020, Smithson Foods purchased $4,000,000 of 2.5 percent corporate bonds at par, and designated them as available-for-sale investments. On December 31, 2020, Smrithson's year-end, the bonds are selling at 98.5. On February 1, 2021, the bonds are selling at 98. To hedge against a further price decrease on the bonds, Smithson purchased for 53.50 per $100 of bonds, February 2022 put options on the bonds at a strike price of 101. The intrinsic value of the puts was designated as the hedge instrument, On December 31, 2021, when the bands were selling at 97, Smithson clased out its position by selling the puts for $4,70, Early in 2022, Smithson sold the honds at 97, Required Prepare Smithson Foods' journal entries during 2020, 2021, and 2022 related to the puts and the bonds. Gains and losses related to the bonds that are appropriately reported in income appear in nonoperating gains (losses)." General Journal Description Debit Credit Date 06/15/20 . 0 0 0 To record purchase of AFS bonds 12/31/20 D 0 * 0 To record change in value of the unhedged bonds 02/01/21 D 0 0 D To recarci change in value of the unhedged bands 0 0 D 2 0 To recarci purchase of our options 12/21/21 0 0 0 0 To adjust the carrying value of the bond investment + 0 D 0 0 To record the gain or loss an options - 0 To read the staf pul options Cash 2022 0 0 0 0 U D 0 OC To record sale of brands and release of Ocito income for the unhedged loss on the bonds