Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 1 of Year 1 , the company paid $ 2 , 4 0 0 cash for rent. This $ 2 , 4 0

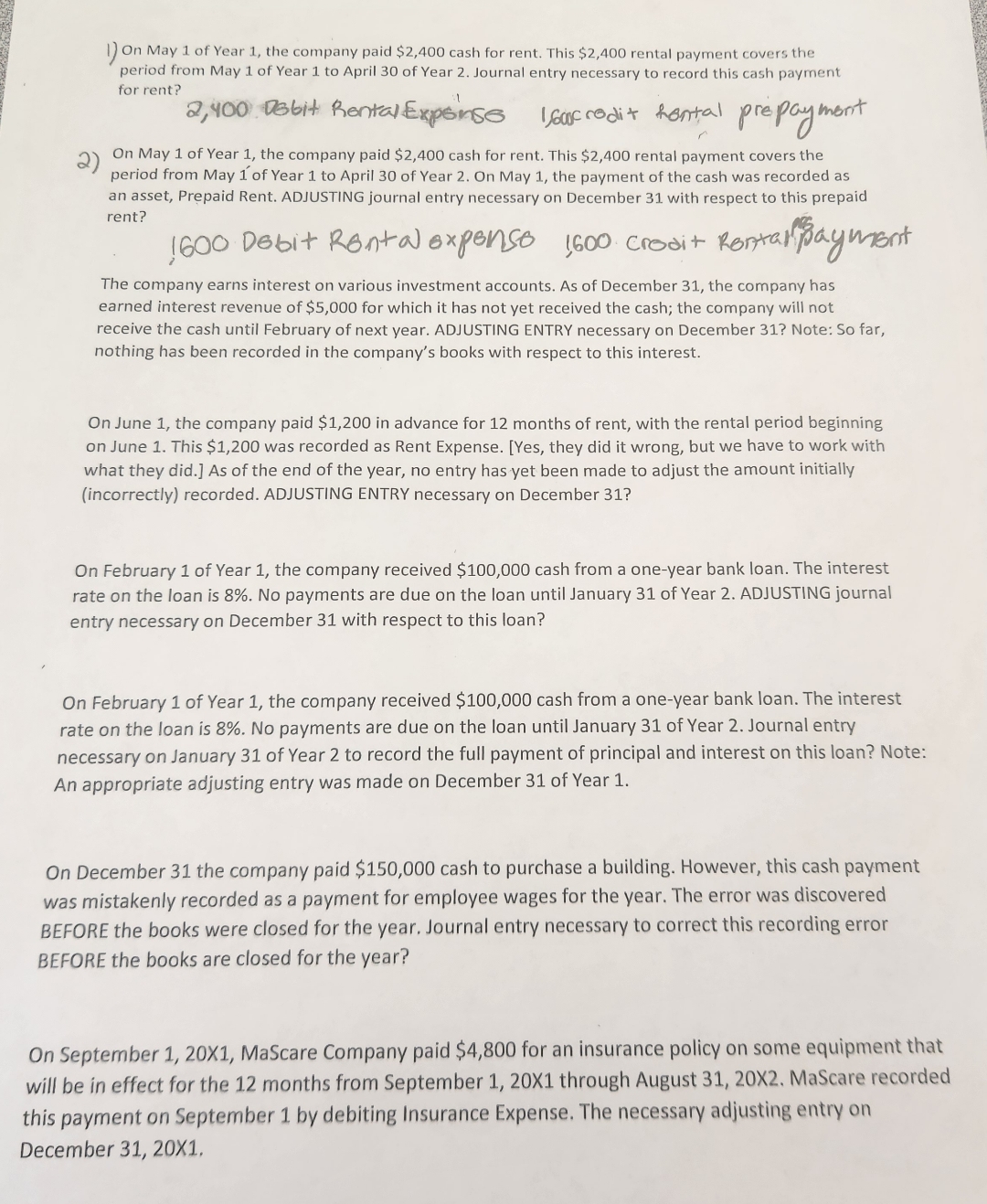

On May of Year the company paid $ cash for rent. This $ rental payment covers the period from May of Year to April of Year Journal entry necessary to record this cash payment for rent?

Debit Rental Expsinse I,crodit hental prepayment

On May of Year the company paid $ cash for rent. This $ rental payment covers the period from May of Year to April of Year On May the payment of the cash was recorded as an asset, Prepaid Rent. ADJUSTING journal entry necessary on December with respect to this prepaid rent?

Debit Rontal expense Crodit Rontalpayment

The company earns interest on various investment accounts. As of December the company has earned interest revenue of $ for which it has not yet received the cash; the company will not receive the cash until February of next year. ADJUSTING ENTRY necessary on December Note: So far, nothing has been recorded in the company's books with respect to this interest.

On June the company paid $ in advance for months of rent, with the rental period beginning on June This $ was recorded as Rent Expense. Yes they did it wrong, but we have to work with what they did. As of the end of the year, no entry has yet been made to adjust the amount initially incorrectly recorded. ADJUSTING ENTRY necessary on December

On February of Year the company received $ cash from a oneyear bank loan. The interest rate on the loan is No payments are due on the loan until January of Year ADJUSTING journal entry necessary on December with respect to this loan?

On February of Year the company received $ cash from a oneyear bank loan. The interest rate on the loan is No payments are due on the loan until January of Year Journal entry necessary on January of Year to record the full payment of principal and interest on this loan? Note: An appropriate adjusting entry was made on December of Year

On December the company paid $ cash to purchase a building. However, this cash payment was mistakenly recorded as a payment for employee wages for the year. The error was discovered BEFORE the books were closed for the year. Journal entry necessary to correct this recording error BEFORE the books are closed for the year?

On September X MaScare Company paid $ for an insurance policy on some equipment that will be in effect for the months from September X through August X MaScare recorded this payment on September by debiting Insurance Expense. The necessary adjusting entry on December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started