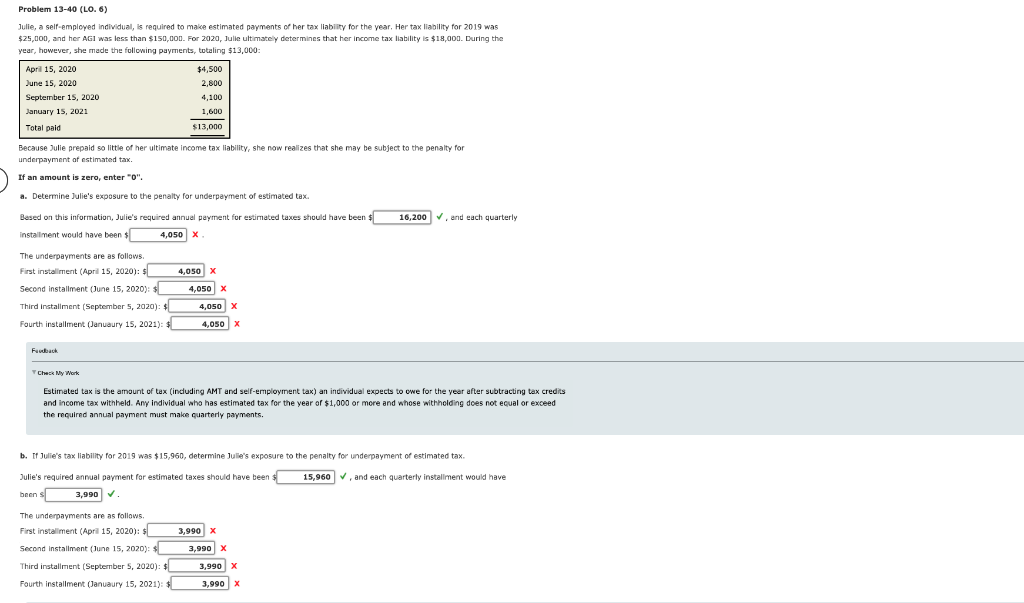

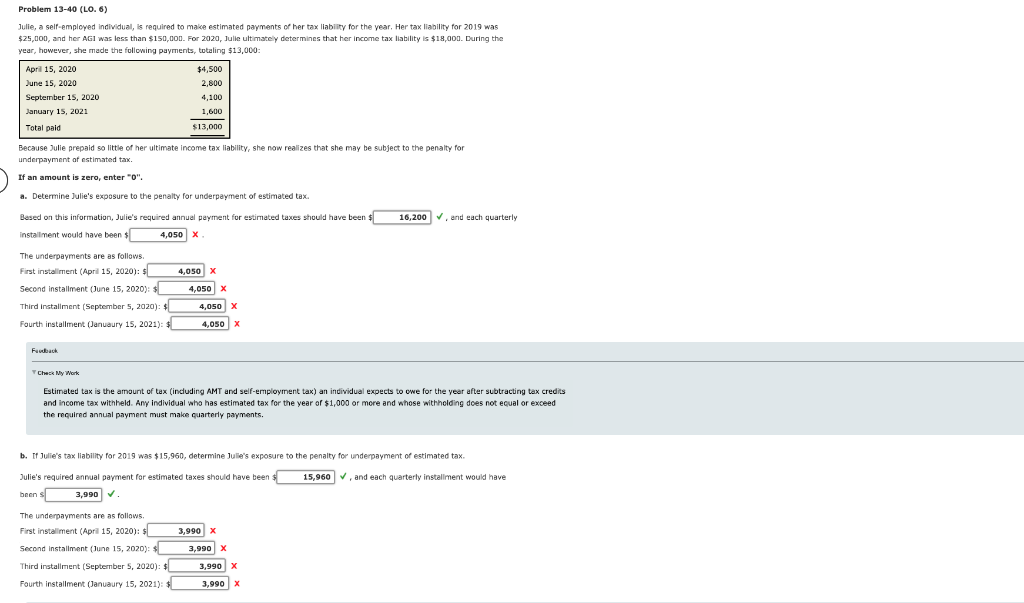

Problem 13-40 (LO. 6) Julie, a self-employed individual, is required to make estimated payments of her tax liability for the year. Her tax liability for 2019 was $25,000, and her AGI was less than $150,000. For 2020, Julle ultimately determines that her income tax liability is $18,000. During the year, however, she made the following payments, totaling $13,000: April 15, 2020 June 15, 2020 September 15, 2020 January 15, 2021 $4,500 2,800 4,100 1,600 $13,000 Total pald Because Julie prepaid so little of her ultimate income tax liability, she now realizes that she may be subject to the penalty for underpayment of estimated tax If an amount is zero, enter "o". . a. Determine Julie's exposure to the penalty for underpayment of estimated tax. Besed on this information, Julie's required annual payment for estimated taxes should have been 16,200, and each quarterly installment would have been $ 4,050 x 4,050 x The underpayments are as follows. First installment (April 15, 2020): $ ): Second installment (June 15, 2020): $ Third installment (September 5, 2020): $ Fourth installment (January 15, 2021): $ 4,050 x 4,050 x 4,050 x Fadbach Check My Wort Estimated tax is the amount of tax (including AMT and self-employment tax) an individual expects to owe for the year after subtracting tax credits and income tax withheld. Any individual who has estimated tax for the year of $1,000 or more and whose withholding does not equal or exceed the required annual payment must make quarterly payments. b. If Julie's tax liability for 2019 was $15,960, determine Julie's exposure to the penalty for underpayment of estimated tax 15,960, and each quarterly installment would have Julie's required annual payment for estimated taxes should have been been s 3,990 The underpayments are as follows, First installment (April 15, 2020) Second installment (June 15, 2020): $ Third installment (September 5, 2020): $ Fourth installment (January 15, 