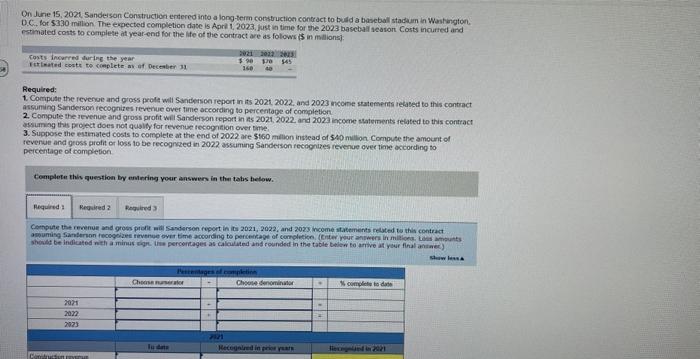

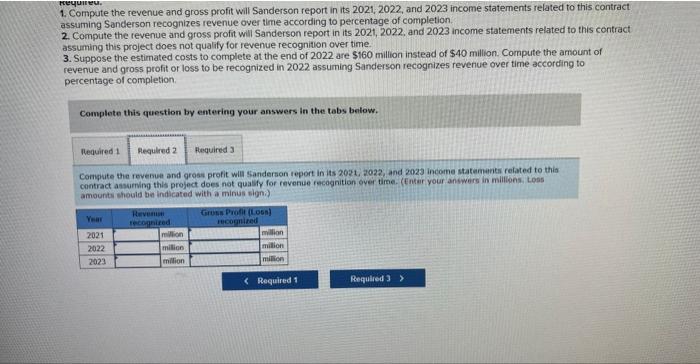

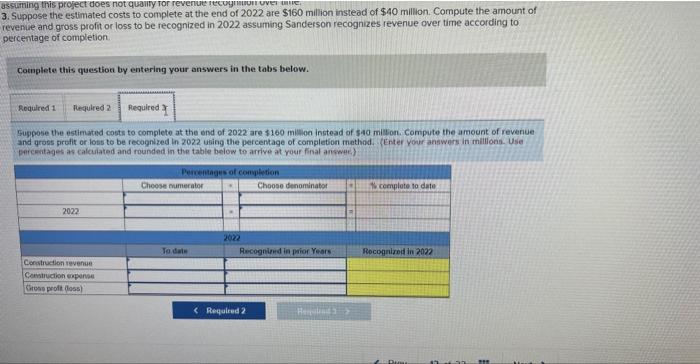

On Jure 15,2021 . Sandeison Construction erdered into a long-term constructice contract to buld a baseball stackum in Wastington. D.C. for $330 milion. The expected completion ditse is Apri 1, 2023 , was in time for the 2023 baseball seasort Costs incurted and estimated costs to complese it year-end for the life of the contract are as folows is in mallionsi: Required: 1. Compute the reveroe and gross profa wili Sunderson report in its 2021 2022 , and 2023 mcome statementis ielabed to this contract ascuming Sandersoni recognites revenue crver time according to percertage of completion 2. Compute the revenue and gross profit wil Sanderson teport an ats 2021,2022, and 2029 incoene statements telated to this contract assuming this project does not qusily for revenuc recogrition over inse, 3. Suppose the esterated costs to complete at the end of 2022 are 5160 million instead of 540 millat Compute the amount of reverue and gross profit of loss to be recognczed in 2022 assuming Sanderson recognizes revenue over time occording to percentage of completion Complete this guestion by ensering your answers in the tabs helow. Cethpute the revenue and gress prefit aiti Sanderson fepont in iti 2021,2022 , and 2023 hocme statements relyted te this contract. 1. Compute the revenue and gross profit will Sanderson report in its 2021,2022 , and 2023 income statements related to this contract assuming Sanderson recognizes revenue over time according to percentage of completion. 2. Compute the revenue and gross profit will Sanderson report in its. 2021, 2022, and 2023 income statements related to this contract assuming this project does not qualify for revenue recognition over time. 3. Suppose the estimated costs to complete at the end of 2022 are $160 million instead of $40 million. Compute the amount of revenue and gross profit or loss to be recognized in 2022 assuming Sanderson recognizes reveriue over time accorcing to percentage of completion. Complete this question by entering your answers in the tabs betow. Compute the revenuh and grosis profit will thanderson teport in its 2021, 2022, and 2023 income stateminti felated to this contract assurving thls project does not gualify for revenue recognition oyer time. (Entir your answers in milikons. Loss amounts should bi indicated with a minus signi) swiming this project does not quainy ror revenut recoynnwoul uver talle Suppose the estimated costs to complete at the end of 2022 are $160 million instead of $40 million. Compute the amount of uvenue and gross profit or loss to be recognized in 2022 assuming Sanderson recognizes revenue over time according to sercentage of completion. Cotnplete this question by entering your answers in the tabs below. 5uppose the estimated costs to complete at the end of 2022 are $160 million instead of 340million. Compute the amount of revenue and qroes profit or loss to be recognized in 2022 ubing the percentage of completion mathod. (Enter your answers in millions. Use. parcentages as calculated and rounded in the table below to arrive at your final anwwer.)