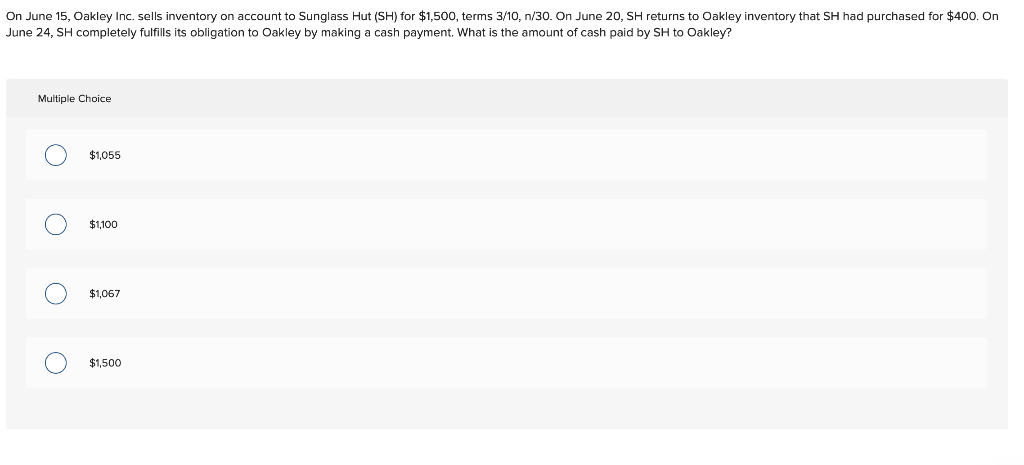

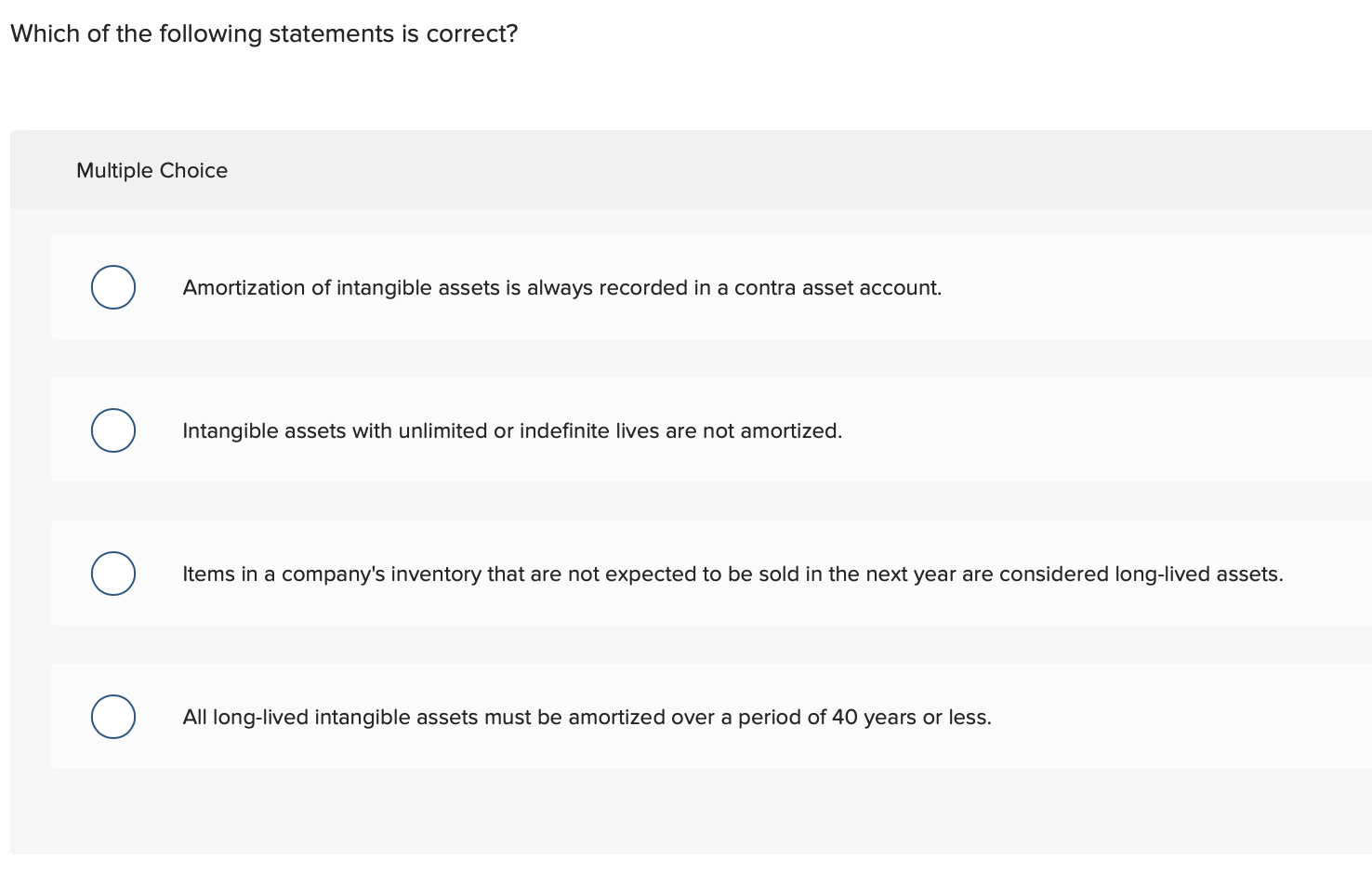

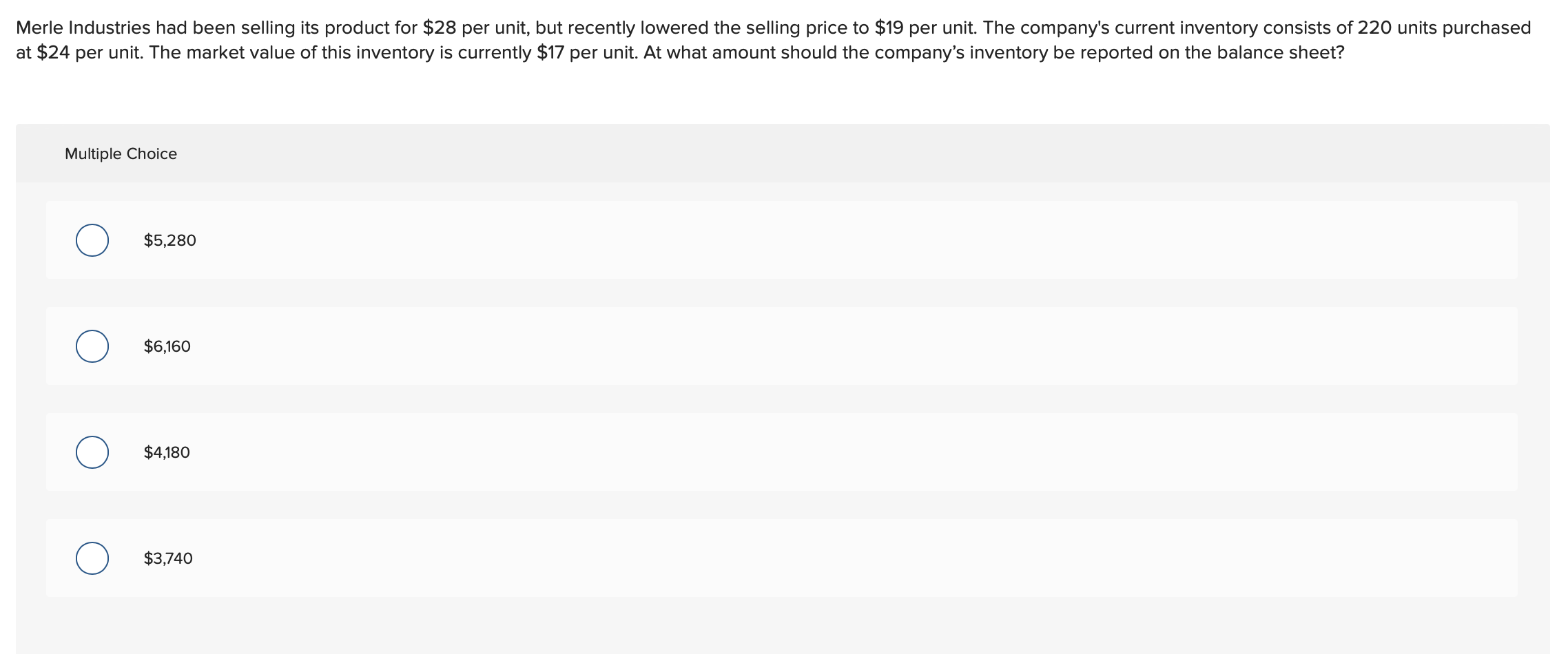

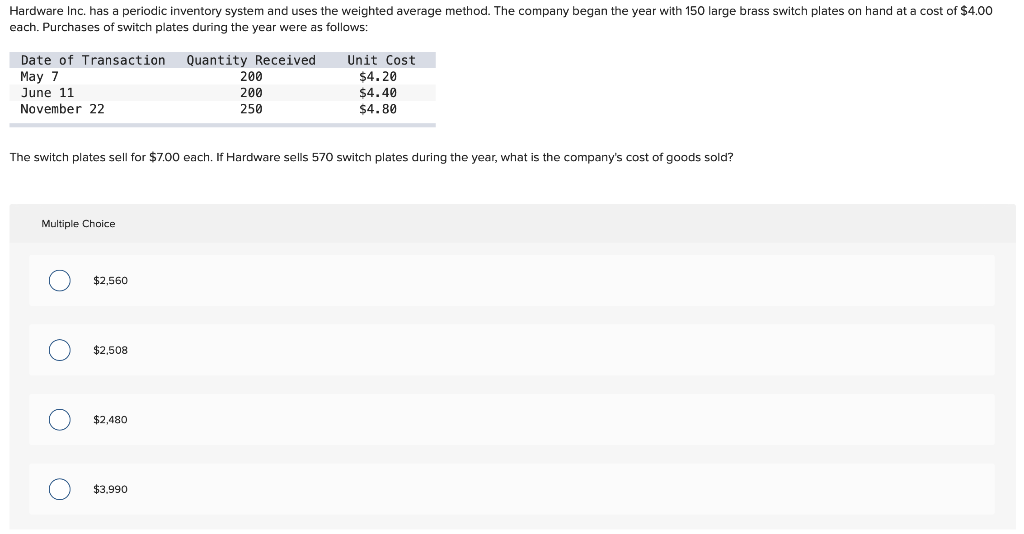

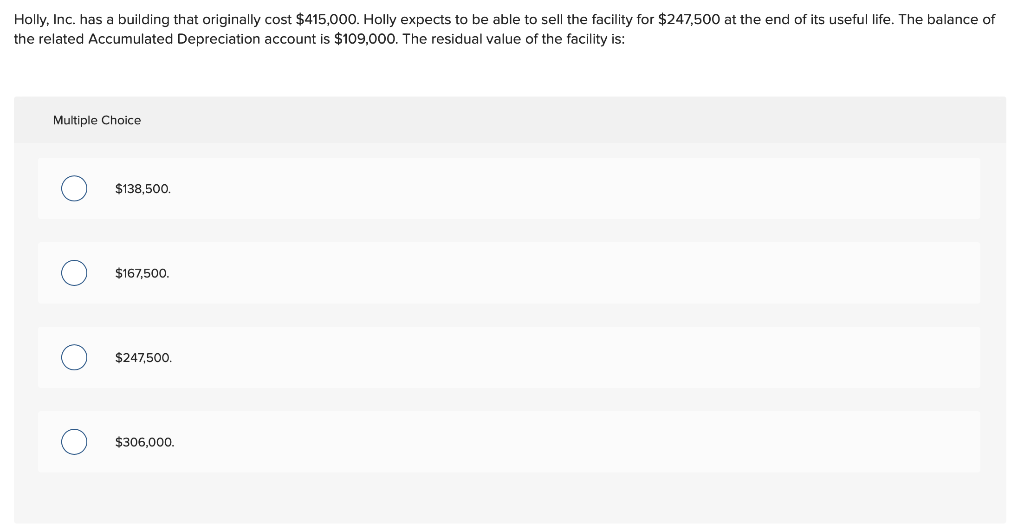

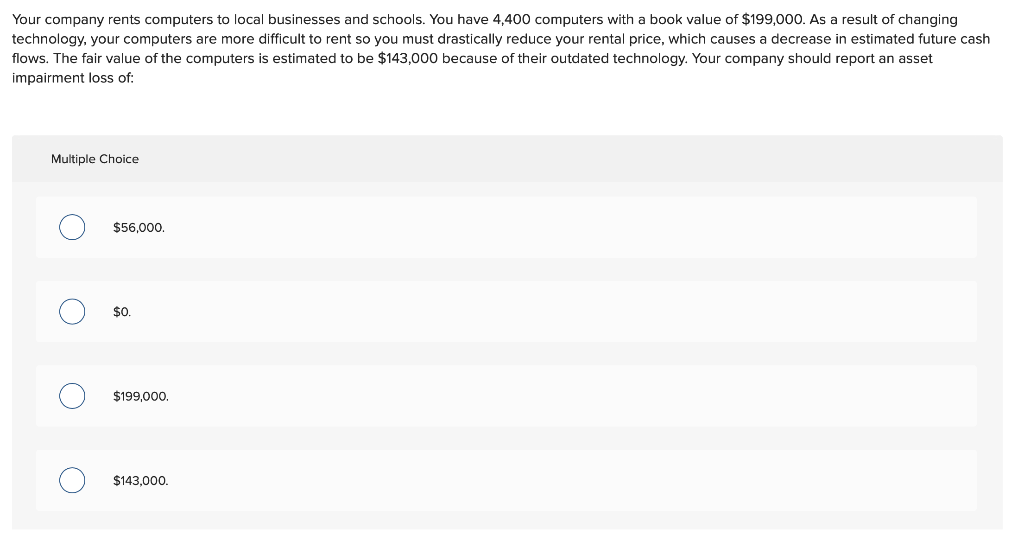

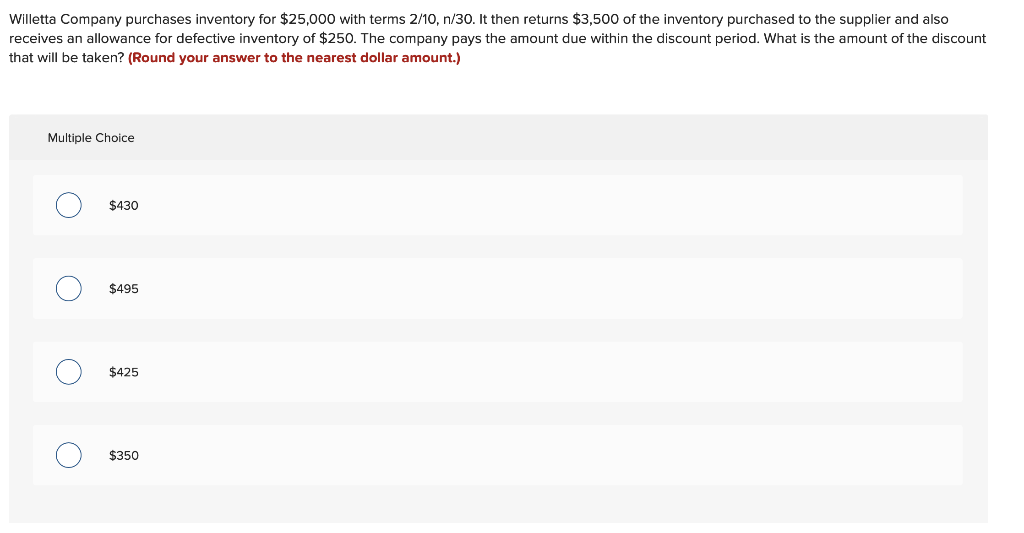

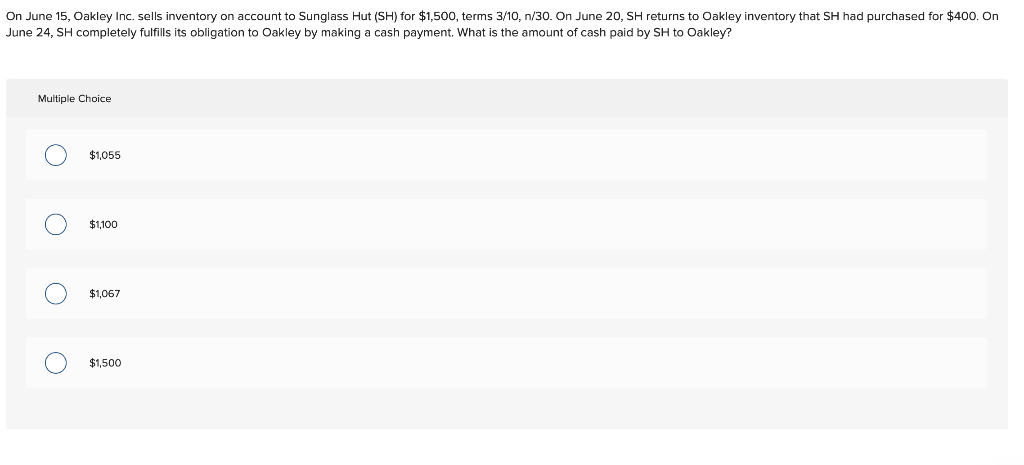

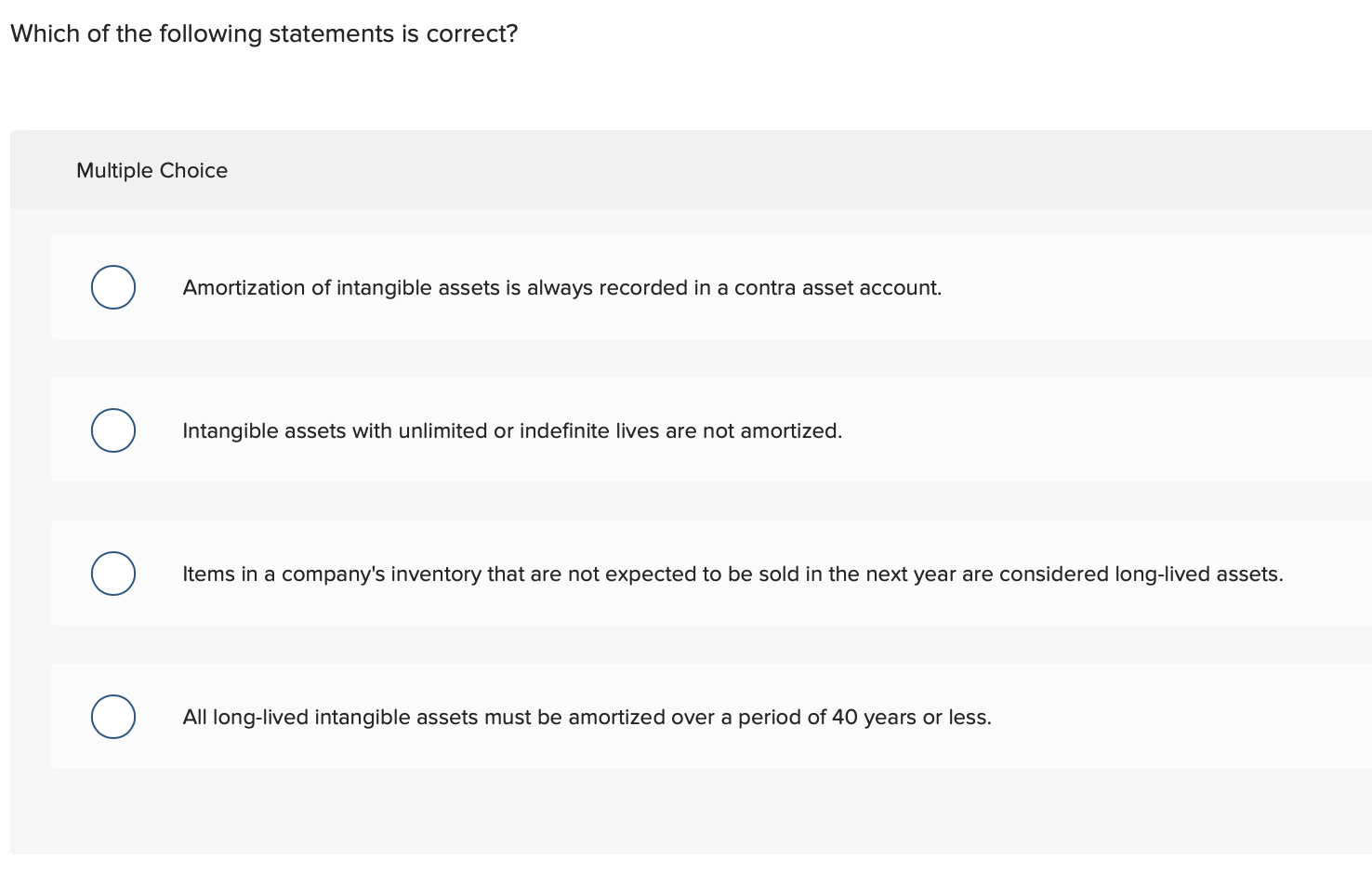

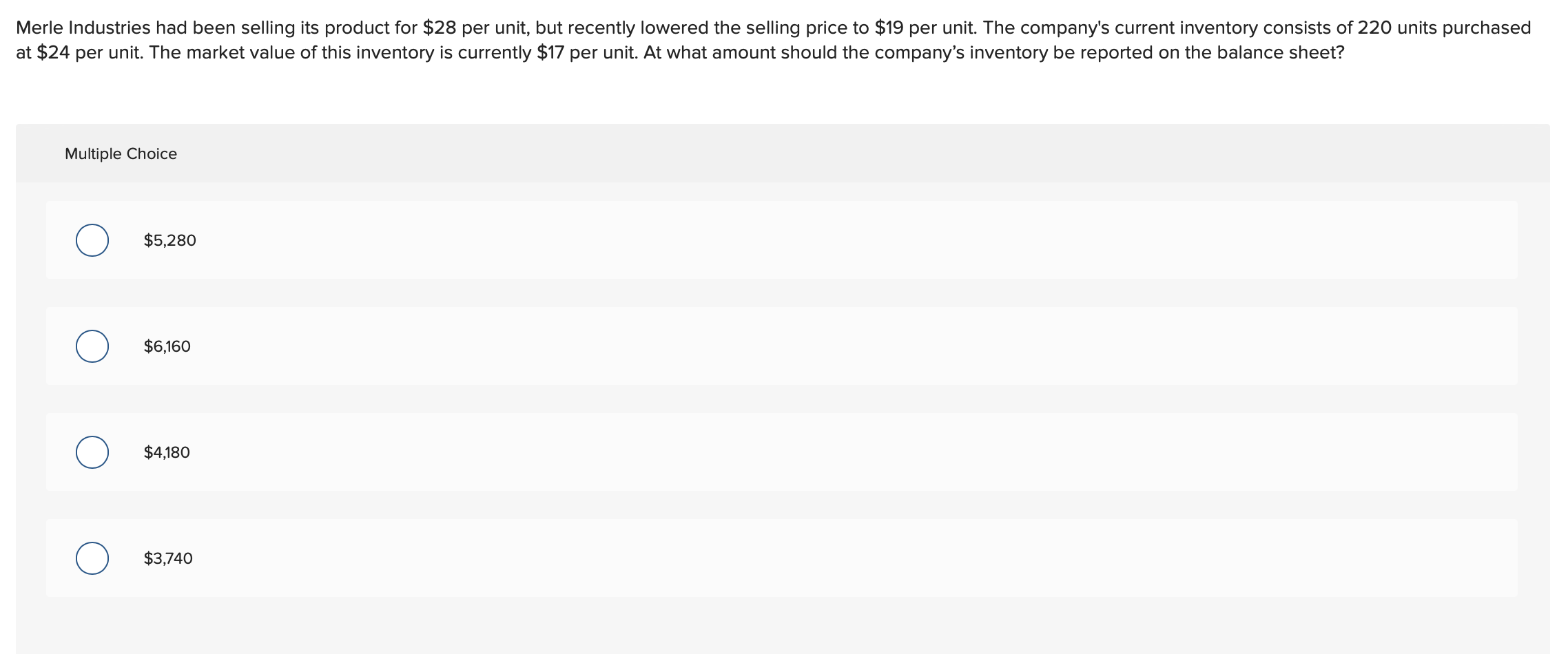

