Question

On March 1, 2017, Conord Corp. acquired a 10-unit residential complex for $1,274,980, paid in cash. An independent appraiser determined that 75% of the total

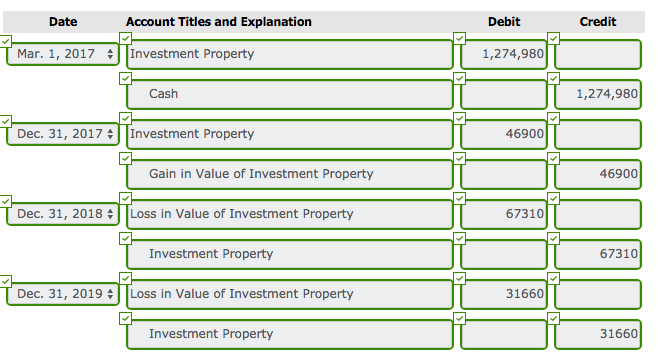

On March 1, 2017, Conord Corp. acquired a 10-unit residential complex for $1,274,980, paid in cash. An independent appraiser determined that 75% of the total purchase price should be allocated to buildings, with the remainder allocated to land. On the date of acquisition, the estimated useful life of the building was 27 years, with estimated residual value of $324,610. Conord estimates that straight-line depreciation would best reflect the pattern of benefits to be received from the building. Fair value of the complex, as assessed by an independent appraiser on each date, is as follows:

| Date | Fair Value | |

| December 31, 2017 | $1,321,880 | |

| December 31, 2018 | $1,254,570 | |

| December 31, 2019 | $1,222,910 |

The complex qualifies as investment property under IAS 40 Investment Property. Conord has a December 31 year end.

The journal entries required for 2017, 2018, and 2019, assuming that Conord applies the fair value model to all of its investment property.

Prepare the journal entries required for 2017, 2018, and 2019, assuming that Conord applies the cost model to all of its investment property.

Here are the list of accounts:

Accounts Payable Accounts Receivable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Leasehold Improvements Accumulated Depreciation - Machinery Accumulated Depreciation - Trucks Advertising Expense Asset Retirement Obligation Buildings Cash Common Shares Contributed Surplus Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Donation Revenue Equipment Finance Expense Finance Revenue Gain in Value of Investment Property Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Machinery Gain on Disposal of Truck Gain on Sale of Land GST Payable GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Inventory Investment Property Land Land Improvements Loss in Value of Investment Property Loss on Disposal of Building Loss on Disposal of Equipment Loss on Disposal of Land Loss on Disposal of Machinery Loss on Disposal of Truck Machinery Maintenance and Repairs Expense Mineral Resources Mortgage Payable No Entry Notes Payable Notes Receivable Office Expense Owner's Drawings Prepaid Expenses Prepaid Insurance Profit on Construction Purchase Discounts Purchase Returns and Allowances Rent Expense Revaluation Gain or Loss Revaluation Surplus (OCI) Revenue - Government Grants Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Service Revenue Supplies Supplies Expense Tenant Deposits Liability Trucks

Date Account Titles and Explanation Debit reli Mar. 1, 2017 Investment Property 1,274,980 Cash 1,274,980 Dec. 31, 2017 Investment Property 46900 Gain in Value of Investment Property 46900 | Dec. 31, 2018 # | | Loss in Value of Investment Property 67310 Investment Property 67310 T Dec. 31, 2019 # | | Loss in Value of Investment Property 31660 Investment Property 31660 Date Account Titles and Explanation Debit Credit Mar. 1, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started