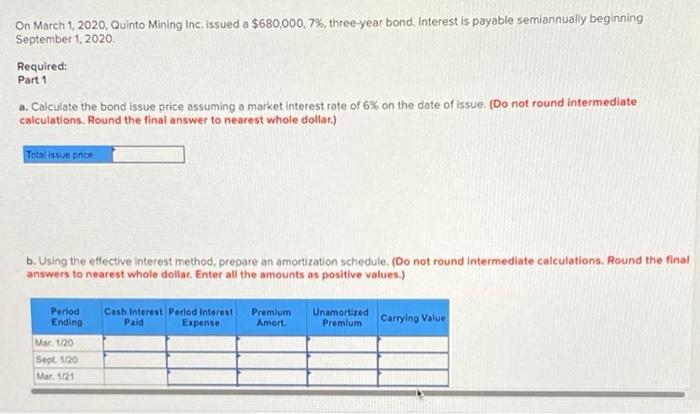

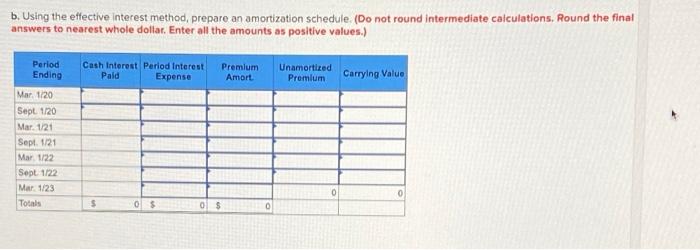

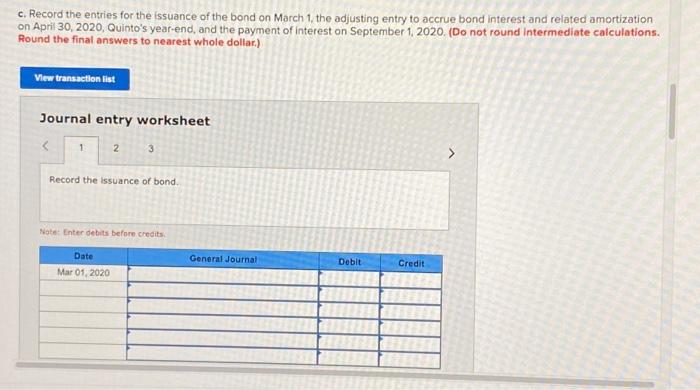

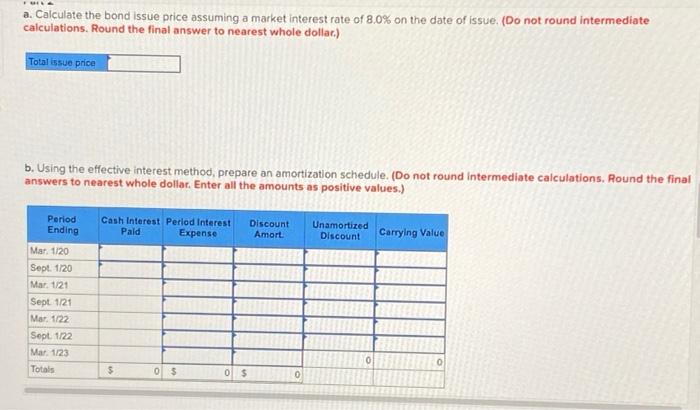

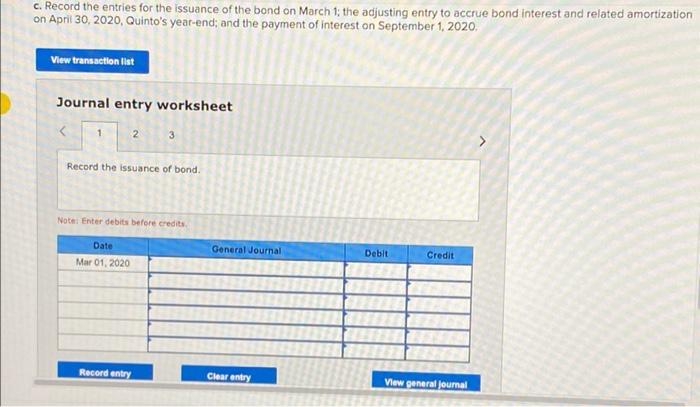

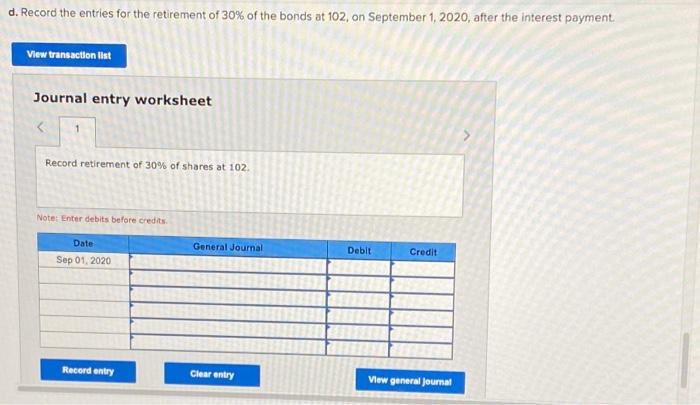

On March 1, 2020, Quinto Mining Inc. issued a $680,000, 7%, three-year bond. Interest is payable semiannually beginning September 1, 2020 Required: Part 1 a. Calculate the bond issue price assuming a market interest rate of 6% on the date of issue. (Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Total issue price b. Using the effective Interest method, prepare an amortization schedule. (Do not round Intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amounts as positive values.) Cash Interest Period interest Pald Expense Premium Amort. Un amortized Premium Carrying Value Period Endino Mar. 1/20 Sept. 120 Mar. 121 b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations, Round the final answers to nearest whole dollar. Enter all the amounts as positive values.) Cash Interest Period Interest Pald Expense Premium Amort. Unamortized Premium Carrying Value Period Ending Mar. 1/20 Sept. 1/20 Mar. 121 Sept. 1/21 Mar 1/22 Sept 1122 Mar. 1/23 Totals 0 $ 05 0 $ 0 c. Record the entries for the issuance of the bond on March 1, the adjusting entry to accrue bond interest and related amortization on April 30, 2020, Quinto's year-end, and the payment of interest on September 1, 2020. (Do not round