Answered step by step

Verified Expert Solution

Question

1 Approved Answer

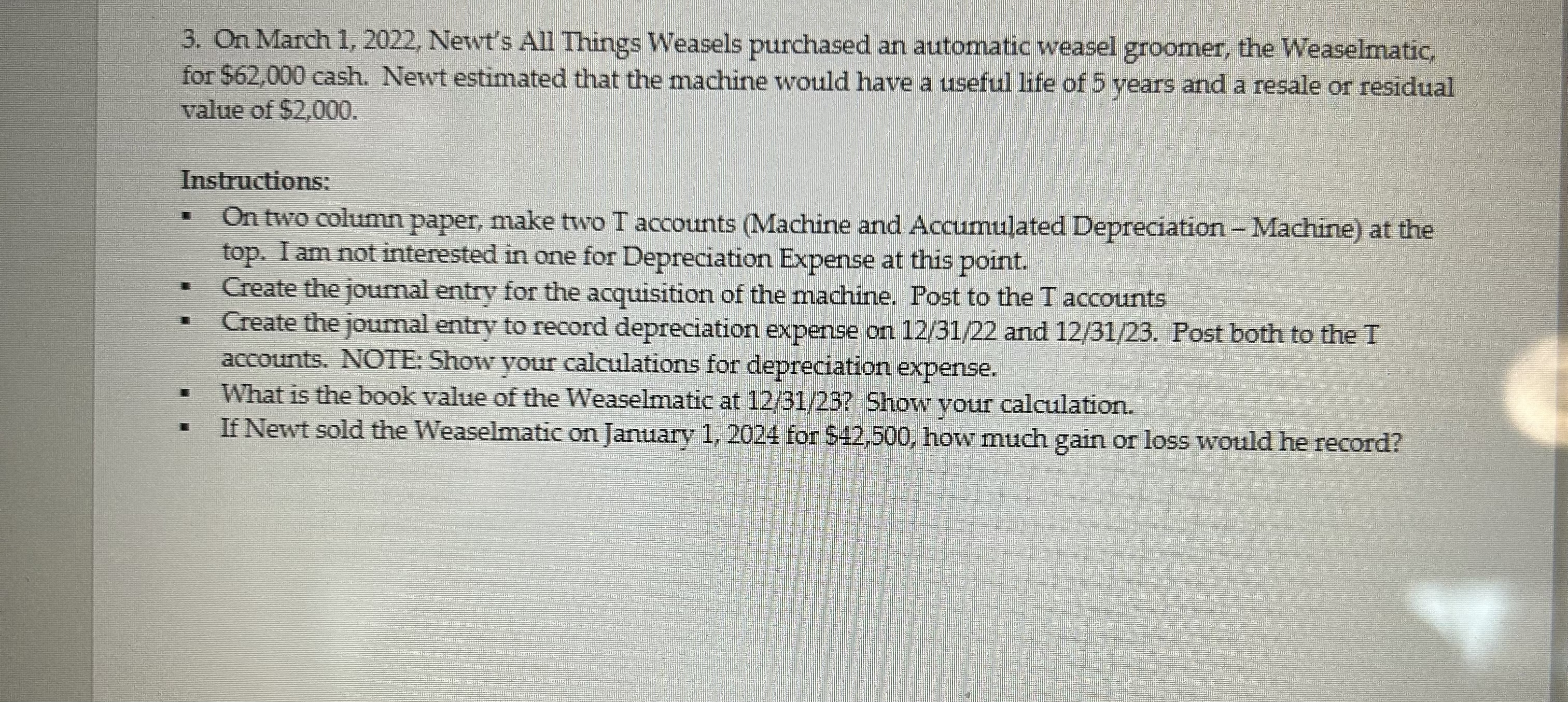

On March 1 , 2 0 2 2 , Newt's All Things Weasels purchased an automatic weasel groomer, the Weaselmatic, for $ 6 2 ,

On March Newt's All Things Weasels purchased an automatic weasel groomer, the Weaselmatic, for $cash. Newt estimated that the machine would have a useful life of years and a resale or residual value of $

Instructions:

On two column paper, make two I accounts Machine and Accumulated Depreciation Machine at the top. I am not interested in one for Depreciation Expense at this point.

Create the joumal entry for the acquisition of the machine. Post to the accounts

Create the joumal entry to record depreciation expense on and Post both to the accounts. NOTE: Show your calculations for depreciation expense.

What is the book value of the Weaselmatic at Show your calculation.

If Newt sold the Weaselmatic on January for $ how much gain or loss would he record?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started