Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 31, 2021, Canseco Plumbing Fixtures purchased equipment for $32,000. Residual value at the end of an estimated four year service life is expected

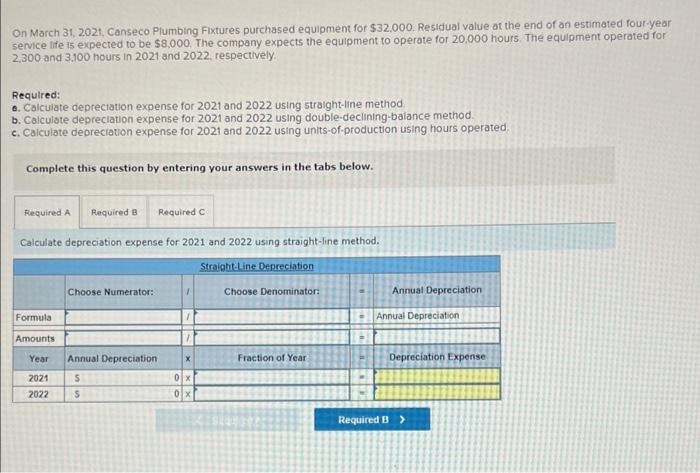

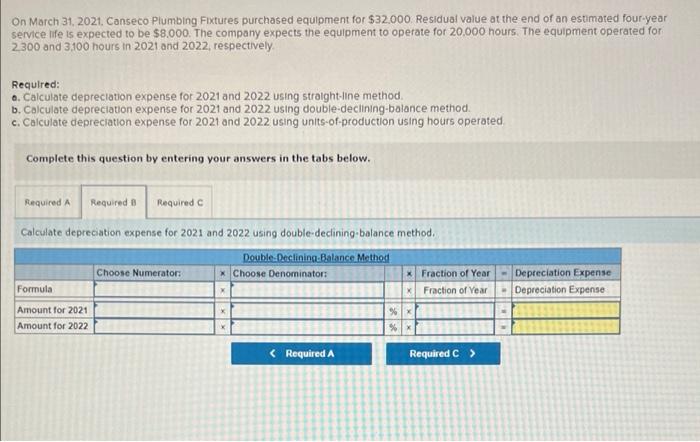

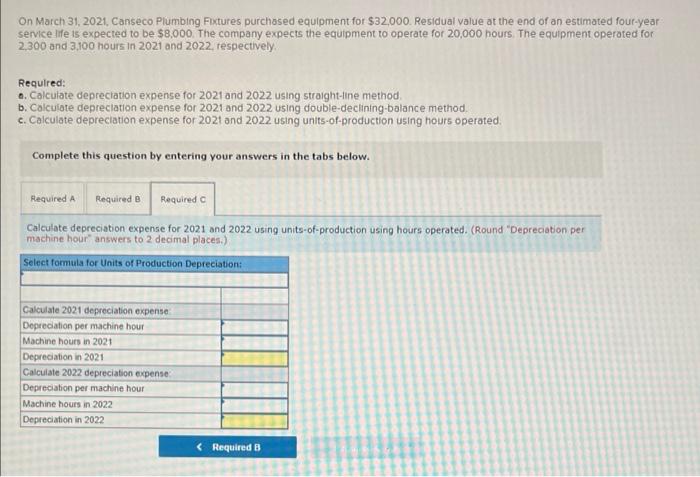

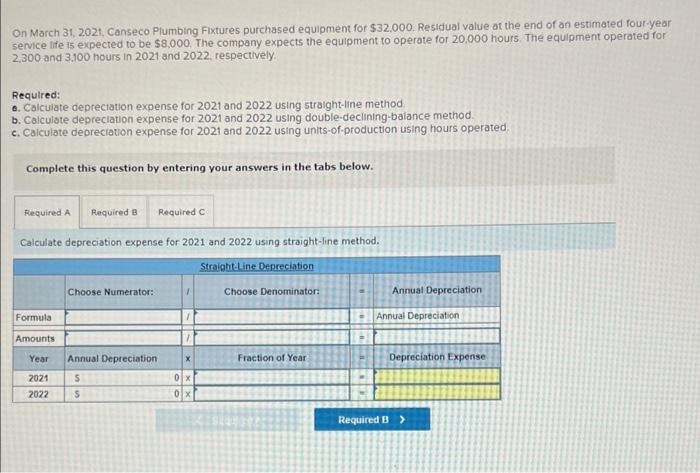

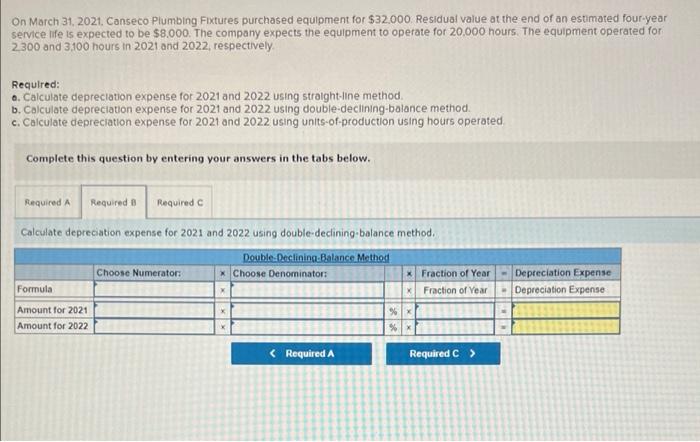

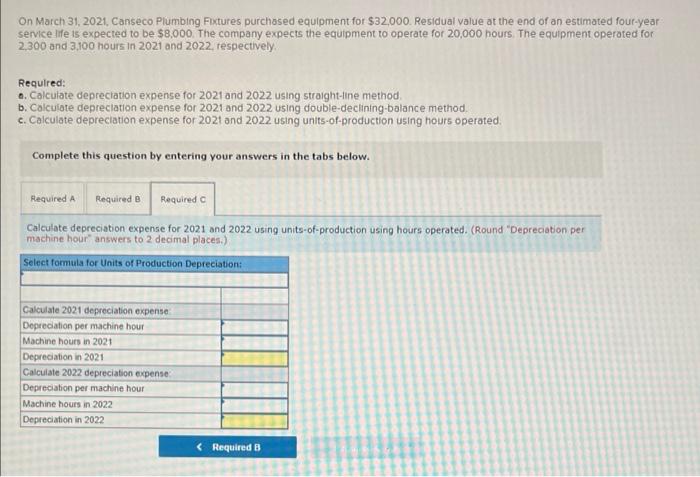

On March 31, 2021, Canseco Plumbing Fixtures purchased equipment for $32,000. Residual value at the end of an estimated four year service life is expected to be $8,000. The company expects the equipment to operate for 20,000 hours. The equipment operated for -2,300 and 3.100 hours in 2021 and 2022, respectively Required: e Calculate depreciation expense for 2021 and 2022 using straight-line method b. Calculate depreciation expense for 2021 and 2022 using double-declining balance method c. Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated, Complete this question by entering your answers in the tabs below. Required A Required B Required Calculate depreciation expense for 2021 and 2022 using straight-line method. Straight Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Formula Annual Depreciation Amounts Year Annual Depreciation Fraction of Year Depreciation Expense 2021 2022 5 5 Ox 0 x Required B> On March 31, 2021. Canseco Plumbing Fixtures purchased equipment for $32.000 Residual value at the end of an estimated four-year service life is expected to be $8.000. The company expects the equipment to operate for 20,000 hours. The equipment operated for 2300 and 3,100 hours in 2021 and 2022, respectively Required: 6. Calculate depreciation expense for 2021 and 2022 using straight line method b. Calculate depreciation expense for 2021 and 2022 using double-declining-balance method. c. Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated Complete this question by entering your answers in the tabs below. Required A Required Required Calculate depreciation expense for 2021 and 2022 using double-declining balance method Double Declining Balance Method Choose Numerators Choose Denominator: * Fraction of Year Formula Fraction of Year Amount for 2021 Amount for 2022 % Depreciation Expense Depreciation Expense On March 31, 2021. Canseco Plumbing Fixtures purchased equipment for $32,000. Residual value at the end of an estimated four-year service life is expected to be $8,000. The company expects the equipment to operate for 20,000 hours. The equipment operated for 2,300 and 3,100 hours in 2021 and 2022, respectively Required: 6. Calculate depreciation expense for 2021 and 2022 using straight-line method b. Calculate depreciation expense for 2021 and 2022 using double-declining balance method. c. Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated Complete this question by entering your answers in the tabs below. Required A Required Required Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated. (Round "Depreciation per machine hour answers to 2 decimal places.) Select formula for Units of Production Depreciation Calculate 2021 depreciation expense Depreciation per machine hour Machine hours in 2021 Depreciation in 2021 Calculate 2022 depreciation expense Depreciation per machine hour Machine hours in 2022 Depreciation in 2022

