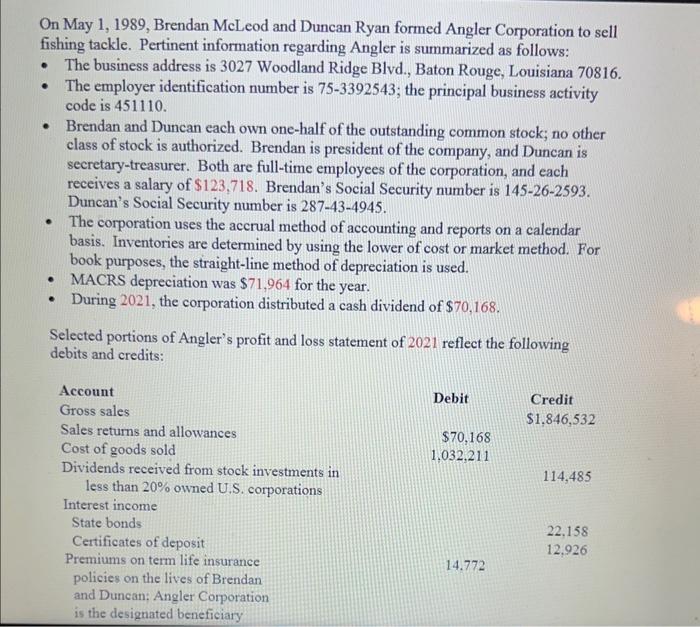

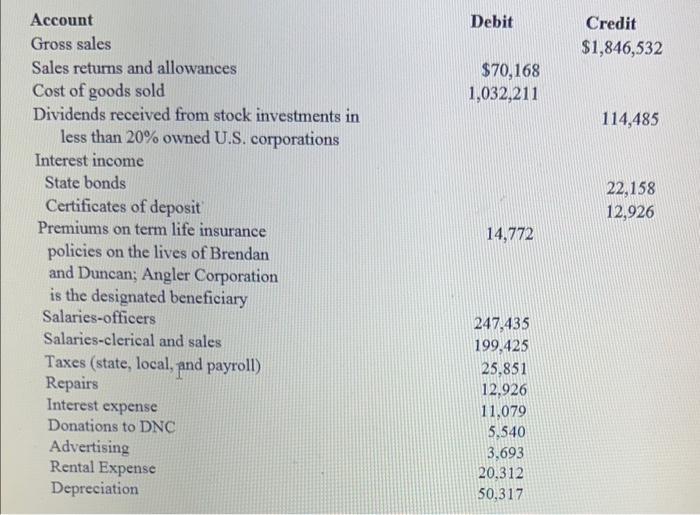

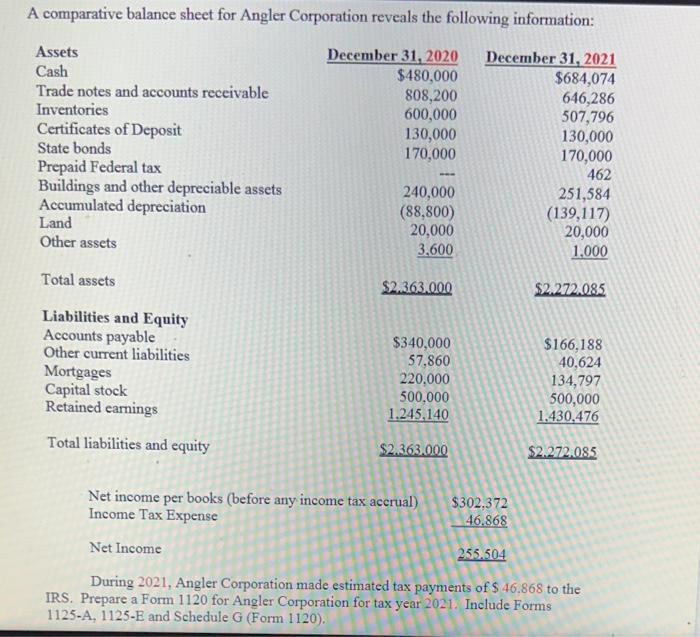

On May 1, 1989, Brendan McLeod and Duncan Ryan formed Angler Corporation to sell fishing tackle. Pertinent information regarding Angler is summarized as follows: - The business address is 3027 Woodland Ridge Blvd., Baton Rouge, Louisiana 70816. - The employer identification number is 753392543; the principal business activity code is 451110. - Brendan and Duncan each own one-half of the outstanding common stock; no other class of stock is authorized. Brendan is president of the company, and Duncan is secretary-treasurer. Both are full-time employees of the corporation, and each receives a salary of $123,718. Brendan's Social Security number is 145-26-2593. Duncan's Social Security number is 287-43-4945. - The corporation uses the accrual method of accounting and reports on a calendar basis. Inventories are determined by using the lower of cost or market method. For book purposes, the straight-line method of depreciation is used. - MACRS depreciation was $71,964 for the year. - During 2021, the corporation distributed a cash dividend of $70,168. Selected portions of Angler's profit and loss statement of 2021 reflect the following debits and credits: A comparative balance sheet for Angler Corporation reveals the following information: During 2021, Angler Corporation made estimated tax payments of $46.868 to the IRS. Prepare a Form 1120 for Angler Corporation for tax year 2021. Include Forms 1125A,1125E and Schedule G (Form 1120). On May 1, 1989, Brendan McLeod and Duncan Ryan formed Angler Corporation to sell fishing tackle. Pertinent information regarding Angler is summarized as follows: - The business address is 3027 Woodland Ridge Blvd., Baton Rouge, Louisiana 70816. - The employer identification number is 753392543; the principal business activity code is 451110. - Brendan and Duncan each own one-half of the outstanding common stock; no other class of stock is authorized. Brendan is president of the company, and Duncan is secretary-treasurer. Both are full-time employees of the corporation, and each receives a salary of $123,718. Brendan's Social Security number is 145-26-2593. Duncan's Social Security number is 287-43-4945. - The corporation uses the accrual method of accounting and reports on a calendar basis. Inventories are determined by using the lower of cost or market method. For book purposes, the straight-line method of depreciation is used. - MACRS depreciation was $71,964 for the year. - During 2021, the corporation distributed a cash dividend of $70,168. Selected portions of Angler's profit and loss statement of 2021 reflect the following debits and credits: A comparative balance sheet for Angler Corporation reveals the following information: During 2021, Angler Corporation made estimated tax payments of $46.868 to the IRS. Prepare a Form 1120 for Angler Corporation for tax year 2021. Include Forms 1125A,1125E and Schedule G (Form 1120)