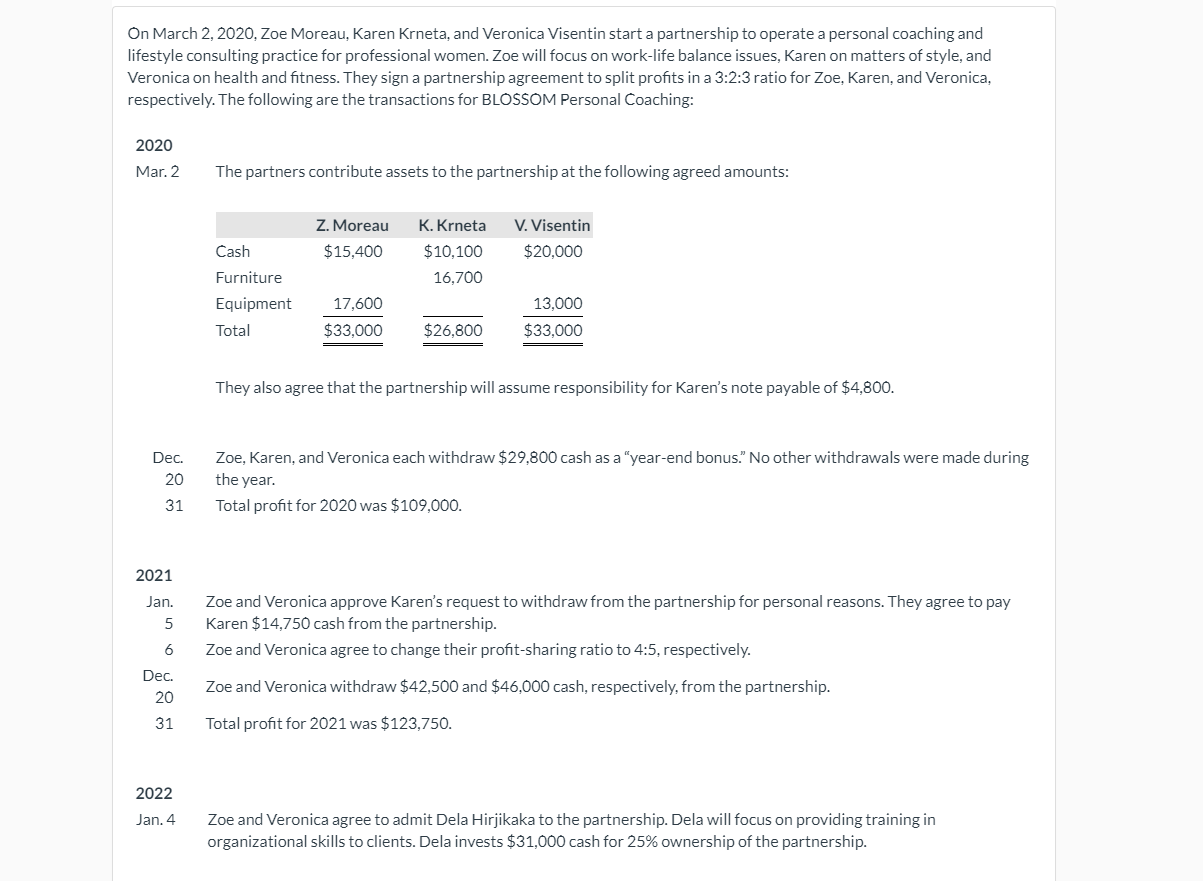

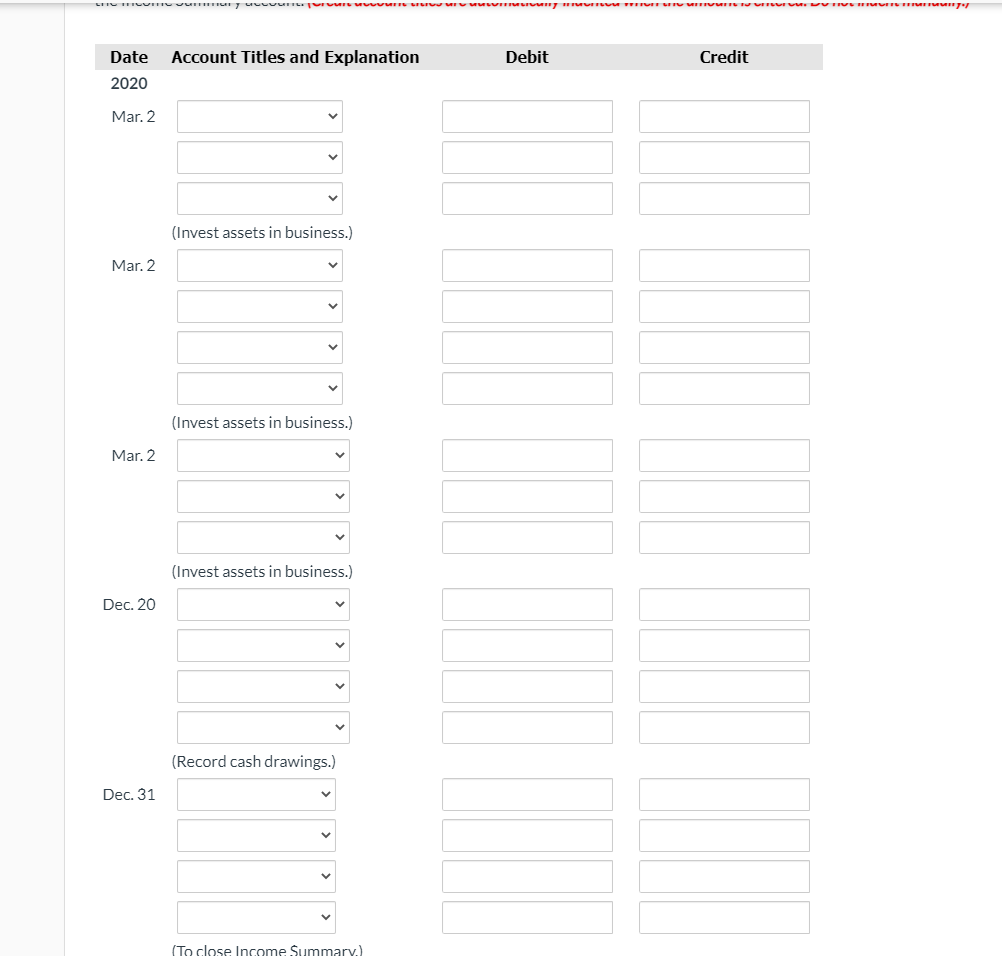

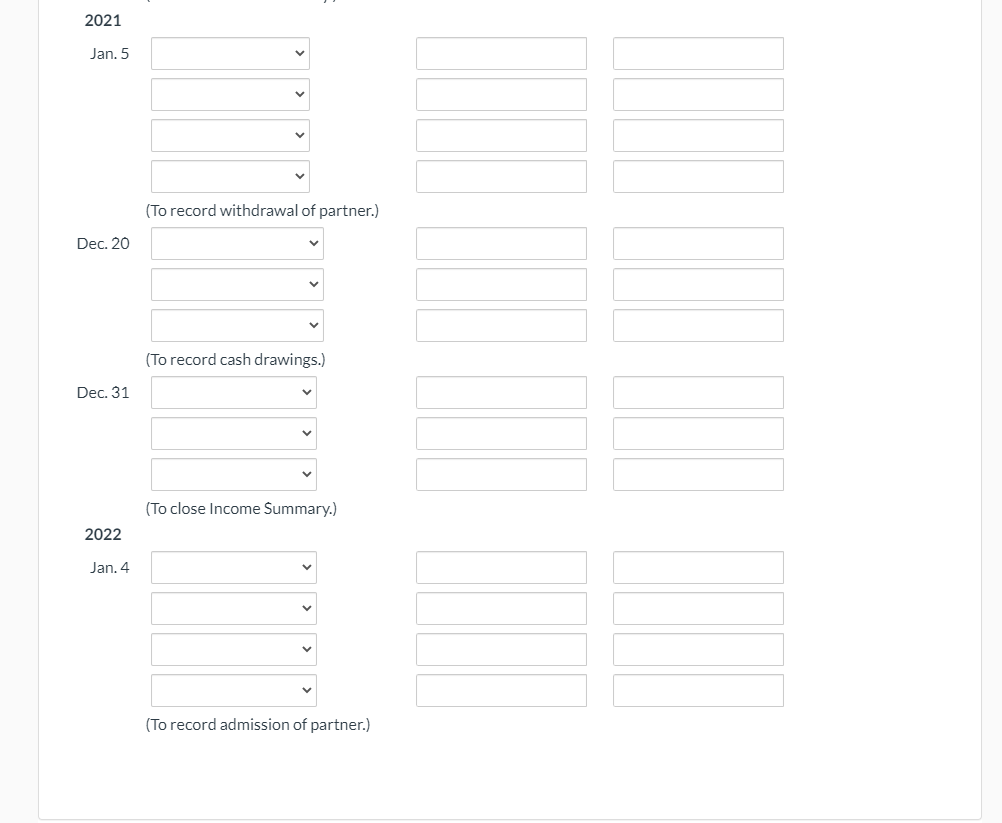

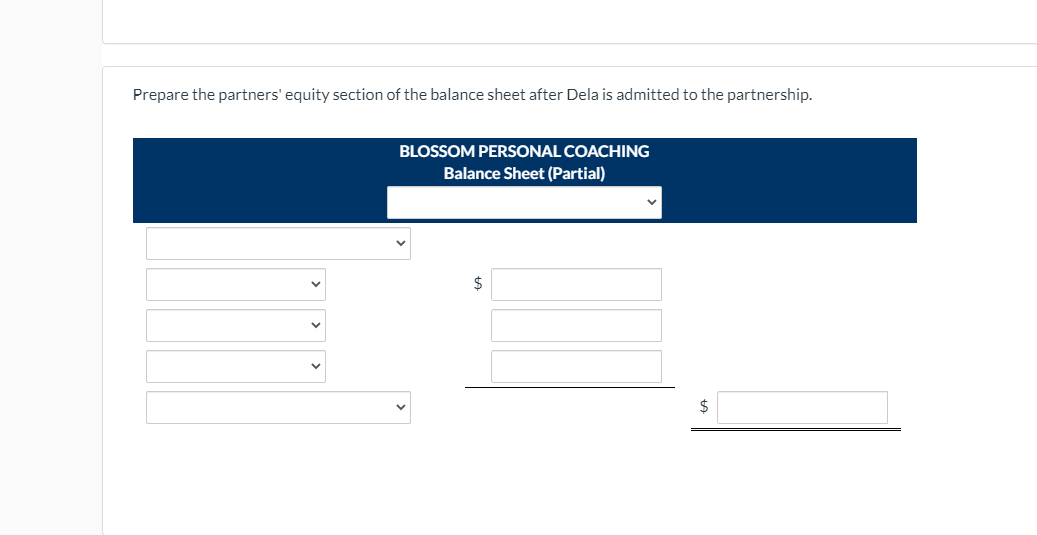

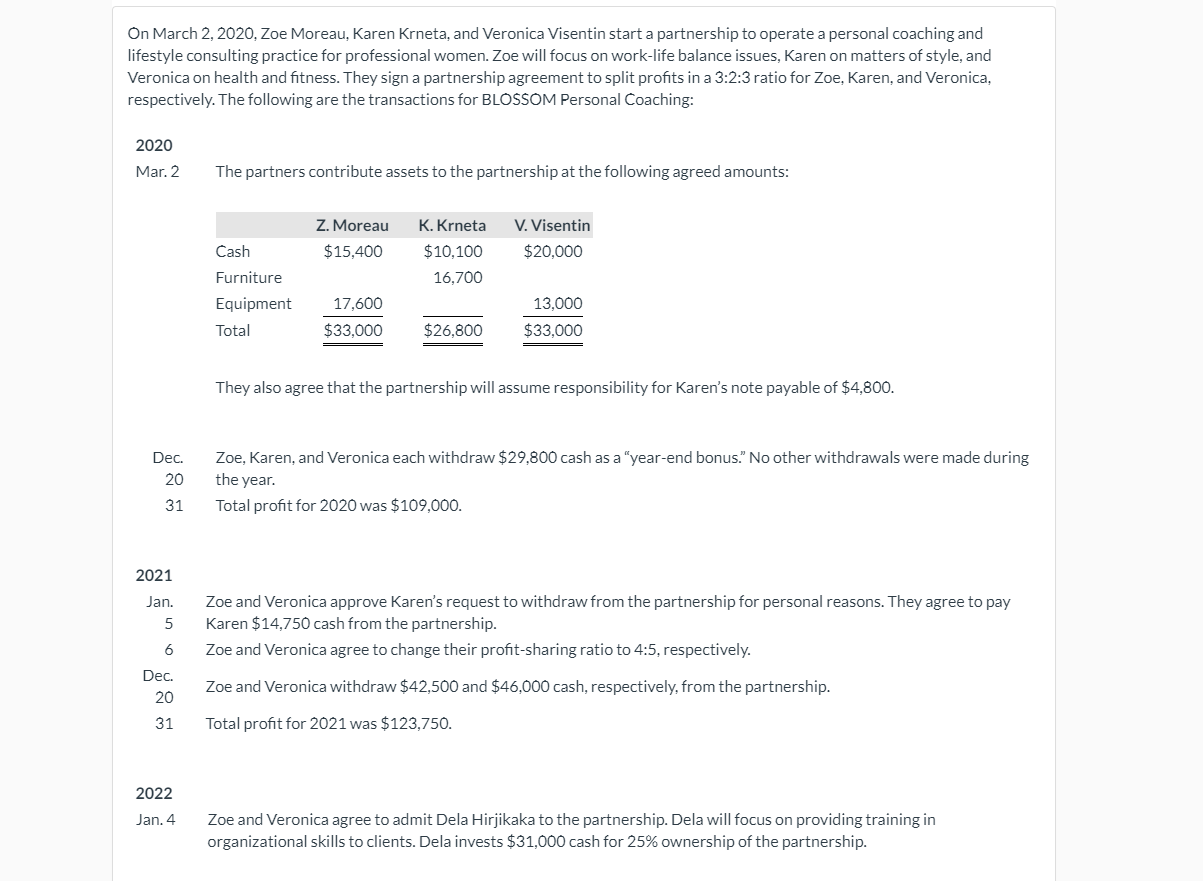

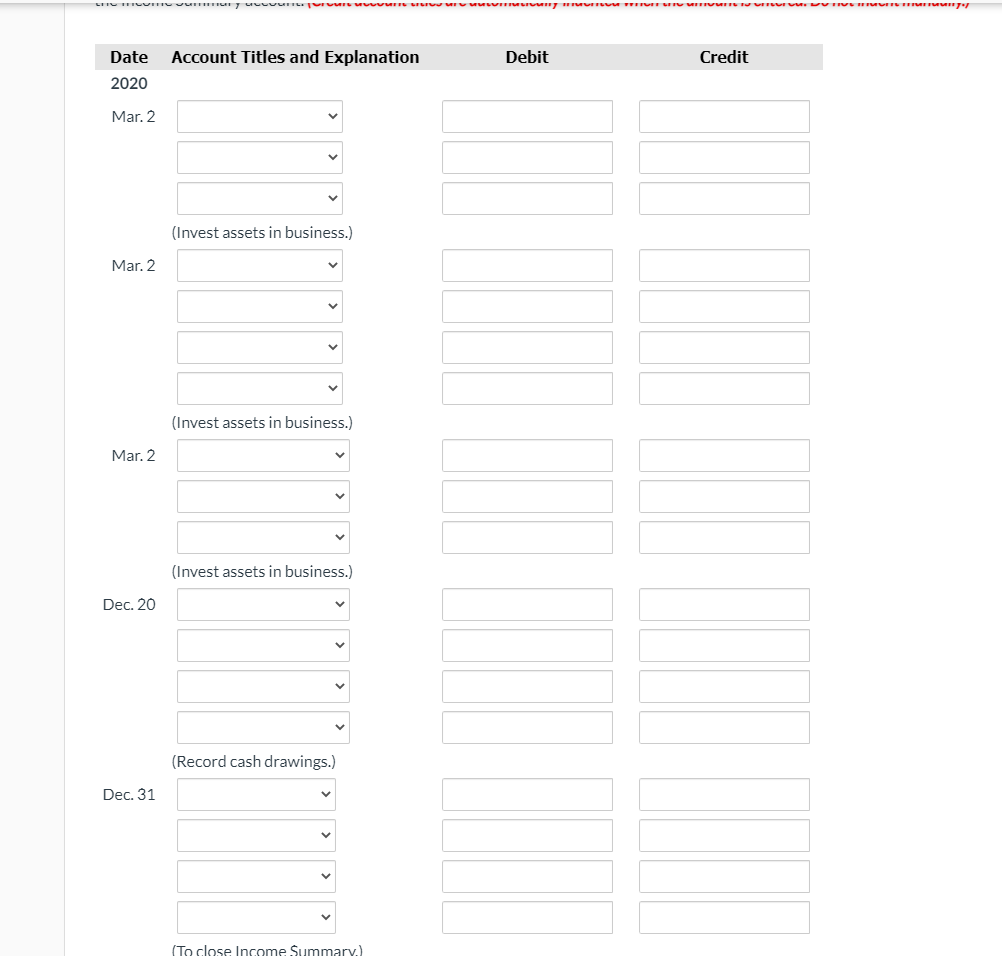

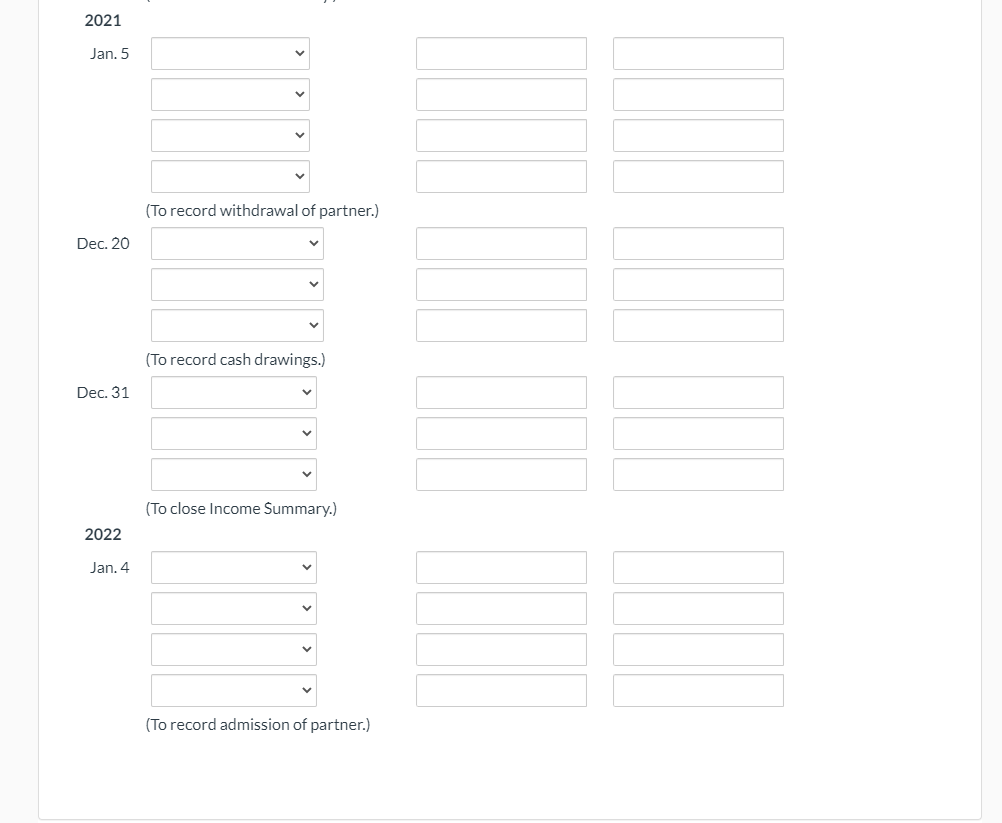

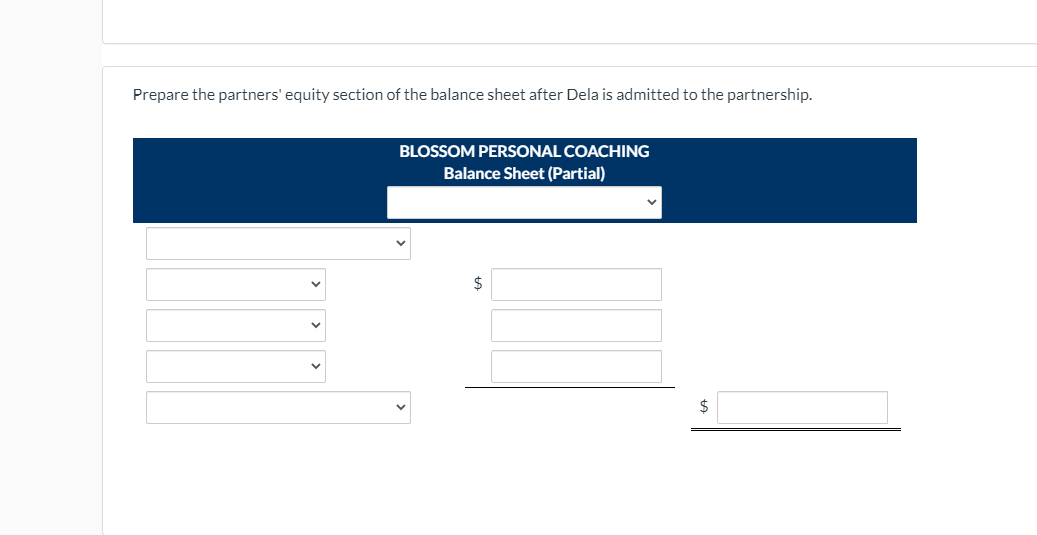

On March 2, 2020, Zoe Moreau, Karen Krneta, and Veronica Visentin start a partnership