Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1, Eckert and Kelley formed a partnership. Eckert contributed $81,000 cash, and Kelley contributed land valued at $64,800 and a building valued at

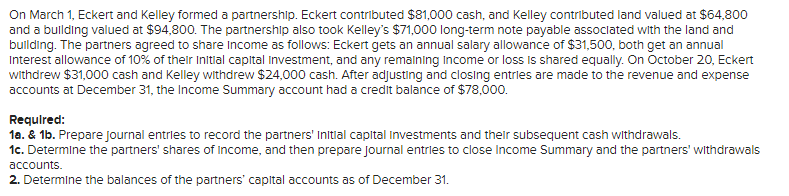

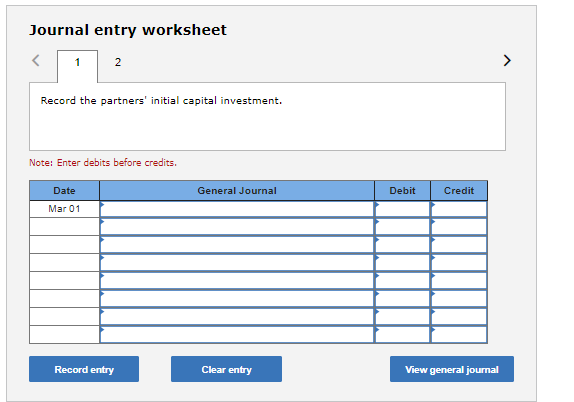

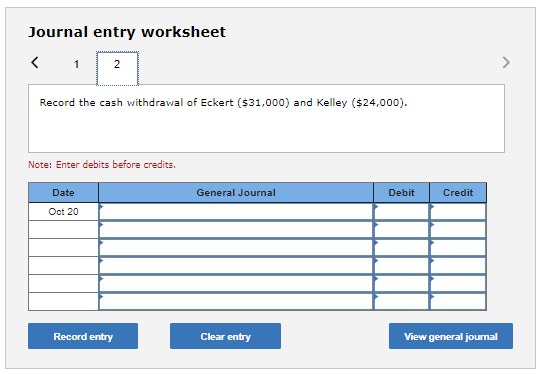

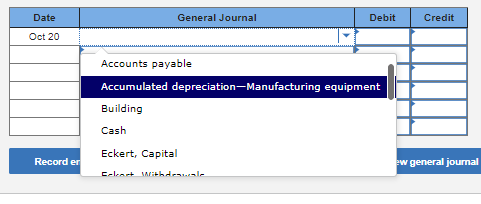

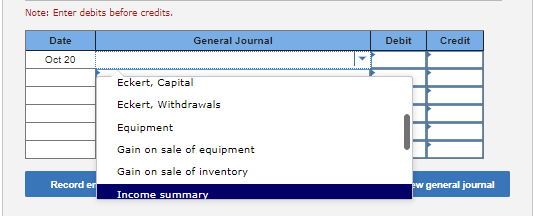

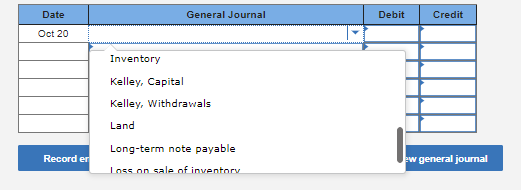

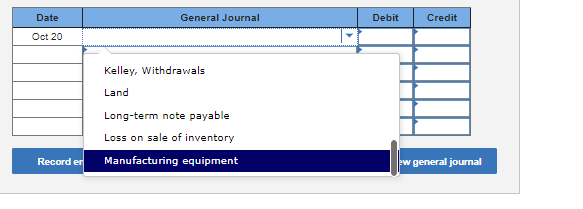

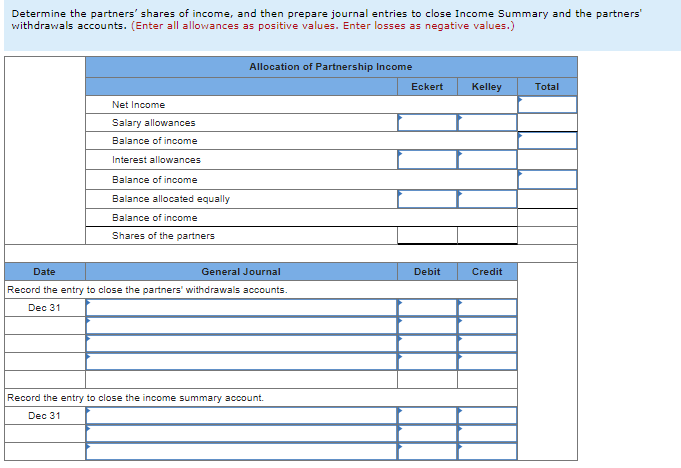

On March 1, Eckert and Kelley formed a partnership. Eckert contributed $81,000 cash, and Kelley contributed land valued at $64,800 and a building valued at $94,800. The partnership also took Kelley's $71,000 long-term note payable associated with the land and building. The partners agreed to share income as follows: Eckert gets an annual salary allowance of $31,500, both get an annual Interest allowance of 10% of their Initial capital Investment, and any remaining income or loss is shared equally. On October 20, Eckert withdrew $31,000 cash and Kelley withdrew $24,000 cash. After adjusting and closing entries are made to the revenue and expense accounts at December 31, the Income Summary account had a credit balance of $78,000. Required: 1a. & 1b. Prepare journal entries to record the partners' Initial capital Investments and their subsequent cash withdrawals. 1c. Determine the partners' shares of Income, and then prepare journal entries to close Income Summary and the partners' withdrawals accounts. 2. Determine the balances of the partners' capital accounts as of December 31. Journal entry worksheet > 1 2 Record the partners' initial capital investment. Note: Enter debits before credits. Date Mar 01 General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet > 1 2 Record the cash withdrawal of Eckert ($31,000) and Kelley ($24,000). Note: Enter debits before credits. Date Oct 20 General Journal Debit Credit Record entry Clear entry View general journal Date Oct 20 General Journal Debit Credit Accounts payable Accumulated depreciation-Manufacturing equipment Building Cash Eckert, Capital Record er Cekart Withdrawale ew general journal Note: Enter debits before credits. Date General Journal Debit Credit Oct 20 Eckert, Capital Eckert, Withdrawals Equipment Gain on sale of equipment Gain on sale of inventory Record en Income summary ew general journal General Journal Debit Credit Date Oct 20 Inventory Kelley, Capital Kelley, Withdrawals Land Long-term note payable Record er ew general journal Loss on sale of inventory Date Oct 20 Record er General Journal Debit Credit Kelley, Withdrawals Land Long-term note payable Loss on sale of inventory Manufacturing equipment ew general journal Determine the partners' shares of income, and then prepare journal entries to close Income Summary and the partners' withdrawals accounts. (Enter all allowances as positive values. Enter losses as negative values.) Date Net Income Salary allowances Balance of income Interest allowances Balance of income Balance allocated equally Balance of income Shares of the partners Allocation of Partnership Income General Journal Record the entry to close the partners' withdrawals accounts. Dec 31 Record the entry to close the income summary account. Dec 31 Eckert Kelley Total Debit Credit Req 1A and 1B Req 1C Req 2 Determine the balances of the partners' capital accounts as of December 31. Capital Account Balances Eckert Kelley Initial investment Withdrawals Share of income Ending balances

