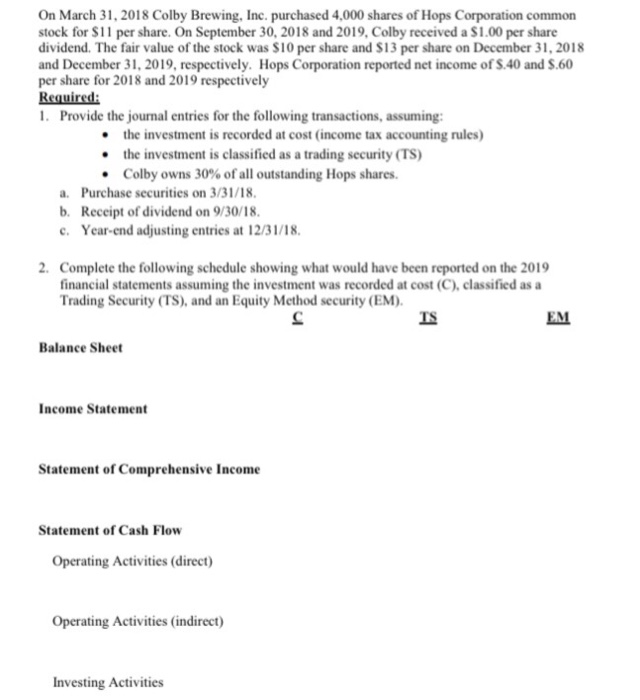

On March 31, 2018 Colby Brewing, Inc. purchased 4,000 shares of Hops Corporation common stock for $11 per share. On September 30, 2018 and 2019, Colby received a S1.00 per share dividend. The fair value of the stock was $10 per share and $13 per share on December 31, 2018 and December 31, 2019, respectively. Hops Corporation reported net income of S.40 and S.60 per share for 2018 and 2019 respectively Required: 1. Provide the journal entries for the following transactions, assuming e the investment is recorded at cost (income tax accounting rules) ethe investment is classified as a trading security (TS) * Colby owns 30% of all outstanding Hops shares. Purchase securities on 3/31/18 a. b. Receipt of dividend on 9/30/18 Year-end adjusting entries at 12/31/18 c. 2. Complete the following schedule showing what would have been reported on the 2019 financial statements assuming the investment was recorded at cost (C), classified as a Trading Security (TS), and an Equity Method security (EM TS EM Balance Sheet Income Statement Statement of Comprehensive Income Statement of Cash Flow Operating Activities (direct) Operating Activities (indirect) Investing Activities On March 31, 2018 Colby Brewing, Inc. purchased 4,000 shares of Hops Corporation common stock for $11 per share. On September 30, 2018 and 2019, Colby received a S1.00 per share dividend. The fair value of the stock was $10 per share and $13 per share on December 31, 2018 and December 31, 2019, respectively. Hops Corporation reported net income of S.40 and S.60 per share for 2018 and 2019 respectively Required: 1. Provide the journal entries for the following transactions, assuming e the investment is recorded at cost (income tax accounting rules) ethe investment is classified as a trading security (TS) * Colby owns 30% of all outstanding Hops shares. Purchase securities on 3/31/18 a. b. Receipt of dividend on 9/30/18 Year-end adjusting entries at 12/31/18 c. 2. Complete the following schedule showing what would have been reported on the 2019 financial statements assuming the investment was recorded at cost (C), classified as a Trading Security (TS), and an Equity Method security (EM TS EM Balance Sheet Income Statement Statement of Comprehensive Income Statement of Cash Flow Operating Activities (direct) Operating Activities (indirect) Investing Activities