to operate a personal coaching and lifestyle consulting practice for professional women. Zoe will focus on work-life balance issues, Karen on matters of style, and Veronica on health and fitness. They sign a partnership agreement to split profits in a 3:2:3 ratio for Zoe, Karen, and Veronica, respectively. The following are the transactions for BLOSSOM Personal Coaching: 2020 Mar. 2 The partners contribute assets to the partnership at the following agreed amounts: Z. Moreau $15.400 K. Krneta $10,100 16,700 V. Visentin $20,000 Cash Furniture Equipment Total 17,600 13,000 $33,000 $33,000 $26,800 They also agree that the partnership will assume responsibility for Karen's note payable of $4,800. Zoe, Karen, and Veronica each withdraw $29,800 cash as a "year-end bonus." No other withdrawals were made during Dec. 20 the year. 31 Total profit for 2020 was $109,000. 2021 Jan. 5 Zoe and Veronica approve Karen's request to withdraw from the partnership for personal reasons. They agree to pay Karen $14,750 cash from the partnership. Zoe and Veronica agree to change their profit-sharing ratio to 4:5, respectively. 6 Dec. Zoe and Veronica withdraw $42,500 and $46,000 cash, respectively, from the partnership. 20 31 Total profit for 2021 was $123,750. 2022 Jan. 4. Zoe and Veronica agree to admit Dela Hirjikaka to the partnership. Dela will focus on providing training in organizational skills to clients. Dela invests $31,000 cash for 25% ownership of the partnership. FT UUTTUUUUU CU VITUTT TU TOUT VITIVI TUTTI TUTTITUUT Account Titles and Explanation Debit Credit Date 2020 Mar. 2 (Invest assets in business.) Mar. 2 (Invest assets in business.) Mar. 2 (Invest assets in business.) Dec. 20 (Record cash drawings.) Dec. 31 (To close Income Summary) 2021 Jan. 5 (To record withdrawal of partner.) Dec. 20 (To record cash drawings.) Dec. 31 (To close Income Summary.) 2022 Jan. 4 (To record admission of partner.) Prepare the partners' equity section of the balance sheet after Dela is admitted to the partnership. BLOSSOM PERSONAL COACHING Balance Sheet (Partial) $ $