Question

On March 1, Johnson Inc. purchased 500 shares of Thomas Company stock when Thomas' stock was selling for $20 per share. Johnson plans to

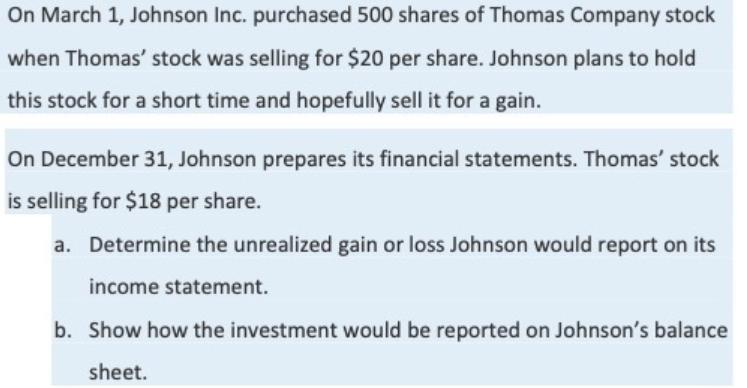

On March 1, Johnson Inc. purchased 500 shares of Thomas Company stock when Thomas' stock was selling for $20 per share. Johnson plans to hold this stock for a short time and hopefully sell it for a gain. On December 31, Johnson prepares its financial statements. Thomas' stock is selling for $18 per share. a. Determine the unrealized gain or loss Johnson would report on its income statement. b. Show how the investment would be reported on Johnson's balance sheet.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the unrealized gain or loss on Johnsons investment in Thomas Company stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay

6th edition

013703038X, 978-0137030385

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App