Answered step by step

Verified Expert Solution

Question

1 Approved Answer

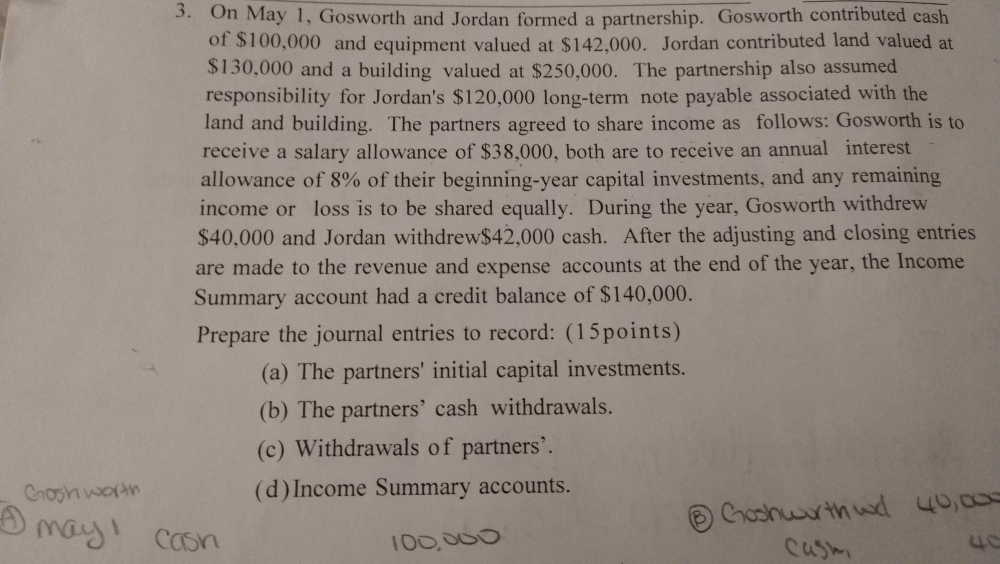

On May 1, Gosworth and Jordan formed a partnership. Gosworth contributed cash of $100.000 and equipment valued at $142.000. Jordan contributed land valued at 130.000

On May 1, Gosworth and Jordan formed a partnership. Gosworth contributed cash of $100.000 and equipment valued at $142.000. Jordan contributed land valued at 130.000 and a building valued at $250,000. The partnership also assumed responsibility for Jordan's $120,000 long-term note payable associated with the land and building. The partners agreed to share income as follows: Gosworth is to receive a salary allowance of $38,000, both are to receive an annual interest allowance of 8% of their beginning-year capital investments, and any remaining income or loss is to be shared equally. During the year, Gosworth withdrew $40,000 and Jordan withdrew$42,000 cash. After the adjusting and closing entries are made to the revenue and expense accounts at the end of the year, the Income Summary account had a credit balance of $140,000. Prepare the journal entries to record: (15 points) (a) The partners' initial capital investments. (b) The partners' cash withdrawals. (c) Withdrawals of partners'. (d) Income Summary accounts. - Gosh worth may cash oshworth wd 40,000 100.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started