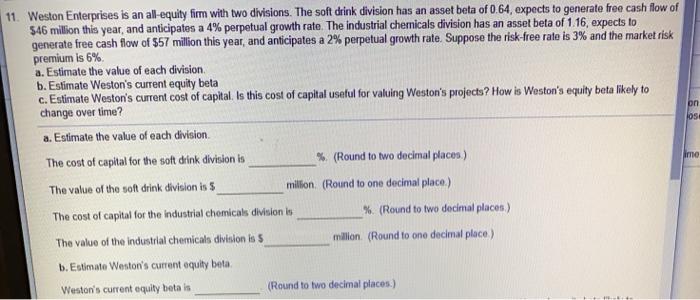

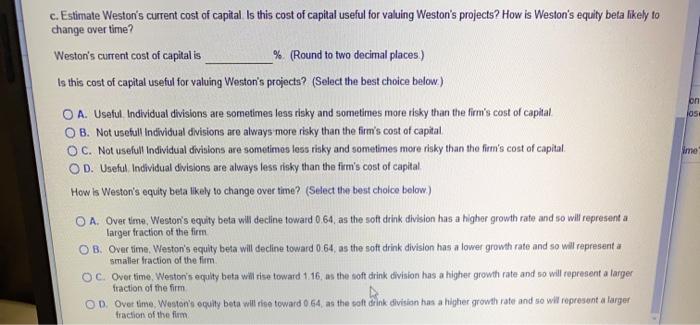

on los 11. Weston Enterprises is an all-equity firm with two divisions. The soft drink division has an asset beta of 0.64, expects to generate free cash flow of $46 million this year, and anticipates a 4% perpetual growth rate. The industrial chemicals division has an asset beta of 116, expects to generate free cash flow of $57 million this year, and anticipates a 2% perpetual growth rate. Suppose the risk-free rate is 3% and the market risk premium is 6% a. Estimate the value of each division b. Estimate Weston's current equity beta c. Estimate Weston's current cost of capital. Is this cost of capital useful for valuing Weston's projects? How is Weston's equity beta likely to change over time? a. Estimate the value of each division The cost of capital for the soft drink division is % (Round to two decimal places) The value of the soft drink division is 5 million (Round to one decimal place) The cost of capital for the industrial chemicals division is %. (Round to two decimal places) The value of the industrial chemicals division is 5 millon (Round to one decimal place) b. Estimato Weston's current equity beta, Weston's current equity betais (Round to two decimal places.) ime c. Estimate Weston's current cost of capital Is this cost of capital useful for valuing Weston's projects? How is Weston's equity beta likely to change over time? Weston's current cost of capital is % (Round to two decimal places) Is this cost of capital useful for valuing Weston's projects? (Select the best choice below) on OS Inre O A Useful Individual divisions are sometimes less risky and sometimes more tisky than the firm's cost of capital O B. Not usefull Individual divisions are always more risky than the firm's cost of capital OC. Not useful Individual divinions are sometimes less risky and sometimes more risky than the firm's cost of capital OD. Useful Individual divisions are always less risky than the firm's cost of capital How is Weston's equity beta likely to change over time? (Select the best choice below) OA. Over time, Westor's equity beta will decline toward 0.64, as the soft drink division has a higher growth rate and so will represent a larger fraction of the firm OB. Over time. Weston's equity beta will decline toward 0.64, as the soft drink division has a lower growth rate and so will representa smaller fraction of the firm OC. Over time. Wonton's equity beta will rise toward 116, as the soft drink division has a higher growth rate and so will represent a larger fraction of the firm OD Over time. Weston's equity beta will rise toward 064, as the soft drink division has a higher growth rate and so will represent a larger fraction of the form