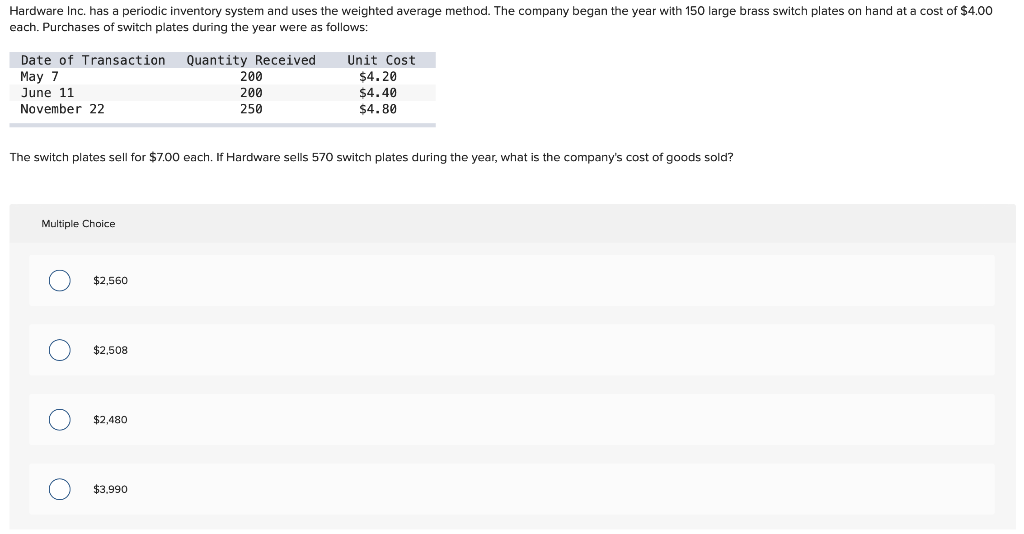

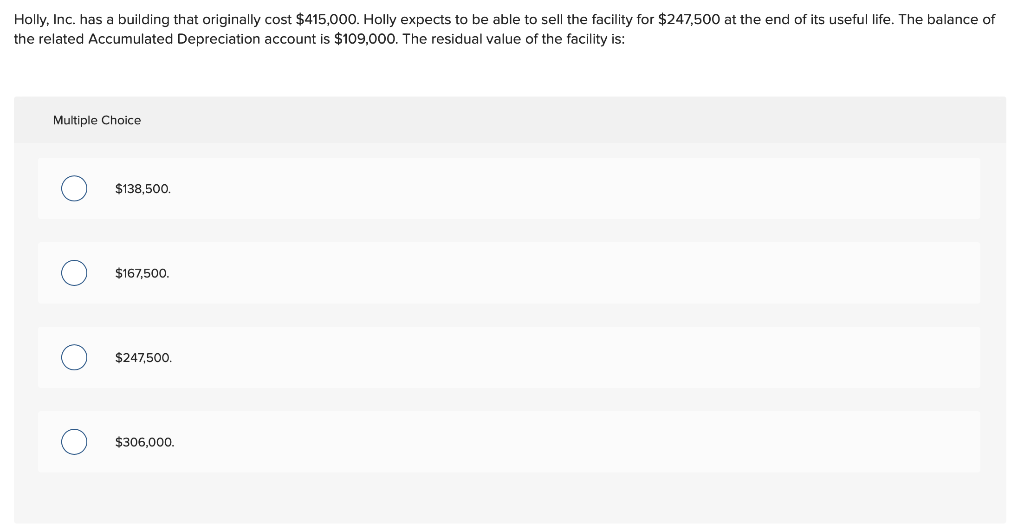

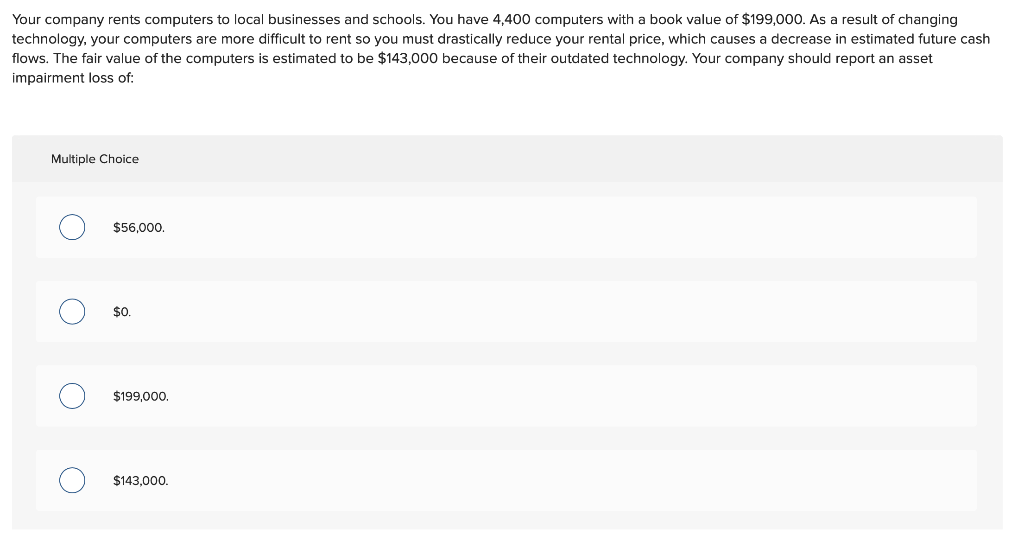

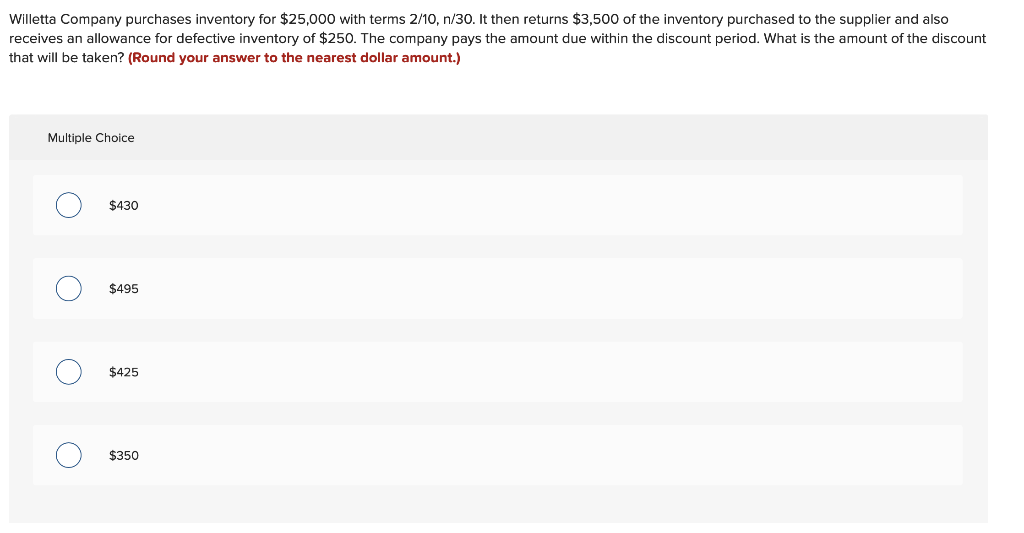

On June 15, Oakley Inc. sells inventory on account to Sunglass Hut (SH) for $1,500, terms 3/10, n/30. On June 20, SH returns to Oakley inventory that SH had purchased for $400. On June 24, SH completely fulfills its obligation to Oakley by making a cash payment. What is the amount of cash paid