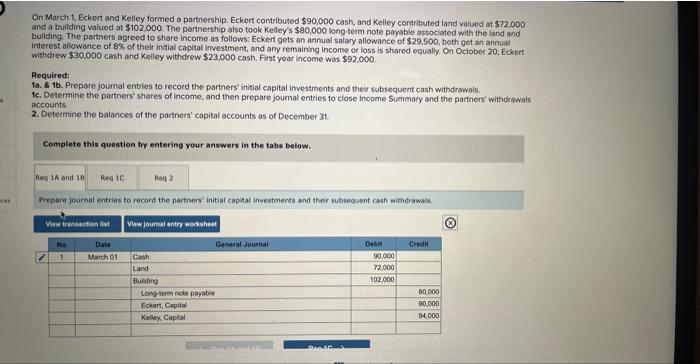

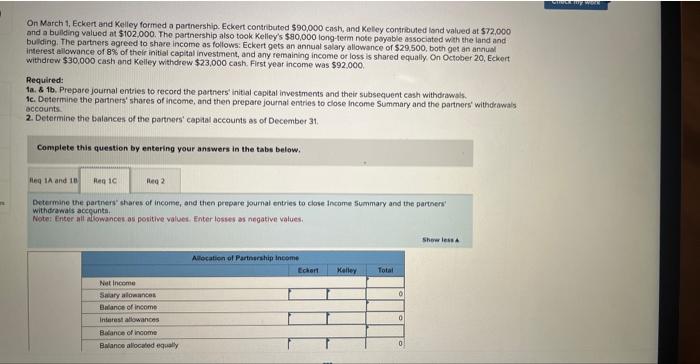

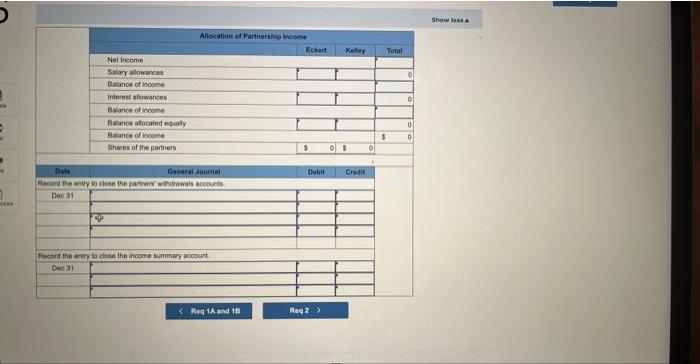

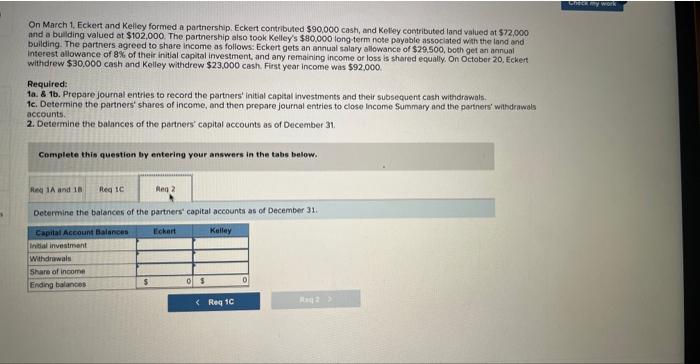

On March 1, Eckert and Kellcy formed a partnership. Eckert contributed $90,000 cash, and Kelley contributed land valued at $72,000 and a bullding valued at $102,000. The partnership also took Kelley's $80,000 long-term note payable associated with the land and bullding. The partners agreod to share income as follows: Eckert gets an annual solary allowance of $29,500, both get an arinual interest allowance of 8% of their in. Iial capital investment, and any remaining income or loss is shared equally. On October 20, Eckert withdrew $30,000 cash and Kelloy withdrew $23,000 cash. First year income was $92,000. Aequired: ta. 8 1b. Prepore joumal entrios to record the parthers' initial capital imvestments and their subsequent cash withdrawais. Te. Determine the partners' shares of income, and then prepare journal entries to close income Summacy and the parthers' withdrawaks iccounts 2. Determine the balances of the partners' copital accounts as of Decomber 31 . Complete this question by entering your answers in the tabs below. Prepare fournal entries to record the partners" initial capital investments and their subsequent cash aithdrawale. On March 1, Eckert and Keiley formed a parthership. Eckert contributed $90,000 cash, and Keley contrived land valued at 572,000 and a bulding valucd at $102,000. The parthership also took Kelley's $90,000 long-term note poyable associated with the land and bulding. The partners agreed to share income as follows: Eckert gets an annual salary allowance of $29,500, both get an annuial interest allowance of 8% of thoir initial capital investment, and any remaining income or loss is shared equally On October 20, Eckert withdrew $30,000 cash and Kelley withdrew $23,000 cash: First year income was $92,000. Required: 1a. 81 b. Prepare journal entries to record the portners' initial cepital investments and their subsequent cash withdrawals. 1c. Dotermine the partners' shares of income, and then prepare joutnat entries to close income Summary and the partners' withdrawals accounts. 2. Detarmine the taalances of the partners' caphal accounts as of December 31. Complete this question by entering your answers in the tabe below. Betermine the partners' shares of income, and then prepare fournal entries to clove income summary and the parthens Withdrawals acceunta. Note: Criter all alowances as positive values. Enter losses as negative vatues. On March 1, Eckert and Kelicy formed a partnership. Eckert contributed $90,000 cash, and Kebey contributed land valued at $72,000 and a bulding valued at $102,000. The parthership also took Kelley's $80,000 long term note payable associated with the land and building. The partners agreed to share income as follows: Eckert gets an annual salary allowance of $29.500, both get an annual interest allowance of 8% of their initial copital investment, and any remaining income or loss is shared equally, On October 20 , Eckert withdrew $30,000 cash and Kelley withdrew $23,000cash. First year income was $92,000. Required: 1a. \& 1b. Prepare journal entries to record the partners' initial capital inwostments and their subsequent cash withdrawals. 1c. Determine the partners' shares of income, and then prepare journal entries to close income Summary and the parthers' withdeawals accounts. 