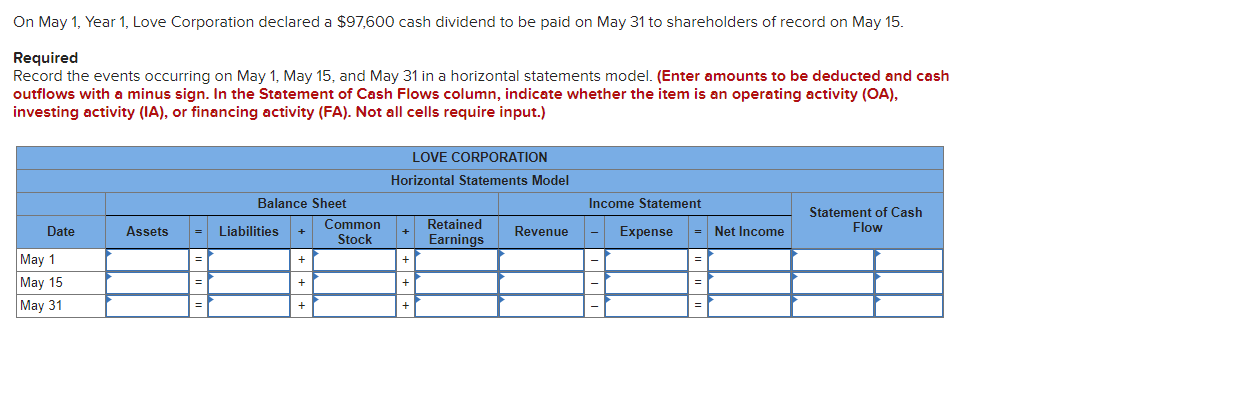

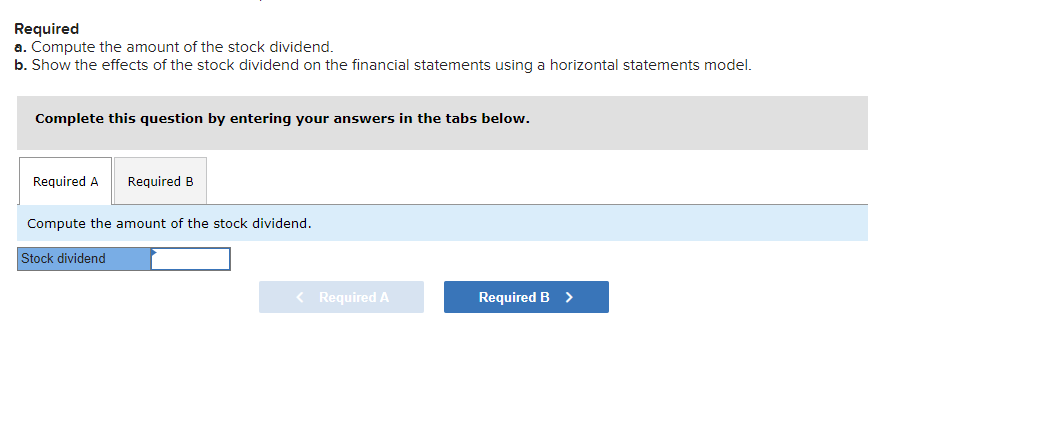

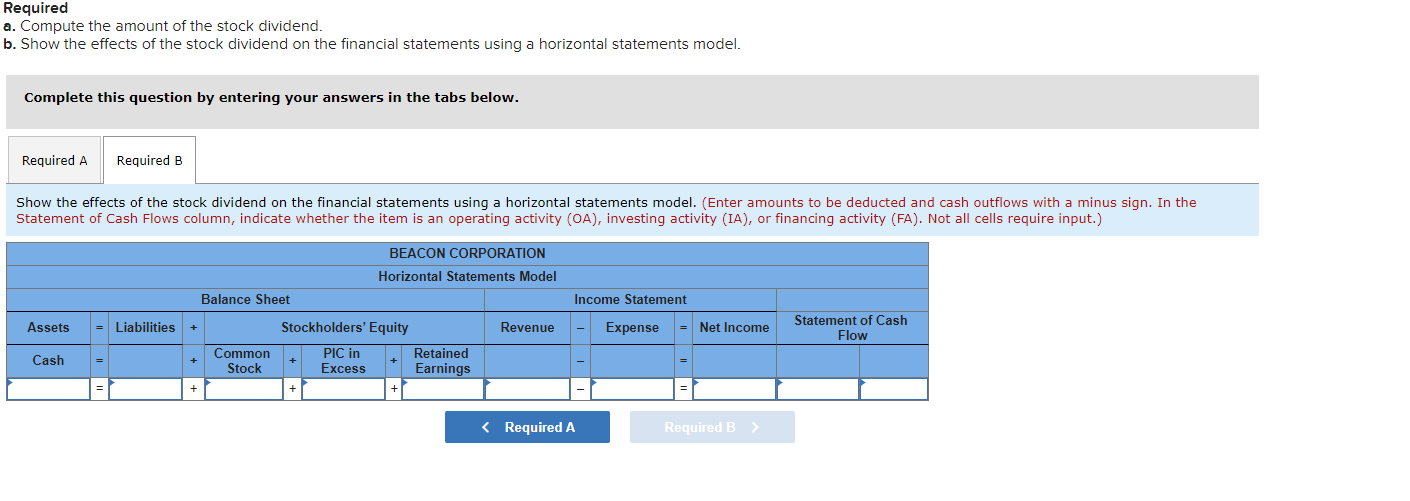

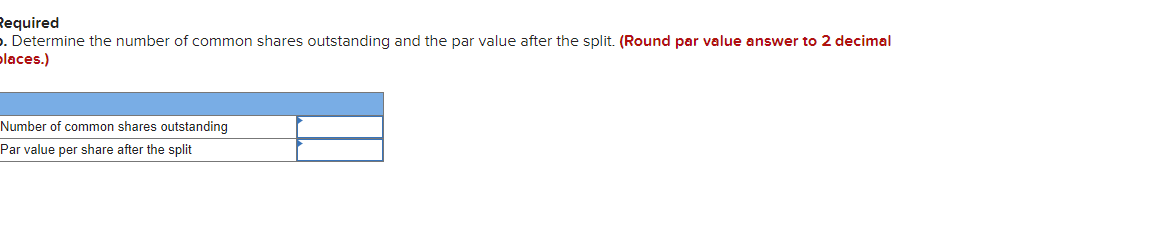

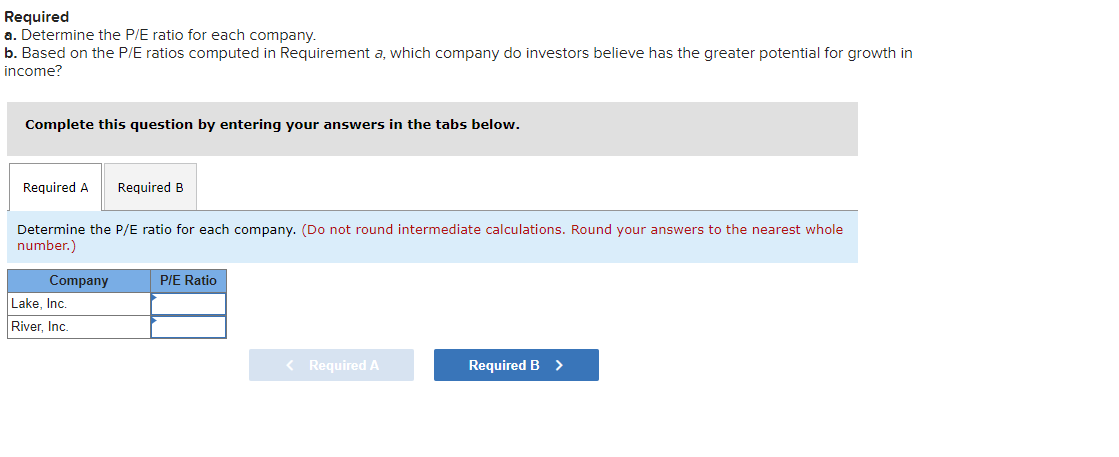

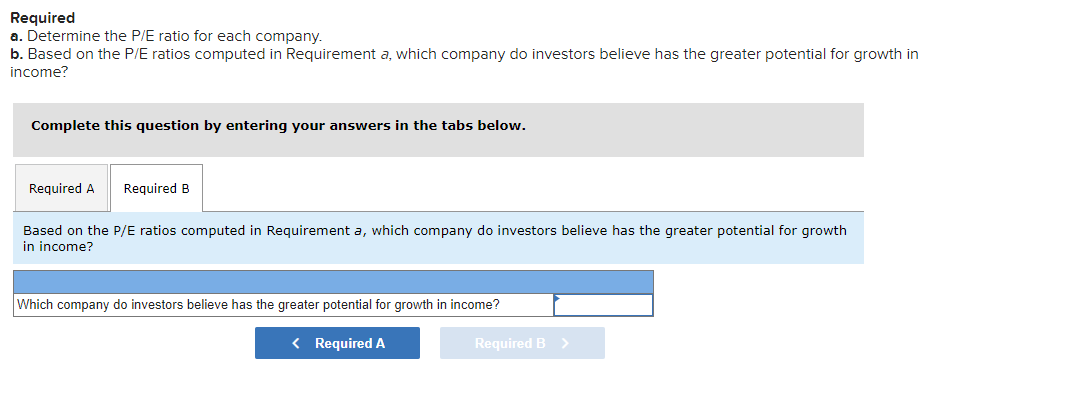

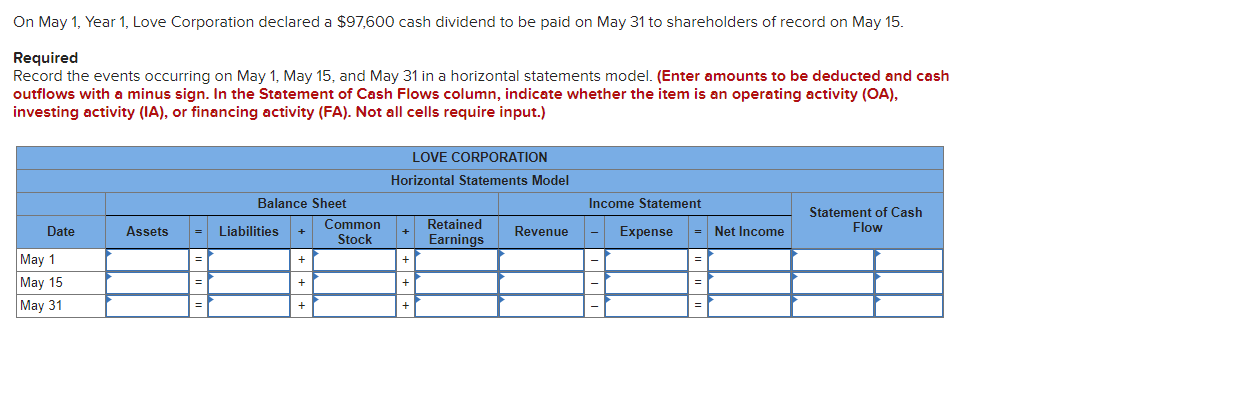

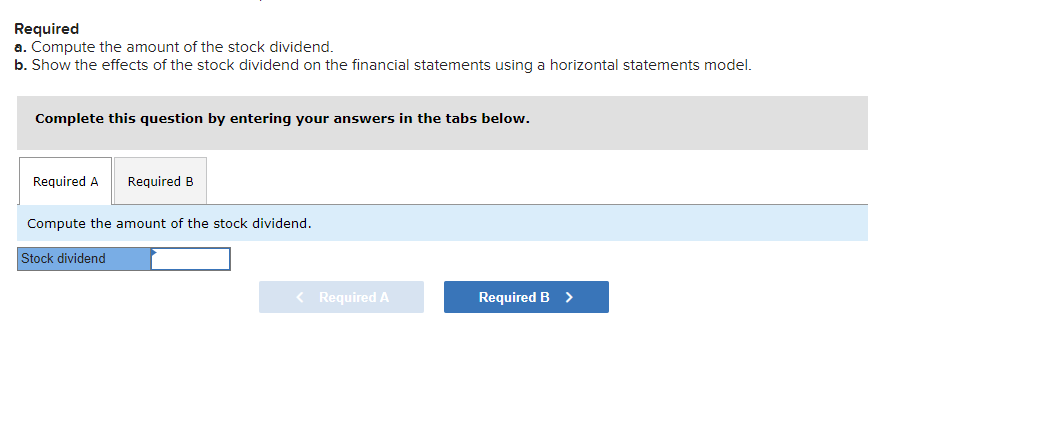

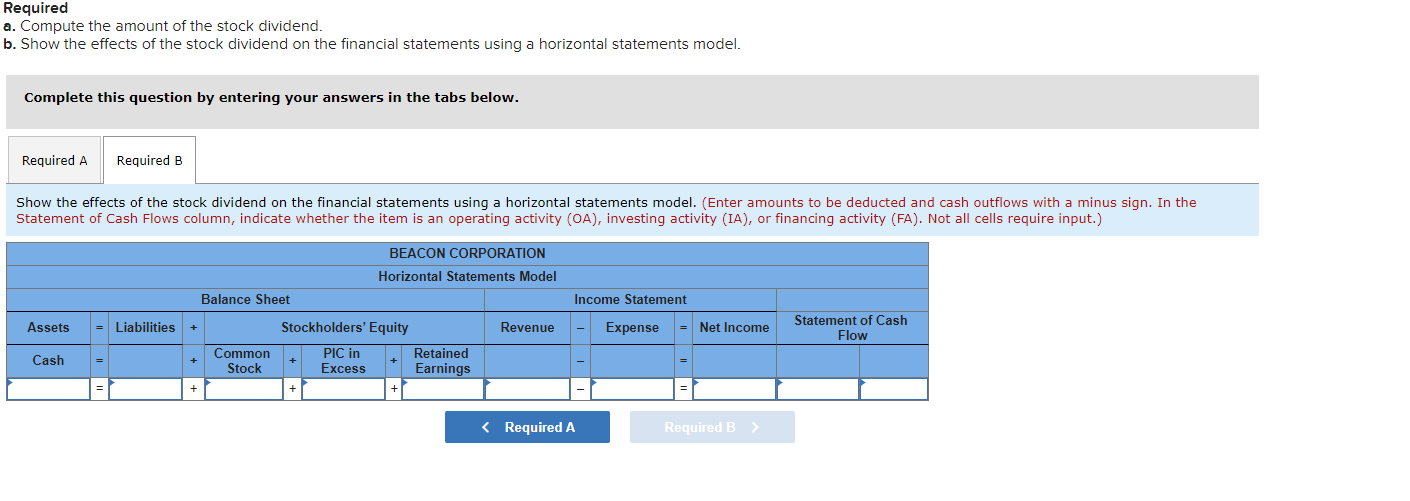

