Question

On March 1, 2020, Quinto Mining Inc. issued a $580,000, 11%, three-year bond. Interest is payable semiannually beginning September 1, 2020. Required: Part 1 a.

On March 1, 2020, Quinto Mining Inc. issued a $580,000, 11%, three-year bond. Interest is payable semiannually beginning September 1, 2020.

Required: Part 1

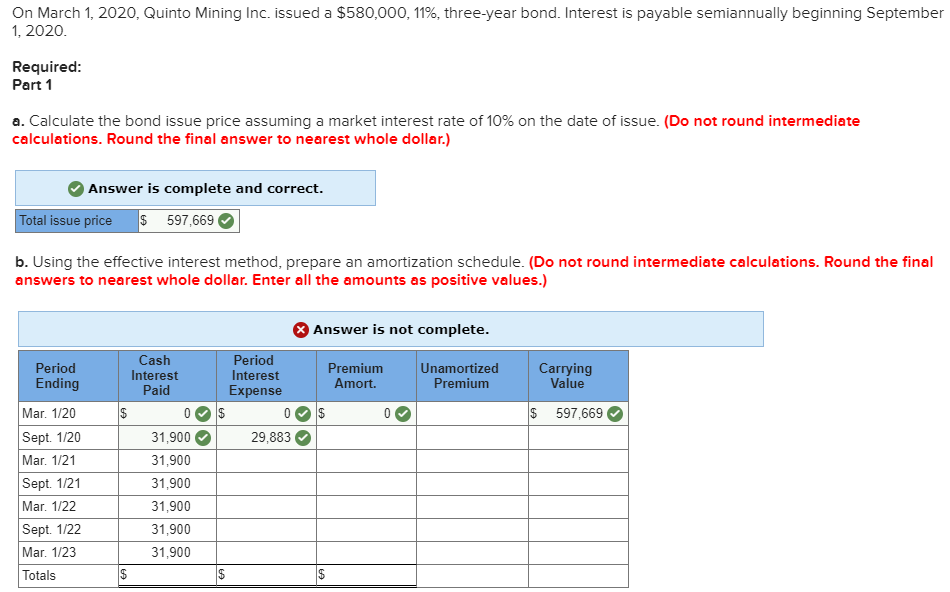

a. Calculate the bond issue price assuming a market interest rate of 10% on the date of issue. (Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Rounded, the answer is $597,669 but I think you'll need part of your calculations from question a. to answer b.

b. Using the effective interest method, prepare an amortization schedule. Make sure to fill in all columns and rows below (Period Interest Expense, Premium Amortization, Unamortized Premium, and Carrying Value). (Make sure not to round intermediate calculations. Round all your final answers to nearest whole dollar. Enter all the amounts as positive values.)

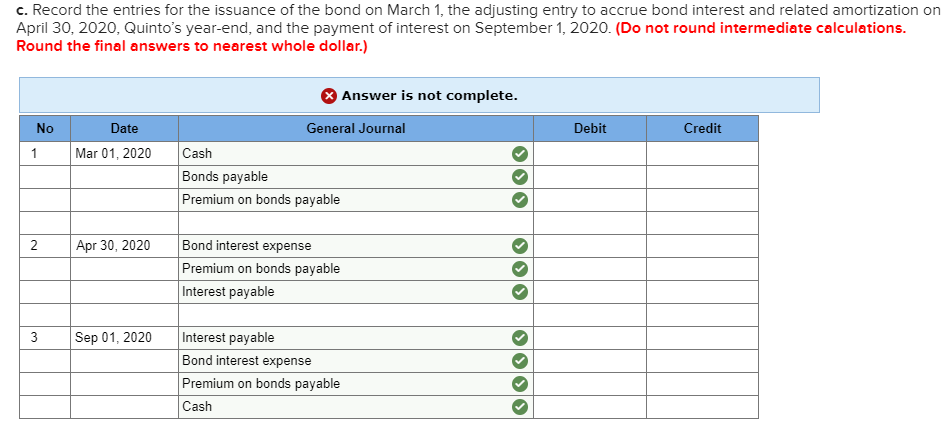

c. Record the entries for the issuance of the bond on March 1, the adjusting entry to accrue bond interest and related amortization on April 30, 2020, Quintos year-end, and the payment of interest on September 1, 2020. I figured out the account names, but I don't know the amounts within the debits/credits. (Do not round intermediate calculations. Round the final answers to nearest whole dollar.)

