Question

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos.

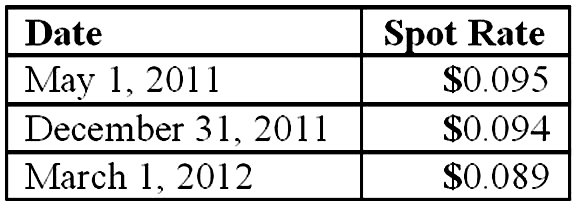

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2012 net income as a result of this fair value hedge of a firm commitment? Please provide detailed calculation.

| A. | $1,800.00 decrease. |

| B. | $2,500.00 increase. |

| C. | $2,500.00 decrease. |

| D. | $188,760.60 increase. |

| E. | $188,760.60 decrease. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started