Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On June 5,2022 , Brown, Inc., a calendar year taxpayer, receives cash of $799,500 from the county upon condemnation of its warehouse building (adjusted basis

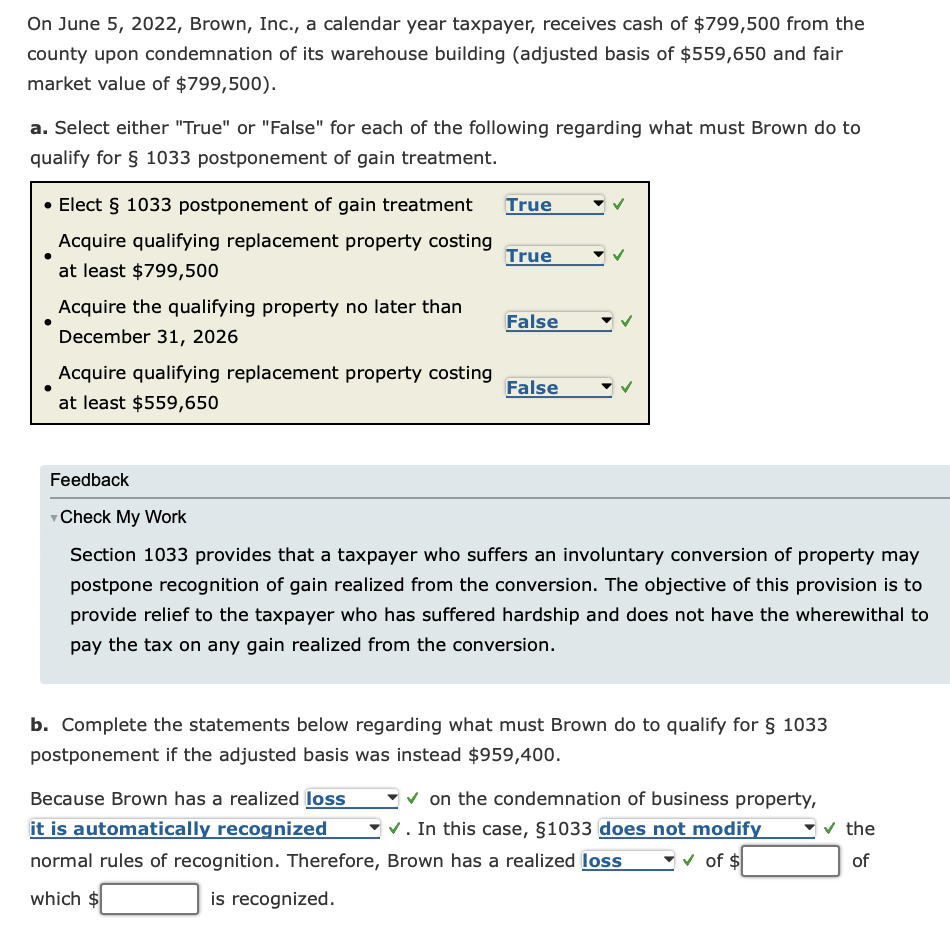

On June 5,2022 , Brown, Inc., a calendar year taxpayer, receives cash of $799,500 from the county upon condemnation of its warehouse building (adjusted basis of $559,650 and fair market value of $799,500 ). a. Select either "True" or "False" for each of the following regarding what must Brown do to qualify for 1033 postponement of gain treatment. - Elect 1033 postponement of gain treatment Acquire qualifying replacement property costing at least $799,500 Acquire the qualifying property no later than December 31, 2026 Acquire qualifying replacement property costing at least $559,650 Feedback - Check My Work Section 1033 provides that a taxpayer who suffers an involuntary conversion of property may postpone recognition of gain realized from the conversion. The objective of this provision is to provide relief to the taxpayer who has suffered hardship and does not have the wherewithal to pay the tax on any gain realized from the conversion. b. Complete the statements below regarding what must Brown do to qualify for 1033 postponement if the adjusted basis was instead $959,400. Because Brown has a realized on the condemnation of business property, . In this case, 1033 the normal rules of recognition. Therefore, Brown has a realized of $ of which \$ is recognized

On June 5,2022 , Brown, Inc., a calendar year taxpayer, receives cash of $799,500 from the county upon condemnation of its warehouse building (adjusted basis of $559,650 and fair market value of $799,500 ). a. Select either "True" or "False" for each of the following regarding what must Brown do to qualify for 1033 postponement of gain treatment. - Elect 1033 postponement of gain treatment Acquire qualifying replacement property costing at least $799,500 Acquire the qualifying property no later than December 31, 2026 Acquire qualifying replacement property costing at least $559,650 Feedback - Check My Work Section 1033 provides that a taxpayer who suffers an involuntary conversion of property may postpone recognition of gain realized from the conversion. The objective of this provision is to provide relief to the taxpayer who has suffered hardship and does not have the wherewithal to pay the tax on any gain realized from the conversion. b. Complete the statements below regarding what must Brown do to qualify for 1033 postponement if the adjusted basis was instead $959,400. Because Brown has a realized on the condemnation of business property, . In this case, 1033 the normal rules of recognition. Therefore, Brown has a realized of $ of which \$ is recognized Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started