Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1, Dortex Manufacturing Ltd. (Dortex) purchased a factory with a lot of land and a machine for $818,000. Dortex paid legal fees

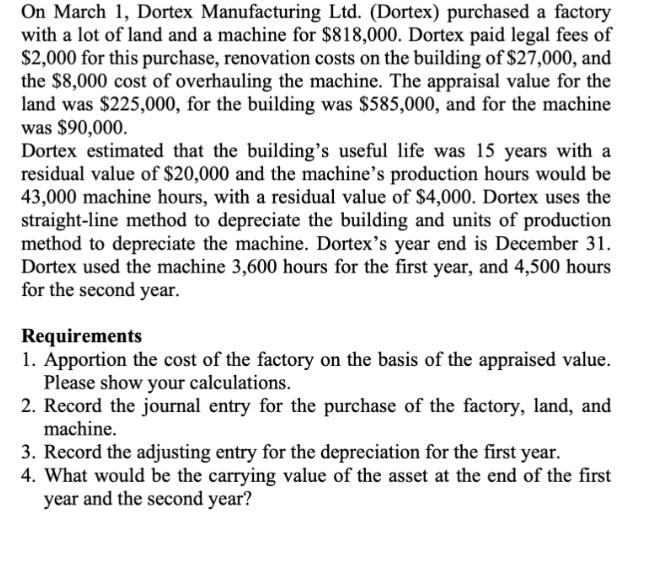

On March 1, Dortex Manufacturing Ltd. (Dortex) purchased a factory with a lot of land and a machine for $818,000. Dortex paid legal fees of $2,000 for this purchase, renovation costs on the building of $27,000, and the $8,000 cost of overhauling the machine. The appraisal value for the land was $225,000, for the building was $585,000, and for the machine was $90,000. Dortex estimated that the building's useful life was 15 years with a residual value of $20,000 and the machine's production hours would be 43,000 machine hours, with a residual value of $4,000. Dortex uses the straight-line method to depreciate the building and units of production method to depreciate the machine. Dortex's year end is December 31. Dortex used the machine 3,600 hours for the first year, and 4,500 hours for the second year. Requirements 1. Apportion the cost of the factory on the basis of the appraised value. Please show your calculations. 2. Record the journal entry for the purchase of the factory, land, and machine. 3. Record the adjusting entry for the depreciation for the first year. 4. What would be the carrying value of the asset at the end of the first year and the second year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Apportion the cost of the factory on the basis of the appraised value The total appraised value is 225000 land 585000 building 90000 machine 900000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started