Intermediate calculations. Round the final answers to nearest whole dollar) View transaction list Journal entry worksheet Record the issuance of bond, Note Enter debts before credits General Journal Date Mar 01, 2020 Debit Credit a. Calculate the bond issue price assuming a market interest rate of 8.0% on the date of issue. (Do not round intermediate calculations. Round the final answer to nearest whole dollar) Total issue price b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amounts as positive values.) Period Ending Cash Interest Period interest Pald Expense Discount Amort. Unamortized Discount Carrying Value Mar. 1/20 Sept. 1/20 Mar. 1/21 Sept 1/21 Mar. 1/22 Sept. 1/22 Mar. 1/23 Totals 0 $ 0 $ 0 $ 0 c. Record the entries for the issuance of the bond on March 1; the adjusting entry to accrue bond interest and related amortization on April 30, 2020, Quinto's year-end; and the payment of interest on September 1, 2020, View transaction list Journal entry worksheet 1 2 3 Record the issuance of bond. Note: Enter debits before credits Date Mar 01, 2020 General Journal Debit Credit Record entry Clear entry View general Journal d. Record the entries for the retirement of 30% of the bonds at 102, on September 1, 2020, after the interest payment View transaction list Journal entry worksheet Record retirement of 90% of shares at 102. Note: Enter debits before credits General Journal Date Sep 01, 2020 Debit Credit Record entry Clear entry View general Journal