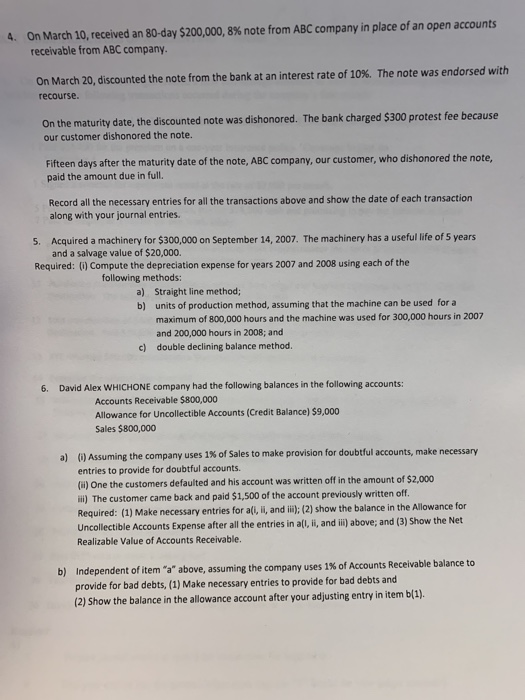

On March 10, received an 80-day $200,000, 8% note from ABC company in place of an open accounts receivable from ABC company. 4. On March 20, discounted the note from the bank at an interest rate of 10%. The note was endorsed with recourse. On the maturity date, the discounted note was dishonored. The bank charged $300 protest fee because our customer dishonored the note. days after the maturity date of the note, ABC company,our customer, who dishonored the note paid the amount due in full. Record all the necessary entries for all the transactions above and show the date of each transaction along with your journal entries Acquired a machinery for $300,000 on September 14, 2007. The machinery has a useful life of 5 years and a salvage value of $20,000. 5. Required: (0) Compute the depreciation expense for years 2007 and 2008 using each of the following methods a) b) Straight line method; units of production method, assuming that the machine can be used for a maximum of 800,000 hours and the machine was used for 300,000 hours in 2007 and 200,000 hours in 2008; and double declining balance method c) David Alex WHICHONE company had the following balances in the following accounts: 6. Accounts Receivable $800,000 Allowance for Uncollectible Accounts (Credit Balance) $9,000 Sales $800,000 (i) Assuming the company uses 1% of Sales to make provision for doubtful accounts, make necessary entries to provide for doubtful accounts (i)One the customers defaulted and his account was written off in the amount of $2,000 l)The customer came back and paid $1,500 of the account previously written off Required: (1) Make necessary entries for al(, i, and il); (2) show the balance in the Allowance for Uncollectible Accounts Expense after all the entries in atl, i,and ii)j above; and (3) Show the Net Realizable Value of Accounts Receivable. a) Independent of item "a" above, assuming the company uses 1% of Accounts Receivable balance to provide for bad debts, (1) Make necessary entries to provide for bad debts and (2) Show the balance in the allowance account after your adjusting entry in item b(). b) On March 10, received an 80-day $200,000, 8% note from ABC company in place of an open accounts receivable from ABC company. 4. On March 20, discounted the note from the bank at an interest rate of 10%. The note was endorsed with recourse. On the maturity date, the discounted note was dishonored. The bank charged $300 protest fee because our customer dishonored the note. days after the maturity date of the note, ABC company,our customer, who dishonored the note paid the amount due in full. Record all the necessary entries for all the transactions above and show the date of each transaction along with your journal entries Acquired a machinery for $300,000 on September 14, 2007. The machinery has a useful life of 5 years and a salvage value of $20,000. 5. Required: (0) Compute the depreciation expense for years 2007 and 2008 using each of the following methods a) b) Straight line method; units of production method, assuming that the machine can be used for a maximum of 800,000 hours and the machine was used for 300,000 hours in 2007 and 200,000 hours in 2008; and double declining balance method c) David Alex WHICHONE company had the following balances in the following accounts: 6. Accounts Receivable $800,000 Allowance for Uncollectible Accounts (Credit Balance) $9,000 Sales $800,000 (i) Assuming the company uses 1% of Sales to make provision for doubtful accounts, make necessary entries to provide for doubtful accounts (i)One the customers defaulted and his account was written off in the amount of $2,000 l)The customer came back and paid $1,500 of the account previously written off Required: (1) Make necessary entries for al(, i, and il); (2) show the balance in the Allowance for Uncollectible Accounts Expense after all the entries in atl, i,and ii)j above; and (3) Show the Net Realizable Value of Accounts Receivable. a) Independent of item "a" above, assuming the company uses 1% of Accounts Receivable balance to provide for bad debts, (1) Make necessary entries to provide for bad debts and (2) Show the balance in the allowance account after your adjusting entry in item b(). b)