On March 1, 2024, Wildhorse Insurance received $5,280 cash from Pronghorn Co. for a one-year insurance policy. Wildhorse Insurance has an October 31 fiscal

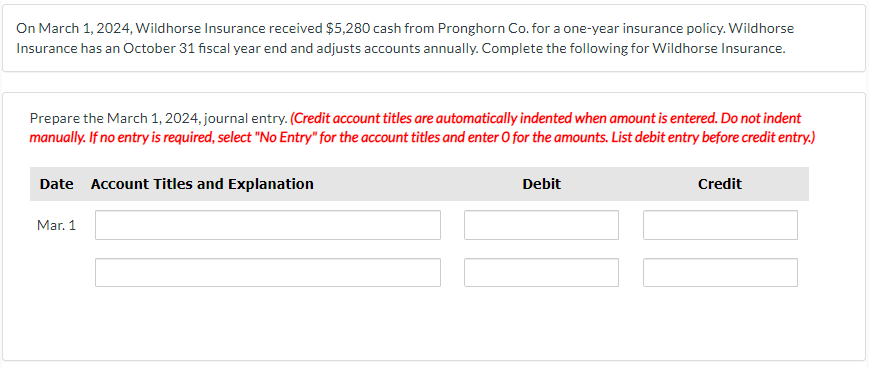

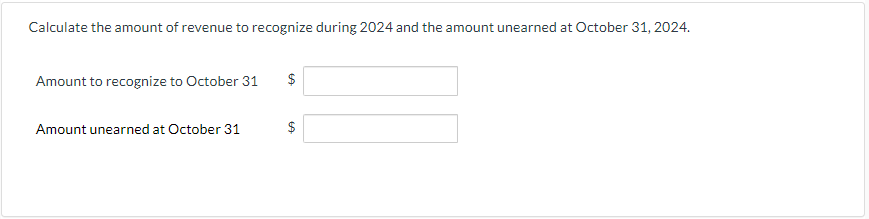

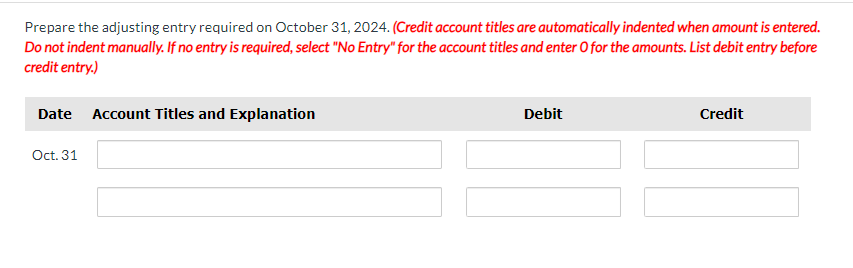

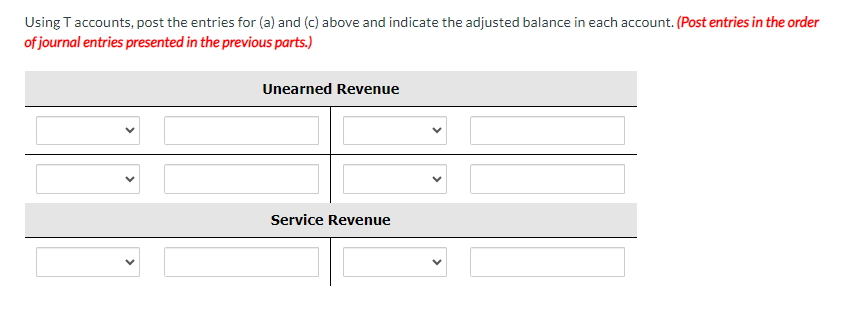

On March 1, 2024, Wildhorse Insurance received $5,280 cash from Pronghorn Co. for a one-year insurance policy. Wildhorse Insurance has an October 31 fiscal year end and adjusts accounts annually. Complete the following for Wildhorse Insurance. Prepare the March 1, 2024, journal entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles and Explanation Debit Credit Mar. 1 Calculate the amount of revenue to recognize during 2024 and the amount unearned at October 31, 2024. Amount to recognize to October 31 Amount unearned at October 31 $ 6A $ 6A Prepare the adjusting entry required on October 31, 2024. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles and Explanation Oct. 31 Debit Credit Using T accounts, post the entries for (a) and (c) above and indicate the adjusted balance in each account. (Post entries in the order of journal entries presented in the previous parts.) Unearned Revenue Service Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the full workings for the journal entry on March 1 2024 for Wildhorse Insurance Transaction ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started