2. Determine the balances of the partners' capital accounts as of December 31. Consplete this question by entering your answers in the tabs below. Determine the balances of the partners' capital accounts as of December 31 . On March 1, Eckert and Kellcy formed a partnership. Eckert contributed $90,000 cash, and Kelley contributed land valued at $72,000 and a bullding valued at $102,000. The partnership also took Kelley's $80,000 long-term note payable associated with the land and bullding. The partners agreod to share income as follows: Eckert gets an annual solary allowance of $29,500, both get an arinual interest allowance of 8% of their in. Iial capital investment, and any remaining income or loss is shared equally. On October 20, Eckert withdrew $30,000 cash and Kelloy withdrew $23,000 cash. First year income was $92,000. Aequired: ta. 8 1b. Prepore joumal entrios to record the parthers' initial capital imvestments and their subsequent cash withdrawais. Te. Determine the partners' shares of income, and then prepare journal entries to close income Summacy and the parthers' withdrawaks iccounts 2. Determine the balances of the partners' copital accounts as of Decomber 31 . Complete this question by entering your answers in the tabs below. Prepare fournal entries to record the partners" initial capital investments and their subsequent cash aithdrawale. On March 1, Eckert and Keiley formed a parthership. Eckert contributed $90,000 cash, and Keley contrived land valued at 572,000 and a bulding valucd at $102,000. The parthership also took Kelley's $90,000 long-term note poyable associated with the land and bulding. The partners agreed to share income as follows: Eckert gets an annual salary allowance of $29,500, both get an annuial interest allowance of 8% of thoir initial capital investment, and any remaining income or loss is shared equally On October 20, Eckert withdrew $30,000 cash and Kelley withdrew $23,000 cash: First year income was $92,000. Required: 1a. 81 b. Prepare journal entries to record the portners' initial cepital investments and their subsequent cash withdrawals. 1c. Dotermine the partners' shares of income, and then prepare joutnat entries to close income Summary and the partners' withdrawals accounts. 2. Detarmine the taalances of the partners' caphal accounts as of December 31. Complete this question by entering your answers in the tabe below. Betermine the partners' shares of income, and then prepare fournal entries to clove income summary and the parthens Withdrawals acceunta. Note: Criter all alowances as positive values. Enter losses as negative vatues. On March 1, Eckert and Kelicy formed a partnership. Eckert contributed $90,000 cash, and Kebey contributed land valued at $72,000 and a bulding valued at $102,000. The parthership also took Kelley's $80,000 long term note payable associated with the land and building. The partners agreed to share income as follows: Eckert gets an annual salary allowance of $29.500, both get an annual interest allowance of 8% of their initial copital investment, and any remaining income or loss is shared equally, On October 20 , Eckert withdrew $30,000 cash and Kelley withdrew $23,000cash. First year income was $92,000. Required: 1a. \& 1b. Prepare journal entries to record the partners' initial capital inwostments and their subsequent cash withdrawals. 1c. Determine the partners' shares of income, and then prepare journal entries to close income Summary and the parthers' withdeawals accounts. 2. Determine the balances of the partners' capital accounts as of December 31. Consplete this question by entering your answers in the tabs below. Determine the balances of the partners' capital accounts as of December 31