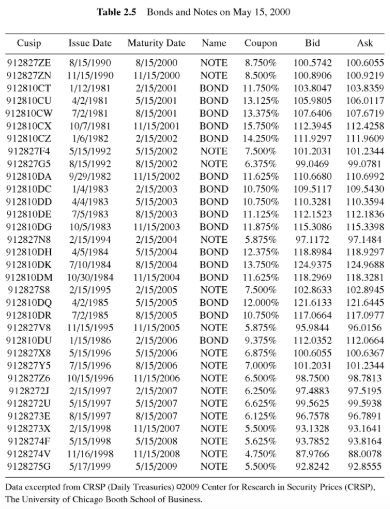

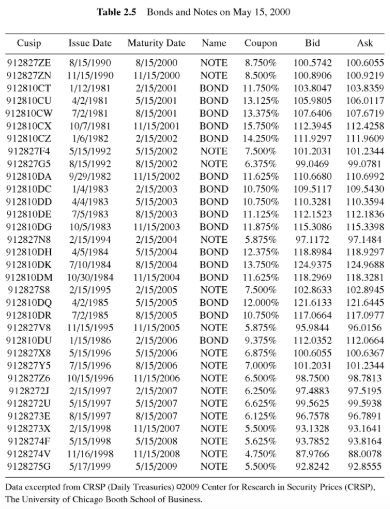

On May 15, 2000 you obtain the data on Treasuries in Table 2.5. Compute the semiannual yield curve, spanning over 4 years, from the data using the bootstrap procedure.

(Hint: For the price of bond, use the average of bid and ask prices.)

