Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 30th 2021 EPCOR Ltd had a cash balance per books of $152,520 and the bank statement from ABC Bank showed a balance of

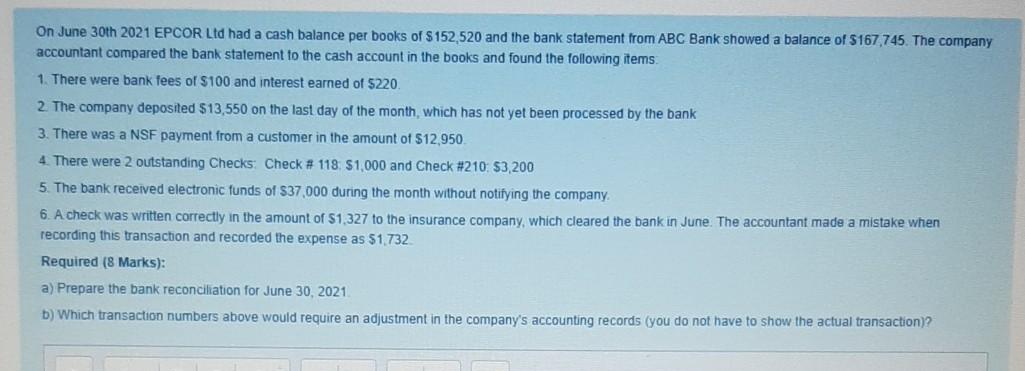

On June 30th 2021 EPCOR Ltd had a cash balance per books of $152,520 and the bank statement from ABC Bank showed a balance of $167,745. The company accountant compared the bank statement to the cash account in the books and found the following items 1. There were bank fees of $100 and interest earned of 5220. 2. The company deposited $13,550 on the last day of the month, which has not yet been processed by the bank 3. There was a NSF payment from a customer in the amount of $12.950 4. There were 2 outstanding Checks: Check # 118. $1,000 and Check #210: $3,200 5. The bank received electronic funds of $37,000 during the month without notifying the company 6. A check was written correctly in the amount of S1,327 to the insurance company, which cleared the bank in June. The accountant made a mistake when recording this transaction and recorded the expense as $1.732 Required (8 Marks): a) Prepare the bank reconciliation for June 30, 2021 b) Which transaction numbers above would require an adjustment in the company's accounting records (you do not have to show the actual transaction)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started