Question

On May 1, 2017, Whispering Company issued 1,700 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the

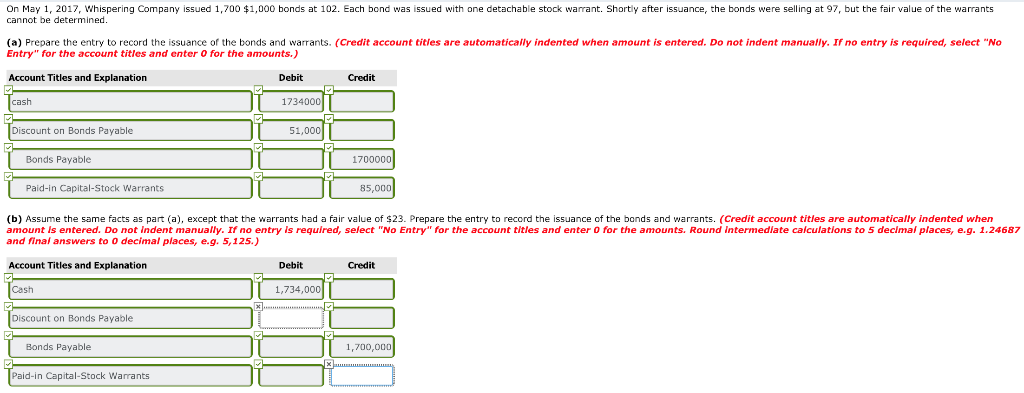

On May 1, 2017, Whispering Company issued 1,700 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 97, but the fair value of the warrants cannot be determined.

(a) Prepare the entry to record the issuance of the bonds and warrants.

(b) Assume the same facts as part (a), except that the warrants had a fair value of $23. Prepare the entry to record the issuance of the bonds and warrants.

Having trouble with part B. I've calculated the discount on B/P by allocating the bonds and warrants, but all my numbers are wrong.

On May 1, 2017, whispering Company issued 1,700 cannot be determined 1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 97, but the fair value of the warrants (a) Prepare the entry to record the issuance of the bonds and warrants. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit cash 1734000 Discount on Bonds Payable 51,000 Bonds Payable 700000 Paid-in Capital-Stock Warrants 85,000 (b) Assume the same facts as part (a), except that the warrants had a fair value of $23. Prepare the entry to record the issuance of the bands and warrants. (Credit account titles are automatically indented when amount Is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round Intermediate calculations to 5 declmal places, e.g. 1.24687 and final answers to 0 decimal places, e.g. 5,125.) Account Titles and Explanation Debit Credit Cash 1,734,000 Discount on Bonds Payable Bonds Payable 1,700,000 Paid-in Capital-Stock WarrantsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started