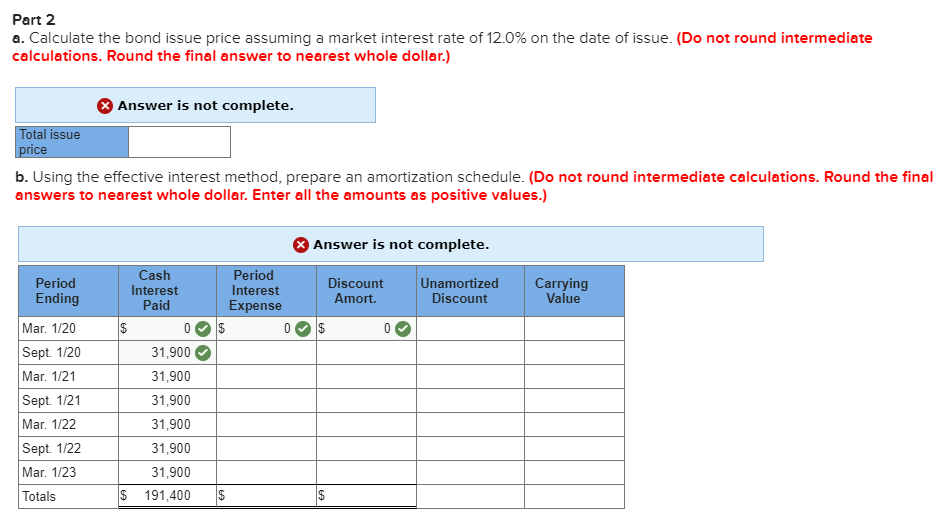

Part 2 a. Calculate the bond issue price assuming a market interest rate of 12.0% on the date of issue. (Do not round intermediate calculations. Round the final answer to nearest whole dollar.)

b. Using the effective interest method, prepare an amortization schedule. Make sure to fill in all columns and rows below (Period Interest Expense, Premium Amortization, Unamortized Premium, and Carrying Value). (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amounts as positive values.)

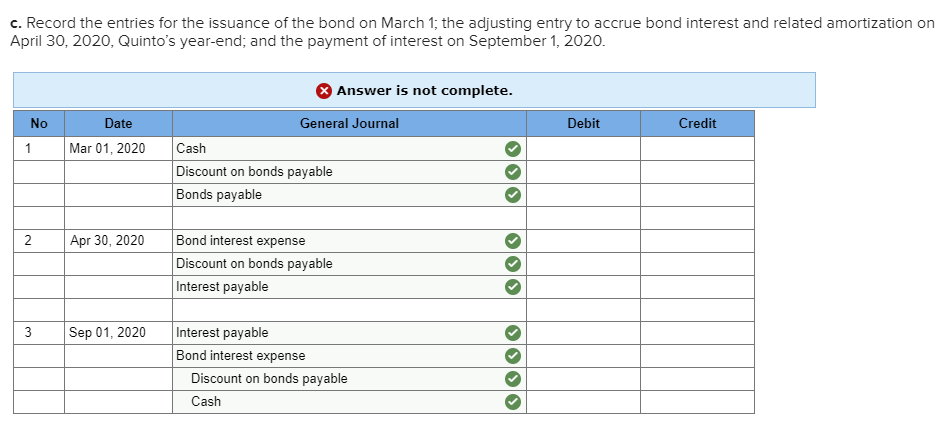

c. Record the entries for the issuance of the bond on March 1; the adjusting entry to accrue bond interest and related amortization on April 30, 2020, Quintos year-end; and the payment of interest on September 1, 2020. I figured out the account names, but I don't know the amounts within the debits/credits.

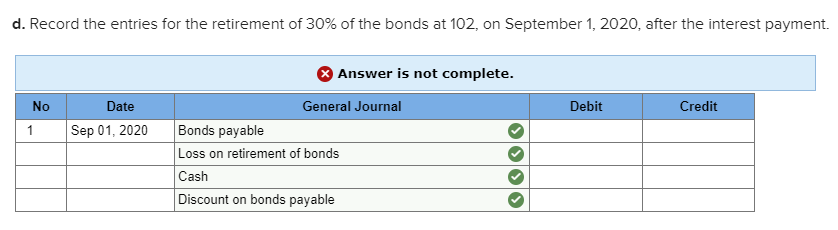

d. Record the entries for the retirement of 30% of the bonds at 102, on September 1, 2020, after the interest payment. I figured out the account names, but I don't know the amounts within the debits/credits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started