Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 2, 2020, Zoe Moreau, Karen Krneta, and Veronica Visentin start a partnership to operate a personal coaching and lifestyle consulting practice for professional

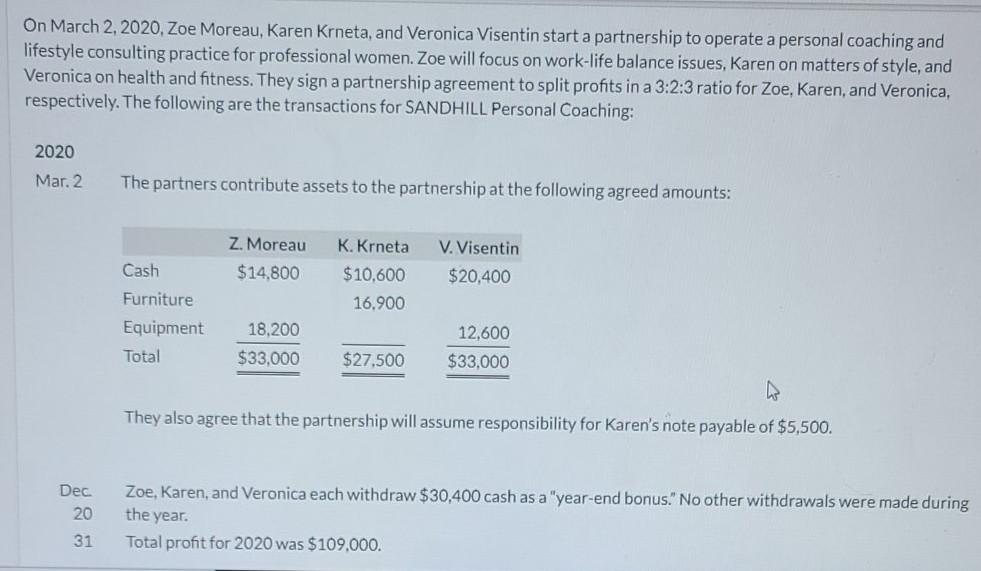

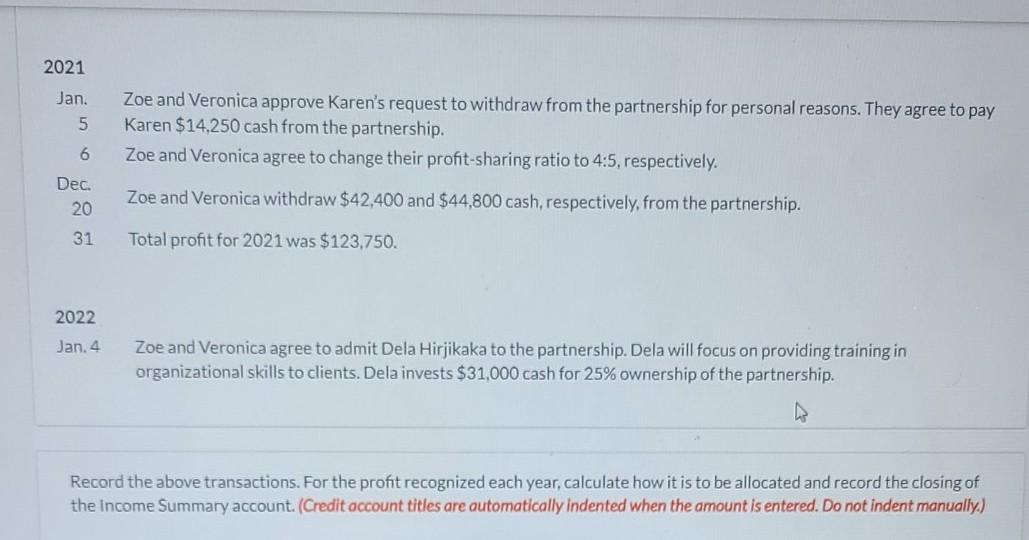

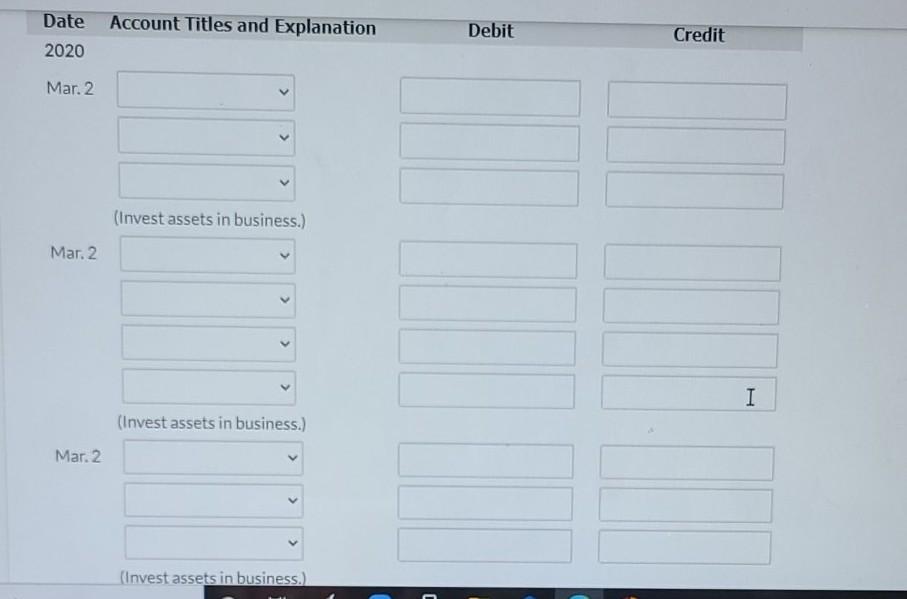

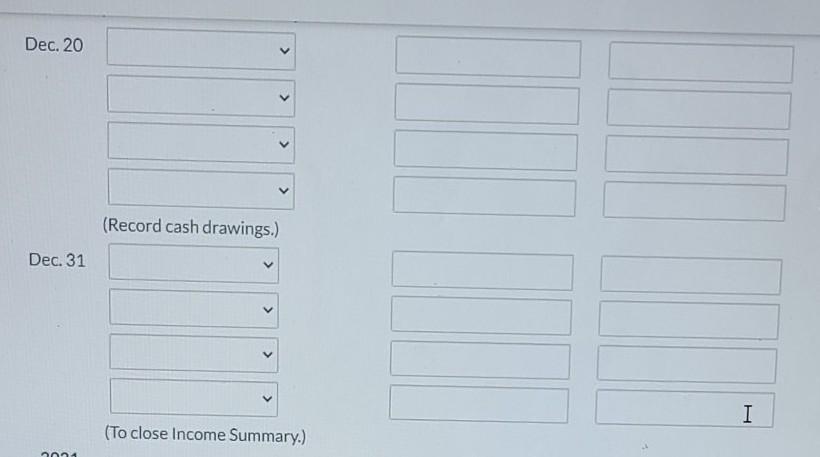

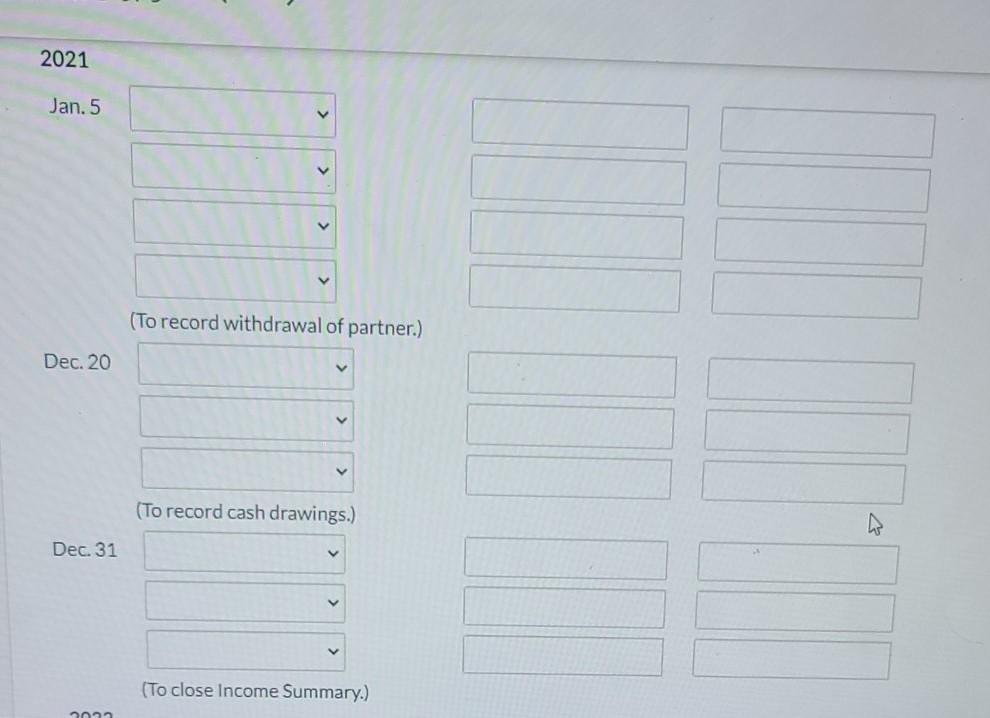

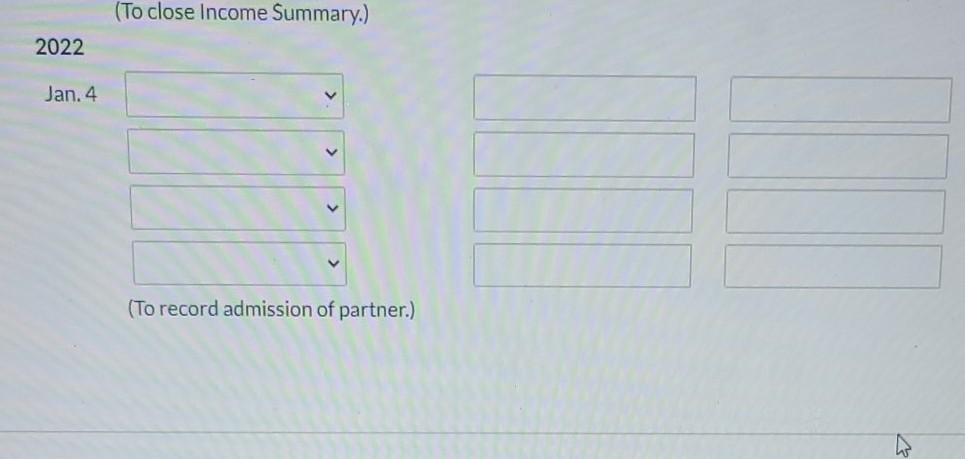

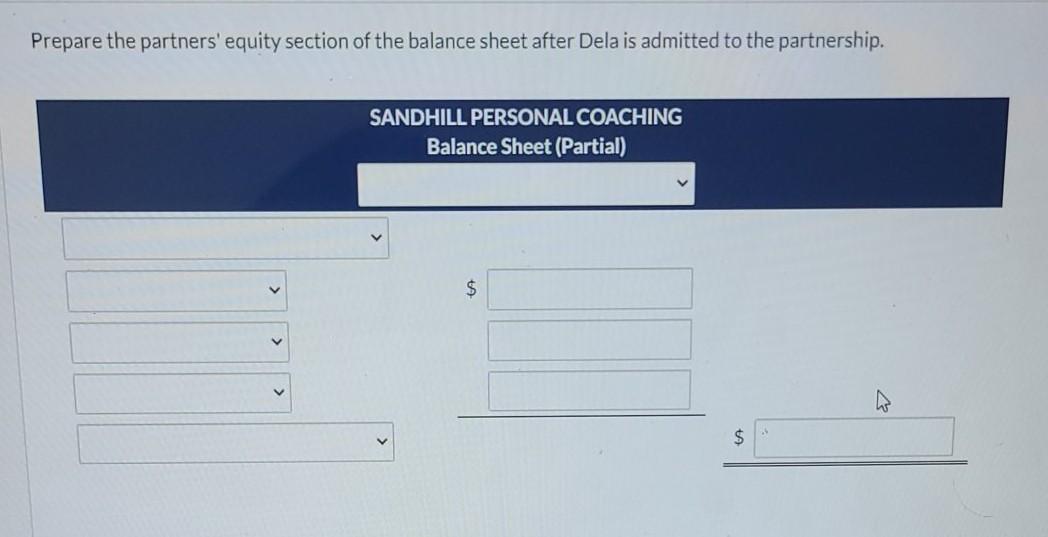

On March 2, 2020, Zoe Moreau, Karen Krneta, and Veronica Visentin start a partnership to operate a personal coaching and lifestyle consulting practice for professional women. Zoe will focus on work-life balance issues, Karen on matters of style, and Veronica on health and