Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 1, 2021, Wildhorse Corp. issued $945,000 of 5-year, 7% bonds at 95. The bonds pay interest annually on May 1. Wildhorse's year

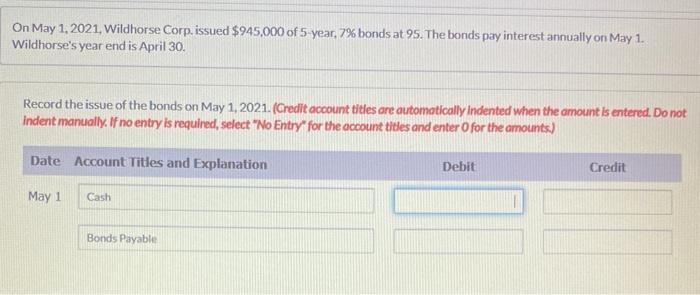

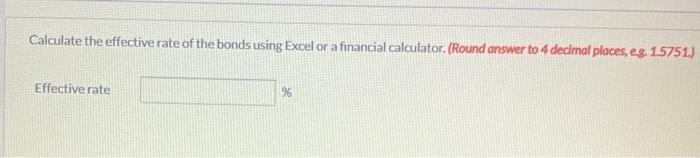

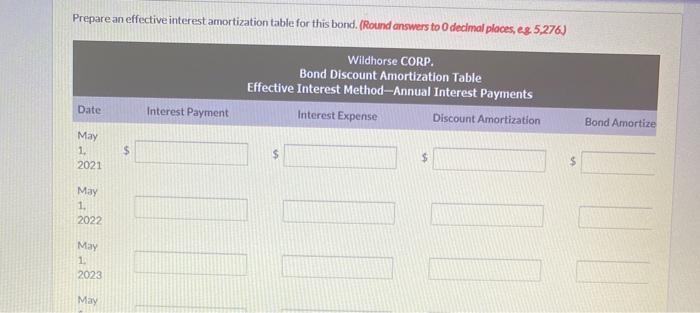

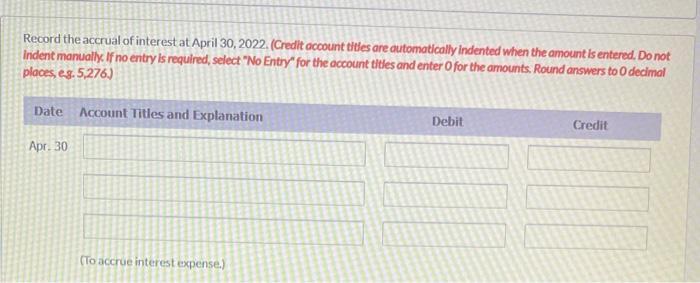

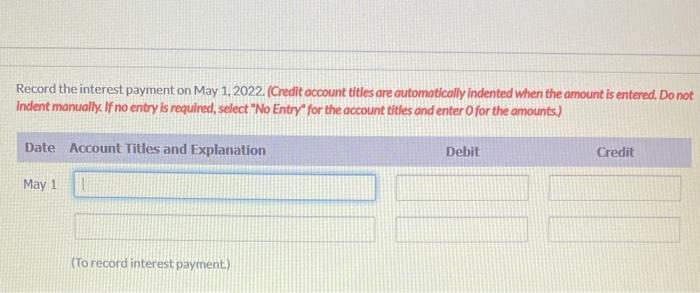

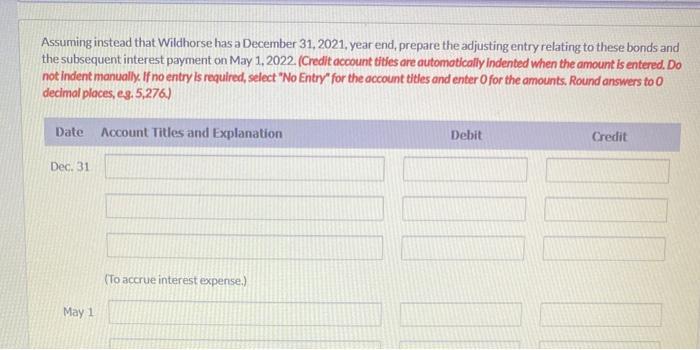

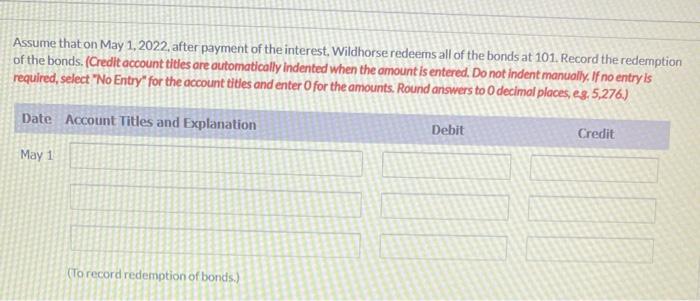

On May 1, 2021, Wildhorse Corp. issued $945,000 of 5-year, 7% bonds at 95. The bonds pay interest annually on May 1. Wildhorse's year end is April 30. Record the issue of the bonds on May 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Date Account Titles and Explanation Debit Credit May 1 Cash Bonds Payable Calculate the effective rate of the bonds using Excel or a financial calculator. (Round answer to 4 decimal places, eg. 1.5751) Effective rate % Prepare an effective interest amortization table for this bond. (Round answers to 0 decimal places, e.g. 5,276) Wildhorse CORP. Bond Discount Amortization Table Effective Interest Method-Annual Interest Payments Interest Expense Date Interest Payment Discount Amortization May 1. 2021 May 1, 2022 May 1. 2023 May $ N $ Bond Amortize Record the accrual of interest at April 30, 2022. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,276) Date Account Titles and Explanation Debit Credit Apr. 30 (To accrue interest expense.) Record the interest payment on May 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Date Account Titles and Explanation Debit Credit May 1 (To record interest payment.) Assuming instead that Wildhorse has a December 31, 2021, year end, prepare the adjusting entry relating to these bonds and the subsequent interest payment on May 1, 2022. (Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,276) Date Account Titles and Explanation Debit Credit Dec. 31. (To accrue interest expense.) May 1 11 Assume that on May 1, 2022, after payment of the interest, Wildhorse redeems all of the bonds at 101. Record the redemption of the bonds. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, eg. 5,276) Date Account Titles and Explanation Debit Credit May 1 (To record redemption of bonds.)

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

2 Working Issued Bond 945000 B Value of a single bond 100 as it is issued at 95 Total number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started