Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 30, 2021, ABC Co. acquired 75,000 of DEF Co.'s 100,000 outstanding shares with par value per share of P1 for P4 per

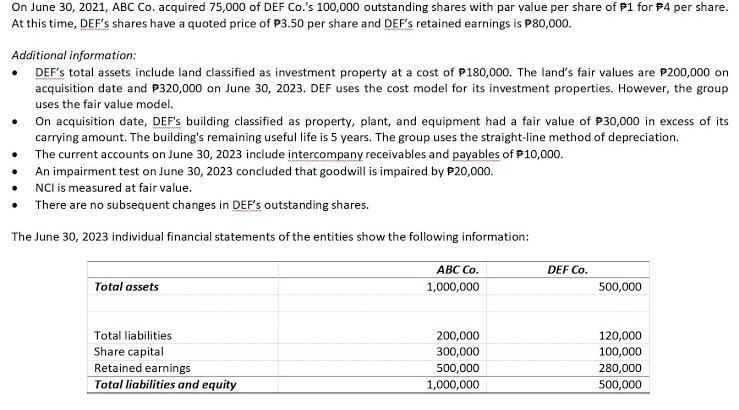

On June 30, 2021, ABC Co. acquired 75,000 of DEF Co.'s 100,000 outstanding shares with par value per share of P1 for P4 per share. At this time, DEF's shares have a quoted price of P3.50 per share and DEF's retained earnings is P80,000. Additional information: DEF's total assets include land classified as investment property at a cost of P180,000. The land's fair values are P200,000 on acquisition date and P320,000 on June 30, 2023. DEF uses the cost model for its investment properties. However, the group uses the fair value model. . On acquisition date, DEF's building classified as property, plant, and equipment had a fair value of P30,000 in excess of its carrying amount. The building's remaining useful life is 5 years. The group uses the straight-line method of depreciation. The current accounts on June 30, 2023 include intercompany receivables and payables of P10,000. An impairment test on June 30, 2023 concluded that goodwill is impaired by $20,000. NCI is measured at fair value. There are no subsequent changes in DEF's outstanding shares. The June 30, 2023 individual financial statements of the entities show the following information: ABC Co. 1,000,000 Total assets 500,000 Total liabilities 200,000 120,000 Share capital 300,000 100,000 Retained earnings 500,000 280,000 Total liabilities and equity 1,000,000 500,000 DEF Co.

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of NCI on 30 June 2023 Particulars NCI on acquisition date Add Share in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started