On March 31, 2021, Canseco Plumbing Fixtures purchased equipment for $32,000. Residual value at the end of an estimated four year service life is expected to be $8,000. The company expects the equipment to operate for 20,000 hours. The equipment operated for -2,300 and 3.100 hours in 2021 and 2022, respectively Required: e Calculate depreciation expense for 2021 and 2022 using straight-line method b. Calculate depreciation expense for 2021 and 2022 using double-declining balance method c. Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated, Complete this question by entering your answers in the tabs below. Required A Required B Required Calculate depreciation expense for 2021 and 2022 using straight-line method. Straight Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Formula Annual Depreciation Amounts Year Annual Depreciation Fraction of Year Depreciation Expense 2021 2022 5 5 Ox 0 x Required B> On March 31, 2021. Canseco Plumbing Fixtures purchased equipment for $32.000 Residual value at the end of an estimated four-year service life is expected to be $8.000. The company expects the equipment to operate for 20,000 hours. The equipment operated for 2300 and 3,100 hours in 2021 and 2022, respectively Required: 6. Calculate depreciation expense for 2021 and 2022 using straight line method b. Calculate depreciation expense for 2021 and 2022 using double-declining-balance method. c. Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated Complete this question by entering your answers in the tabs below. Required A Required Required Calculate depreciation expense for 2021 and 2022 using double-declining balance method Double Declining Balance Method Choose Numerators Choose Denominator: * Fraction of Year Formula Fraction of Year Amount for 2021 Amount for 2022 % Depreciation Expense Depreciation Expense On March 31, 2021. Canseco Plumbing Fixtures purchased equipment for $32,000. Residual value at the end of an estimated four-year service life is expected to be $8,000. The company expects the equipment to operate for 20,000 hours. The equipment operated for 2,300 and 3,100 hours in 2021 and 2022, respectively Required: 6. Calculate depreciation expense for 2021 and 2022 using straight-line method b. Calculate depreciation expense for 2021 and 2022 using double-declining balance method. c. Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated Complete this question by entering your answers in the tabs below. Required A Required Required Calculate depreciation expense for 2021 and 2022 using units-of-production using hours operated. (Round "Depreciation per machine hour answers to 2 decimal places.) Select formula for Units of Production Depreciation Calculate 2021 depreciation expense Depreciation per machine hour Machine hours in 2021 Depreciation in 2021 Calculate 2022 depreciation expense Depreciation per machine hour Machine hours in 2022 Depreciation in 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started