Answered step by step

Verified Expert Solution

Question

1 Approved Answer

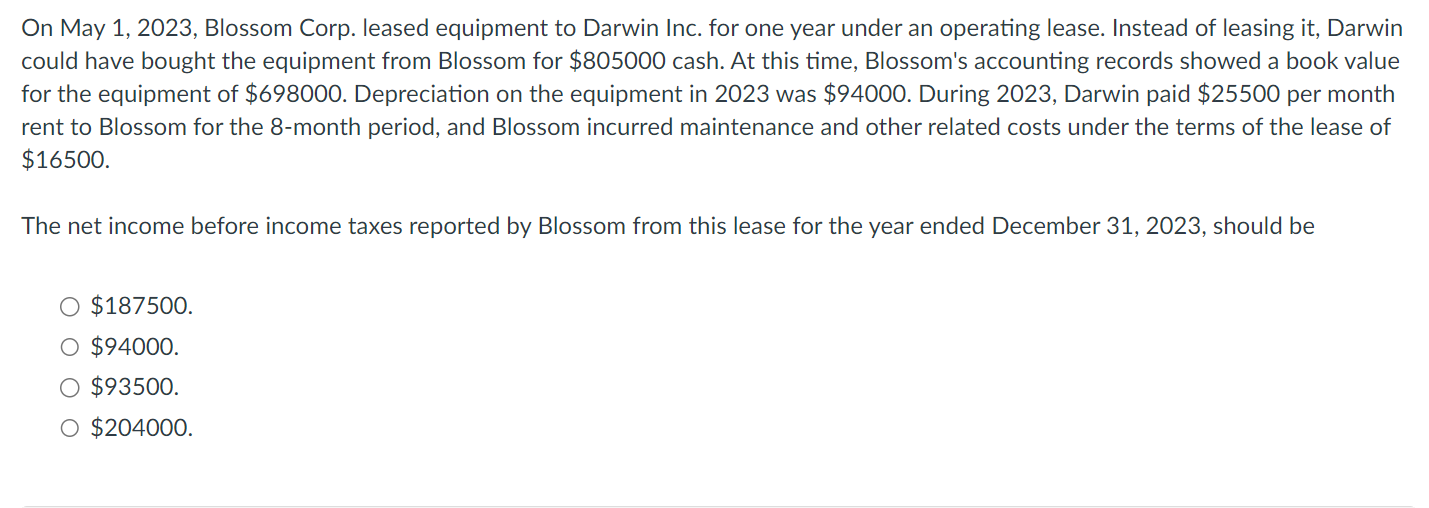

On May 1 , 2 0 2 3 , Blossom Corp. leased equipment to Darwin Inc. for one year under an operating lease. Instead of

On May Blossom Corp. leased equipment to Darwin Inc. for one year under an operating lease. Instead of leasing it Darwin

could have bought the equipment from Blossom for $ cash. At this time, Blossom's accounting records showed a book value

for the equipment of $ Depreciation on the equipment in was $ During Darwin paid $ per month

rent to Blossom for the month period, and Blossom incurred maintenance and other related costs under the terms of the lease of

$

The net income before income taxes reported by Blossom from this lease for the year ended December should be

$

$

$

$

Please do not use ChatGpt to answer and please explain the process. Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started