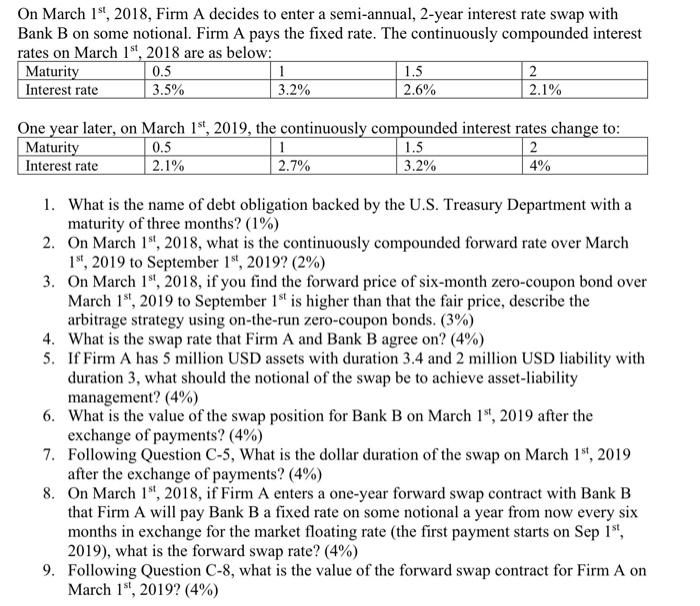

On March 18, 2018, Firm A decides to enter a semi-annual, 2-year interest rate swap with Bank B on some notional. Firm A pays the fixed rate. The continuously compounded interest rates on March 15, 2018 are as below: Maturity 0.5 1 1.5 2 Interest rate 3.5% 3.2% 2.6% 2.1% One year later, on March 1st, 2019, the continuously compounded interest rates change to: Maturity 0.5 1 1.5 2 Interest rate 2.1% 2.7% 3.2% 4% 1. What is the name of debt obligation backed by the U.S. Treasury Department with a maturity of three months? (1%) 2. On March 18, 2018, what is the continuously compounded forward rate over March 15, 2019 to September 1st, 2019? (2%) 3. On March 18, 2018, if you find the forward price of six-month zero-coupon bond over March 18, 2019 to September 1st is higher than that the fair price, describe the arbitrage strategy using on-the-run zero-coupon bonds. (3%) 4. What is the swap rate that Firm A and Bank B agree on? (4%) 5. If Firm A has 5 million USD assets with duration 3.4 and 2 million USD liability with duration 3, what should the notional of the swap be to achieve asset-liability management? (4%) 6. What is the value of the swap position for Bank B on March 18, 2019 after the exchange of payments? (4%) 7. Following Question C-5, What is the dollar duration of the swap on March 15, 2019 after the exchange of payments? (4%) 8. On March 18, 2018, if Firm A enters a one-year forward swap contract with Bank B that Firm A will pay Bank B a fixed rate on some notional a year from now every six months in exchange for the market floating rate (the first payment starts on Sep 1s', 2019), what is the forward swap rate? (4%) 9. Following Question C-8, what is the value of the forward swap contract for Firm A on March 15, 2019? (4%) On March 18, 2018, Firm A decides to enter a semi-annual, 2-year interest rate swap with Bank B on some notional. Firm A pays the fixed rate. The continuously compounded interest rates on March 15, 2018 are as below: Maturity 0.5 1 1.5 2 Interest rate 3.5% 3.2% 2.6% 2.1% One year later, on March 1st, 2019, the continuously compounded interest rates change to: Maturity 0.5 1 1.5 2 Interest rate 2.1% 2.7% 3.2% 4% 1. What is the name of debt obligation backed by the U.S. Treasury Department with a maturity of three months? (1%) 2. On March 18, 2018, what is the continuously compounded forward rate over March 15, 2019 to September 1st, 2019? (2%) 3. On March 18, 2018, if you find the forward price of six-month zero-coupon bond over March 18, 2019 to September 1st is higher than that the fair price, describe the arbitrage strategy using on-the-run zero-coupon bonds. (3%) 4. What is the swap rate that Firm A and Bank B agree on? (4%) 5. If Firm A has 5 million USD assets with duration 3.4 and 2 million USD liability with duration 3, what should the notional of the swap be to achieve asset-liability management? (4%) 6. What is the value of the swap position for Bank B on March 18, 2019 after the exchange of payments? (4%) 7. Following Question C-5, What is the dollar duration of the swap on March 15, 2019 after the exchange of payments? (4%) 8. On March 18, 2018, if Firm A enters a one-year forward swap contract with Bank B that Firm A will pay Bank B a fixed rate on some notional a year from now every six months in exchange for the market floating rate (the first payment starts on Sep 1s', 2019), what is the forward swap rate? (4%) 9. Following Question C-8, what is the value of the forward swap contract for Firm A on March 15, 2019? (4%)