2021): $ 3,990 X 3,990 X 3,990 X 3,990 x Problem 13-40 (LO. 6) Julie, a self-employed individual, is required to make estimated payments of her tax liability for the year. Her tax liability for 2019 was $25,000, and her AGI was less than $150,000. For 2020, Julle ultimately determines that her income tax liability is $18,000. During the year, however, she made the following payments, totaling $13,000: April 15, 2020 June 15, 2020 September 15, 2020 January 15, 2021 $4,500 2,800 4,100 1,600 $13,000 Total pald Because Julie prepaid so little of her ultimate income tax liability, she now realizes that she may be subject to the penalty for underpayment of estimated tax If an amount is zero, enter "o". . a. Determine Julie's exposure to the penalty for underpayment of estimated tax. Besed on this information, Julie's required annual payment for estimated taxes should have been 16,200, and each quarterly installment would have been $ 4,050 x 4,050 x The underpayments are as follows. First installment (April 15, 2020): $ ): Second installment (June 15, 2020): $ Third installment (September 5, 2020): $ Fourth installment (January 15, 2021): $ 4,050 x 4,050 x 4,050 x Fadbach Check My Wort Estimated tax is the amount of tax (including AMT and self-employment tax) an individual expects to owe for the year after subtracting tax credits and income tax withheld. Any individual who has estimated tax for the year of $1,000 or more and whose withholding does not equal or exceed the required annual payment must make quarterly payments. b. If Julie's tax liability for 2019 was $15,960, determine Julie's exposure to the penalty for underpayment of estimated tax 15,960, and each quarterly installment would have Julie's required annual payment for estimated taxes should have been been s 3,990 The underpayments are as follows, First installment (April 15, 2020) Second installment (June 15, 2020): $ Third installment (September 5, 2020): $ Fourth installment (January 15, 2021): $ 3,990 X 3,990 X 3,990 X 3,990 x