On March 1, Eckert and Kelley formed a partnership. Eckert contributed $81,000 cash, and Kelley contributed land valued at $64,800 and a building valued at $94,800. The partnership also took Kelley's $71,000 long-term note payable associated with the land and building. The partners agreed to share income as follows: Eckert gets an annual salary allowance of $31,500, both get an annual Interest allowance of 10% of their Initial capital Investment, and any remaining income or loss is shared equally. On October 20, Eckert withdrew $31,000 cash and Kelley withdrew $24,000 cash. After adjusting and closing entries are made to the revenue and expense accounts at December 31, the Income Summary account had a credit balance of $78,000. Required: 1a. & 1b. Prepare journal entries to record the partners' Initial capital Investments and their subsequent cash withdrawals. 1c. Determine the partners' shares of Income, and then prepare journal entries to close Income Summary and the partners' withdrawals accounts. 2. Determine the balances of the partners' capital accounts as of December 31. Journal entry worksheet > 1 2 Record the partners' initial capital investment. Note: Enter debits before credits. Date Mar 01 General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet > 1 2 Record the cash withdrawal of Eckert ($31,000) and Kelley ($24,000). Note: Enter debits before credits. Date Oct 20 General Journal Debit Credit Record entry Clear entry View general journal Date Oct 20 General Journal Debit Credit Accounts payable Accumulated depreciation-Manufacturing equipment Building Cash Eckert, Capital Record er Cekart Withdrawale ew general journal Note: Enter debits before credits. Date General Journal Debit Credit Oct 20 Eckert, Capital Eckert, Withdrawals Equipment Gain on sale of equipment Gain on sale of inventory Record en Income summary ew general journal General Journal Debit Credit Date Oct 20 Inventory Kelley, Capital Kelley, Withdrawals Land Long-term note payable Record er ew general journal Loss on sale of inventory Date Oct 20 Record er General Journal Debit Credit Kelley, Withdrawals Land Long-term note payable Loss on sale of inventory Manufacturing equipment ew general journal Determine the partners' shares of income, and then prepare journal entries to close Income Summary and the partners' withdrawals accounts. (Enter all allowances as positive values. Enter losses as negative values.) Date Net Income Salary allowances Balance of income Interest allowances Balance of income Balance allocated equally Balance of income Shares of the partners Allocation of Partnership Income General Journal Record the entry to close the partners' withdrawals accounts. Dec 31 Record the entry to close the income summary account. Dec 31 Eckert Kelley Total Debit Credit Req 1A and 1B Req 1C Req 2 Determine the balances of the partners' capital accounts as of December 31. Capital Account Balances Eckert Kelley Initial investment Withdrawals Share of income Ending balances Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started