fitness. They sign a partnership agreement to split profits in a 3:2:3 ratio for Zoe, Karen, and Veronica, respectively. The following are the transactions for SANDHILL Personal Coaching: 2020 Mar. 2. The partners contribute assets to the partnership at the following agreed amounts: Z. Moreau $14,800 Cash K. Krneta $10,600 16.900 V. Visentin $20,400 Furniture Equipment Total 18.200 $33,000 12,600 $33,000 $27,500 They also agree that the partnership will assume responsibility for Karen's note payable of $5,500. Dec 20 31 Zoe, Karen, and Veronica each withdraw $30,400 cash as a "year-end bonus." No other withdrawals were made during the year. Total profit for 2020 was $109,000. 2021 Jan. 5 Zoe and Veronica approve Karen's request to withdraw from the partnership for personal reasons. They agree to pay Karen $14,250 cash from the partnership. Zoe and Veronica agree to change their profit-sharing ratio to 4:5, respectively. 6 Dec Zoe and Veronica withdraw $42,400 and $44,800 cash, respectively, from the partnership. 20 31 Total profit for 2021 was $123.750. 2022 Jan. 4 Zoe and Veronica agree to admit Dela Hirjikaka to the partnership. Dela will focus on providing training in organizational skills to clients. Dela invests $31,000 cash for 25% ownership of the partnership. Record the above transactions. For the profit recognized each year, calculate how it is to be allocated and record the closing of the Income Summary account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Dec. 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started