Answered step by step

Verified Expert Solution

Question

1 Approved Answer

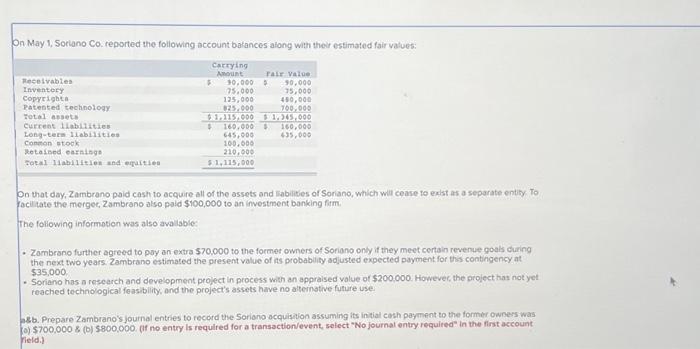

On May 1, Soriano Co. reported the following account balances along with their estimated fair values: Receivables Inventory Copyrights Patented technology Total assets Current liabilities

On May 1, Soriano Co. reported the following account balances along with their estimated fair values: Receivables Inventory Copyrights Patented technology Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and equities Carrying Amount Fair Value $ 90,000 $ 90,000 75,000 125,000 825,000 75,000 480,000 700,000 $ 1,115,000 $ 1,345,000 $ 160,000 $ 160,000 645,000 635,000 100,000 210,000 $ 1,115,000 On that day, Zambrano paid cash to acquire all of the assets and liabilities of Soriano, which will cease to exist as a separate entity. To facilitate the merger, Zambrano also paid $100,000 to an investment banking firm. The following information was also available: Zambrano further agreed to pay an extra $70,000 to the former owners of Soriano only if they meet certain revenue goals during the next two years. Zambrano estimated the present value of its probability adjusted expected payment for this contingency at $35,000. . Soriano has a research and development project in process with an appraised value of $200,000. However, the project has not yet reached technological feasibility, and the project's assets have no alternative future use. a&b. Prepare Zambrano's journal entries to record the Soriano acquisition assuming its initial cash payment to the former owners was (a) $700,000 & (b) $800,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started