Table 2.5 Bonds and Notes on May 15, 2000 Cusip Issue Date 912827ZE 8/15/1990 912827ZN 11/15/1990 912810CT 1/12/1981 9128IOCU 4/2/1981 912810CW 7/2/1981 912810CX 10/7/1981 912810CZ 1/6/1982 91282774 S/15/1992 912827G5R/15/1992 912810DA 9/29/1982 912810DC 1/4/1983 912810DD 4/4/1983 912810DE 7/5/1983 912810DG 10/5/1983 912827N8 2/15/1994 912810DH 4/5/1984 912810DK 7/10/1984 912810DM 10/30/1984 91282758 2/15/1995 912810DQ4/2/1985 912810DR 7/2/1985 912827V8 11/15/1995 912810DU 1/15/1986 912827X8 5/15/1996 912827Y5 7/15/1996 91282726 10/15/1996 912827212/15/1997 9128272U 5/15/1997 9128273E 8/15/1997 9128273X 2/15/1998 9128274F S/15/1998 9128274V 11/16/1998 9128275G 5/17/1999 Maturity Date 8/15/2000 11/15/2000 2/15/2001 5/15/2001 8/15/2001 11/15/2001 2/15/2002 5/15/2002 8/15/2002 11/15/2002 2/15/2003 5/15/2003 8/15/2003 11/15/2003 2/15/2004 5/15/2004 8/15/2004 11/15/2004 2/15/2005 5/15/2005 8/15/2005 11/15/2005 2/15/2006 5/15/2006 8/15/2006 11/15/2006 2/15/2007 5/15/2007 8/15/2007 11/15/2007 5/15/2008 11/15/2008 5/15/2009 Name NOTE NOTE BOND BOND BOND BOND BOND NOTE NOTE BOND BOND BOND BOND BOND NOTE BOND BOND BOND NOTE BOND BOND NOTE BOND NOTE NOTE NOTE NOTE NOTE NOTE NOTE NOTE NOTE NOTE Coupon 8.750% 8.500% 11.750% 13.125% 13.375% 15.750% 14.250% 7.500% 6.375% 11.625% 10.750% 10.750% 11.125% 11.875% 5.875% 12.375% 13.750% 11.625% 7.500% 12.000% 10.750% 5.875% 9.375% 6.875% 7.000% 6.500 6.250% 6,625% 6.125% 5.500% 5.625% 4.750% 5.500% Bid Ask 100.5742 100.6055 100.8906 100.9219 103.8047 103.8359 105.9805 106.0117 107.6406 107.6719 112.3945 112.4258 111.9297 111.9609 101.2031 101.2444 99,0469 99.0781 110.6680 110.6992 109.5117 109.5430 110.3281 110.3594 112.1523 112.1836 115.3086 115.3398 97.1172 97.1484 118.8984 118.9297 124.9375 124.9688 118.2969 118.3281 102.8633 102.8945 121.6133 121.6445 117,0664 117.0977 95.9844 96.0156 112.0352 112.0664 100.6055 100.6367 101.2031 101.2344 98.750098.7813 97.4883 97.5195 99.5625 99.5938 96.7578 96.7891 93.1328 93.1641 93.7852 93.8164 87.9766 88.0078 92.824292.8555 Data Excerpted from CRSP (Daily Treasures) 00009 Cemer for Research in Security Prices (CRSP). The University of Chicago Booth School of Business Table 2.5 Bonds and Notes on May 15, 2000 Cusip Issue Date 912827ZE 8/15/1990 912827ZN 11/15/1990 912810CT 1/12/1981 9128IOCU 4/2/1981 912810CW 7/2/1981 912810CX 10/7/1981 912810CZ 1/6/1982 91282774 S/15/1992 912827G5R/15/1992 912810DA 9/29/1982 912810DC 1/4/1983 912810DD 4/4/1983 912810DE 7/5/1983 912810DG 10/5/1983 912827N8 2/15/1994 912810DH 4/5/1984 912810DK 7/10/1984 912810DM 10/30/1984 91282758 2/15/1995 912810DQ4/2/1985 912810DR 7/2/1985 912827V8 11/15/1995 912810DU 1/15/1986 912827X8 5/15/1996 912827Y5 7/15/1996 91282726 10/15/1996 912827212/15/1997 9128272U 5/15/1997 9128273E 8/15/1997 9128273X 2/15/1998 9128274F S/15/1998 9128274V 11/16/1998 9128275G 5/17/1999 Maturity Date 8/15/2000 11/15/2000 2/15/2001 5/15/2001 8/15/2001 11/15/2001 2/15/2002 5/15/2002 8/15/2002 11/15/2002 2/15/2003 5/15/2003 8/15/2003 11/15/2003 2/15/2004 5/15/2004 8/15/2004 11/15/2004 2/15/2005 5/15/2005 8/15/2005 11/15/2005 2/15/2006 5/15/2006 8/15/2006 11/15/2006 2/15/2007 5/15/2007 8/15/2007 11/15/2007 5/15/2008 11/15/2008 5/15/2009 Name NOTE NOTE BOND BOND BOND BOND BOND NOTE NOTE BOND BOND BOND BOND BOND NOTE BOND BOND BOND NOTE BOND BOND NOTE BOND NOTE NOTE NOTE NOTE NOTE NOTE NOTE NOTE NOTE NOTE Coupon 8.750% 8.500% 11.750% 13.125% 13.375% 15.750% 14.250% 7.500% 6.375% 11.625% 10.750% 10.750% 11.125% 11.875% 5.875% 12.375% 13.750% 11.625% 7.500% 12.000% 10.750% 5.875% 9.375% 6.875% 7.000% 6.500 6.250% 6,625% 6.125% 5.500% 5.625% 4.750% 5.500% Bid Ask 100.5742 100.6055 100.8906 100.9219 103.8047 103.8359 105.9805 106.0117 107.6406 107.6719 112.3945 112.4258 111.9297 111.9609 101.2031 101.2444 99,0469 99.0781 110.6680 110.6992 109.5117 109.5430 110.3281 110.3594 112.1523 112.1836 115.3086 115.3398 97.1172 97.1484 118.8984 118.9297 124.9375 124.9688 118.2969 118.3281 102.8633 102.8945 121.6133 121.6445 117,0664 117.0977 95.9844 96.0156 112.0352 112.0664 100.6055 100.6367 101.2031 101.2344 98.750098.7813 97.4883 97.5195 99.5625 99.5938 96.7578 96.7891 93.1328 93.1641 93.7852 93.8164 87.9766 88.0078 92.824292.8555 Data Excerpted from CRSP (Daily Treasures) 00009 Cemer for Research in Security Prices (CRSP). The University of Chicago Booth School of Business