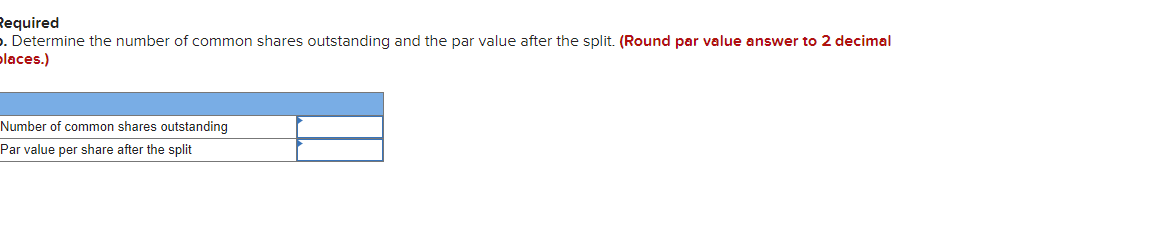

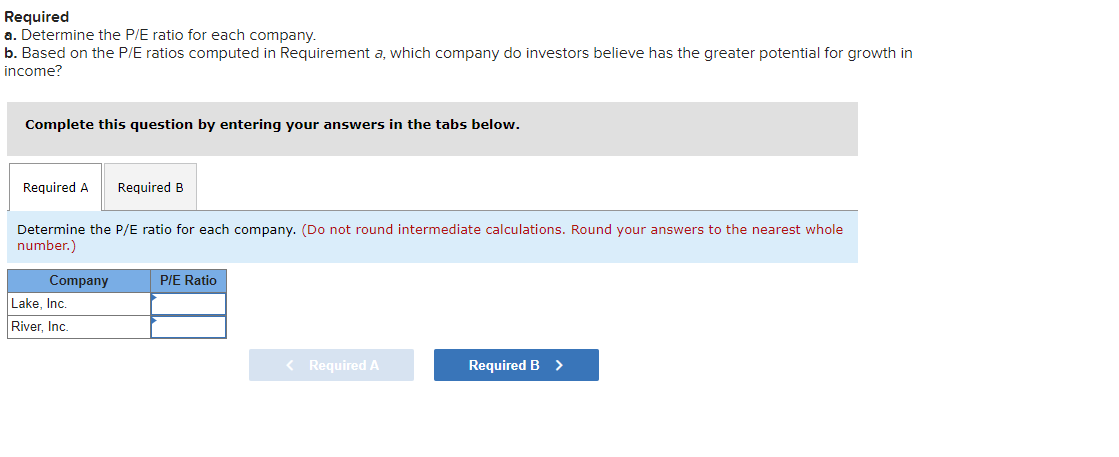

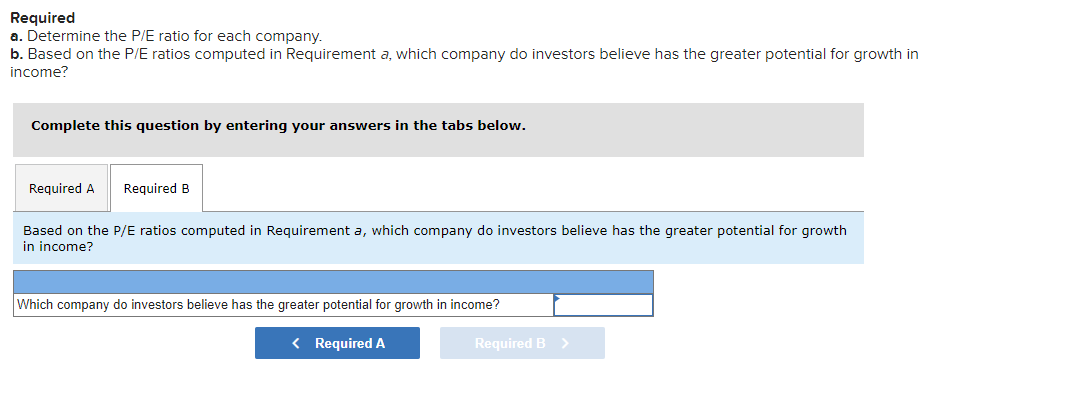

On May 1, Year 1, Love Corporation declared a $97,600 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1, May 15, and May 31 in a horizontal statements model. (Enter amounts to be deducted and cash outflows with a minus sign. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Not all cells require input.) LOVE CORPORATION Horizontal Statements Model Income Statement Balance Sheet Common Liabilities Stock Statement of Cash Flow Date Assets Retained Earnings Revenue Expense Net Income + May 1 May 15 May 31 + + Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of the stock dividend. Stock dividend Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Show the effects of the stock dividend on the financial statements using a horizontal statements model. (Enter amounts to be deducted and cash outflows with a minus sign. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Not all cells require input.) BEACON CORPORATION Horizontal Statements Model Balance Sheet Income Statement Assets Liabilities Revenue Expense Net Income Statement of Cash Flow Stockholders' Equity Retained Excess Earnings PIC in Common Stock Cash Required a. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your answers in the tabs below. Required A Required B Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Which company do investors believe has the greater potential for growth in income?