Question

on list K tion 1 stion 2 stion 3 Data table The Goldman Company retails two products: a standard and a deluxe version of

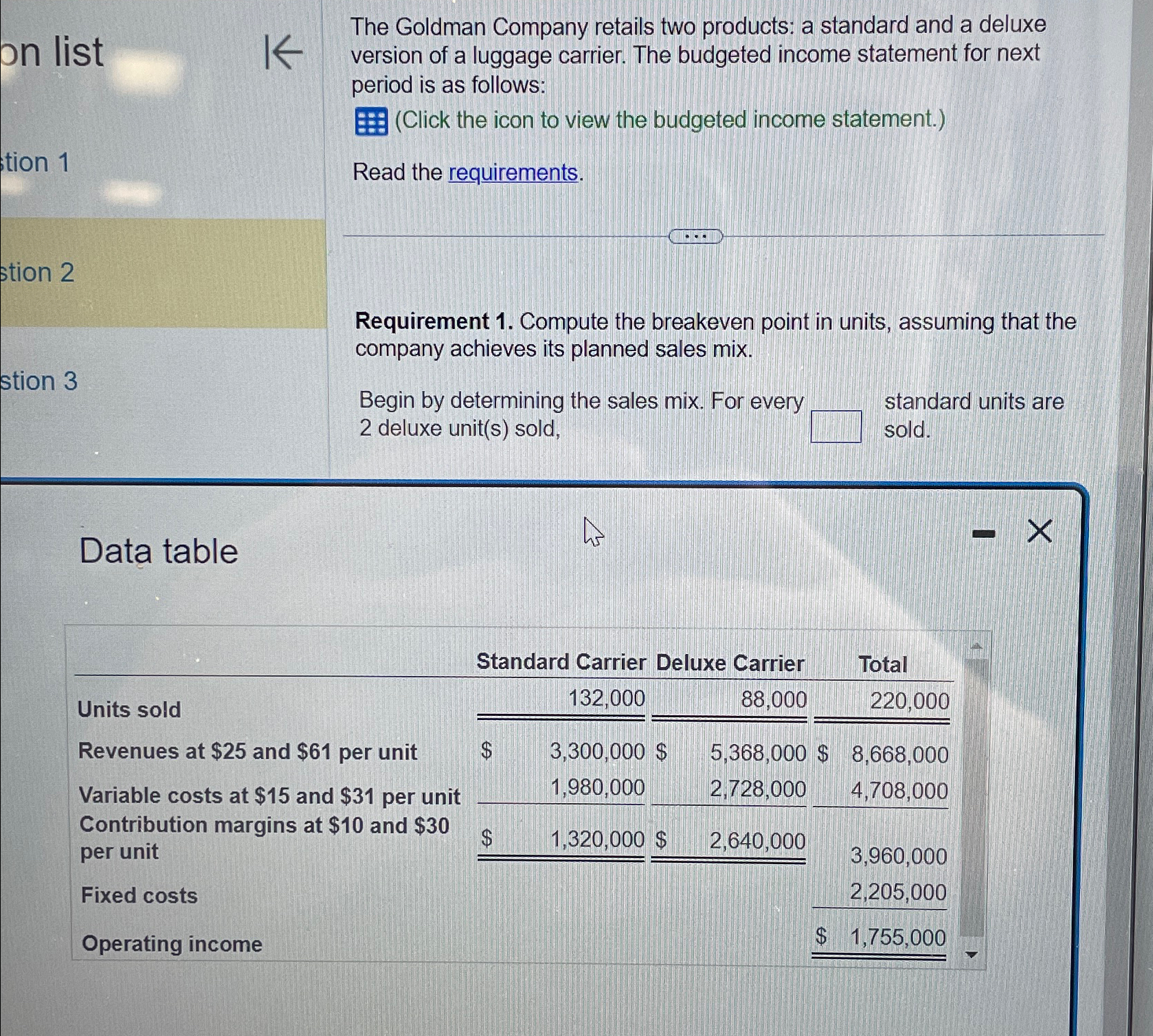

on list K tion 1 stion 2 stion 3 Data table The Goldman Company retails two products: a standard and a deluxe version of a luggage carrier. The budgeted income statement for next period is as follows: (Click the icon to view the budgeted income statement.) Read the requirements. Requirement 1. Compute the breakeven point in units, assuming that the company achieves its planned sales mix. Begin by determining the sales mix. For every 2 deluxe unit(s) sold, standard units are sold. Standard Carrier Deluxe Carrier Total 132,000 88,000 220,000 Units sold Revenues at $25 and $61 per unit $ Variable costs at $15 and $31 per unit Contribution margins at $10 and $30 per unit 3,300,000 $ 5,368,000 $ 8,668,000 1,980,000 2,728,000 4,708,000 69 $ 1,320,000 $ 2,640,000 3,960,000 Fixed costs Operating income 2,205,000 $ 1,755,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav

13th Edition

8120335643, 136126634, 978-0136126638

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App