by SH to Oakley? Multiple Choice O $1,055 O $1,100 O $1,067 O $1,500 Which of the following statements is correct? Multiple Choice Amortization of intangible assets is always recorded in a contra asset account. Intangible assets with unlimited or indefinite lives are not amortized. Items in a company's inventory that are not expected to be sold in the next year are considered long-lived assets. All long-lived intangible assets must be amortized over a period of 40 years or less. Merle Industries had been selling its product for $28 per unit, but recently lowered the selling price to $19 per unit. The company's current inventory consists of 220 units purchased at $24 per unit. The market value of this inventory is currently $17 per unit. At what amount should the company's inventory be reported on the balance sheet? Multiple Choice $5,280 $6,160 $4,180 $3,740 Hardware Inc. has a periodic inventory system and uses the weighted average method. The company began the year with 150 large brass switch plates on hand at a cost of $4.00 each. Purchases of switch plates during the year were as follows: Date of Transaction May 7 June 11 November 22 Quantity Received 200 200 250 Unit Cost $4.20 $4.40 $4.80 The switch plates sell for $7.00 each. If Hardware sells 570 switch plates during the year, what is the company's cost of goods sold? Multiple Choice $2,560 O O $2,508 O $2,480 $3.990 O Holly, Inc. has a building that originally cost $415,000. Holly expects to be able to sell the facility for $247,500 at the end of its useful life. The balance of the related Accumulated Depreciation account is $109,000. The residual value of the facility is: Multiple Choice $138,500. O $167,500. $247,500. O O $306,000. Your company rents computers to local businesses and schools. You have 4,400 computers with a book value of $199,000. As a result of changing technology, your computers are more difficult to rent so you must drastically reduce your rental price, which causes a decrease in estimated future cash flows. The fair value of the computers is estimated to be $143,000 because of their outdated technology. Your company should report an asset impairment loss of: Multiple Choice $56,000. O $0 $199,000. O o $143,000. Willetta Company purchases inventory for $25,000 with terms 2/10, n/30. It then returns $3,500 of the inventory purchased to the supplier and also receives an allowance for defective inventory of $250. The company pays the amount due within the discount period. What is the amount of the discount that will be taken? (Round your answer to the nearest dollar amount.) Multiple Choice $430 $495 O O $425 O $350