Question

On March 5, 2015, you were hired by Hemingway Inc., a closely held company, as a staff member of its newly created internal auditing department.

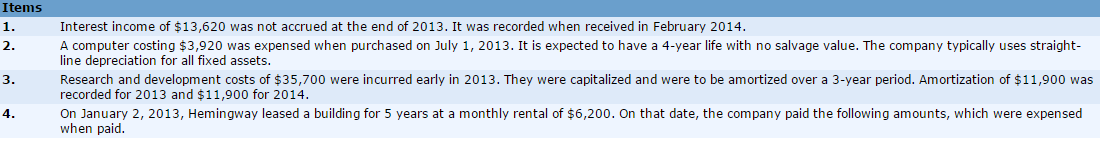

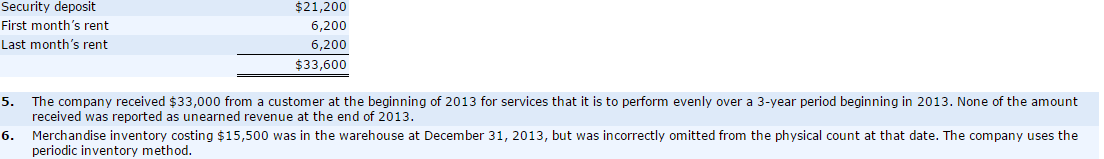

On March 5, 2015, you were hired by Hemingway Inc., a closely held company, as a staff member of its newly created internal auditing department. While reviewing the companys records for 2013 and 2014, you discover that no adjustments have yet been made for the items listed below.

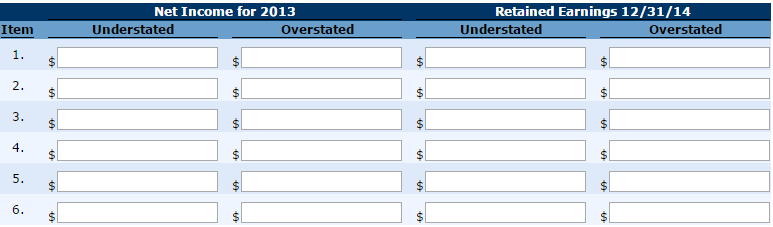

Indicate the effect of any errors on the net income figure reported on the income statement for the year ending December 31, 2013, and the retained earnings figure reported on the balance sheet at December 31, 2014. Assume all amounts are material, and ignore income tax effects. Using the following format, enter the appropriate dollar amounts in the appropriate columns. Consider each item independent of the other items. It is not necessary to total the columns on the grid.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started