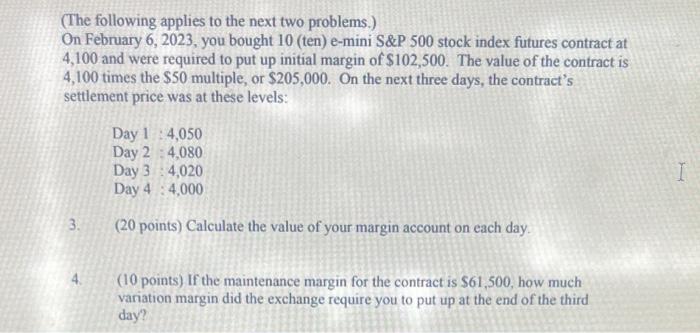

Question: On March 3 , 2 0 2 5 , you bought 1 0 ( ten ) e - mini S&P 5 0 0 stock index

On March you bought ten emini S&P stock index futures

contract at and were required to put up initial margin of $ The

value of the contract is times the $ multiple, or $ On the next

three days, the contracts settlement price was at these levels:

Day :

Day :

Day :

Day :

a points Calculate the value of your margin account on each day.

b points If the maintenance margin for the contract is $ how much

variation margin did the exchange require you to put up at the end of the third

day?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock