Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 1, 2020, X Corp. hired HBC to construct a new office building. The Construction was begun on May 1, 2020 and was

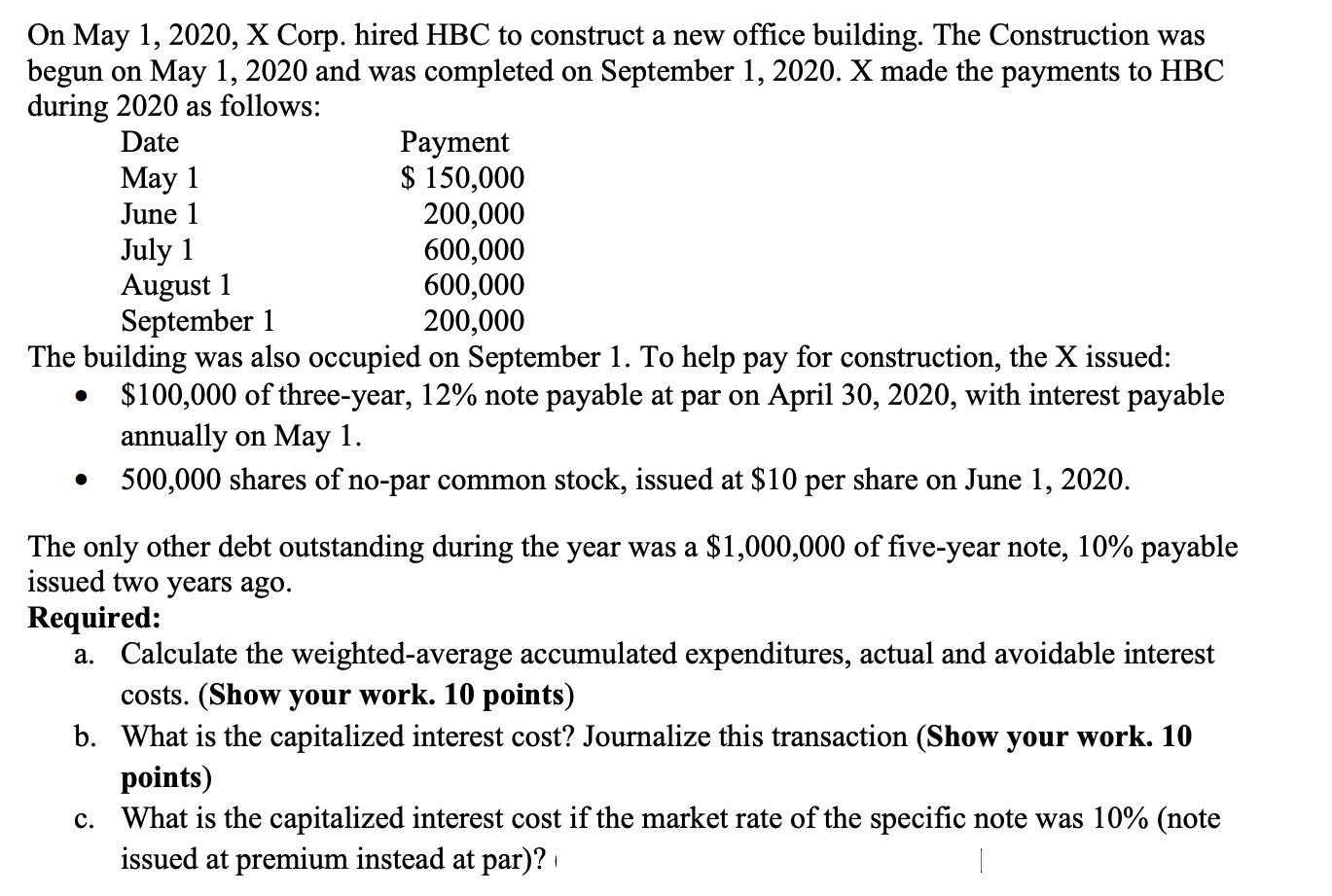

On May 1, 2020, X Corp. hired HBC to construct a new office building. The Construction was begun on May 1, 2020 and was completed on September 1, 2020. X made the payments to HBC during 2020 as follows: Date May 1 Payment $ 150,000 200,000 June 1 600,000 July 1 August 1 600,000 September 1 200,000 The building was also occupied on September 1. To help pay for construction, the X issued: $100,000 of three-year, 12% note payable at par on April 30, 2020, with interest payable annually on May 1. 500,000 shares of no-par common stock, issued at $10 per share on June 1, 2020. The only other debt outstanding during the year was a $1,000,000 of five-year note, 10% payable issued two years ago. Required: a. Calculate the weighted-average accumulated expenditures, actual and avoidable interest costs. (Show your work. 10 points) b. What is the capitalized interest cost? Journalize this transaction (Show your work. 10 points) c. What is the capitalized interest cost if the market rate of the specific note was 10% (note issued at premium instead at par)?

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer to point a Calculation of weighted average accumulated expenditures actual and avoidable inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started