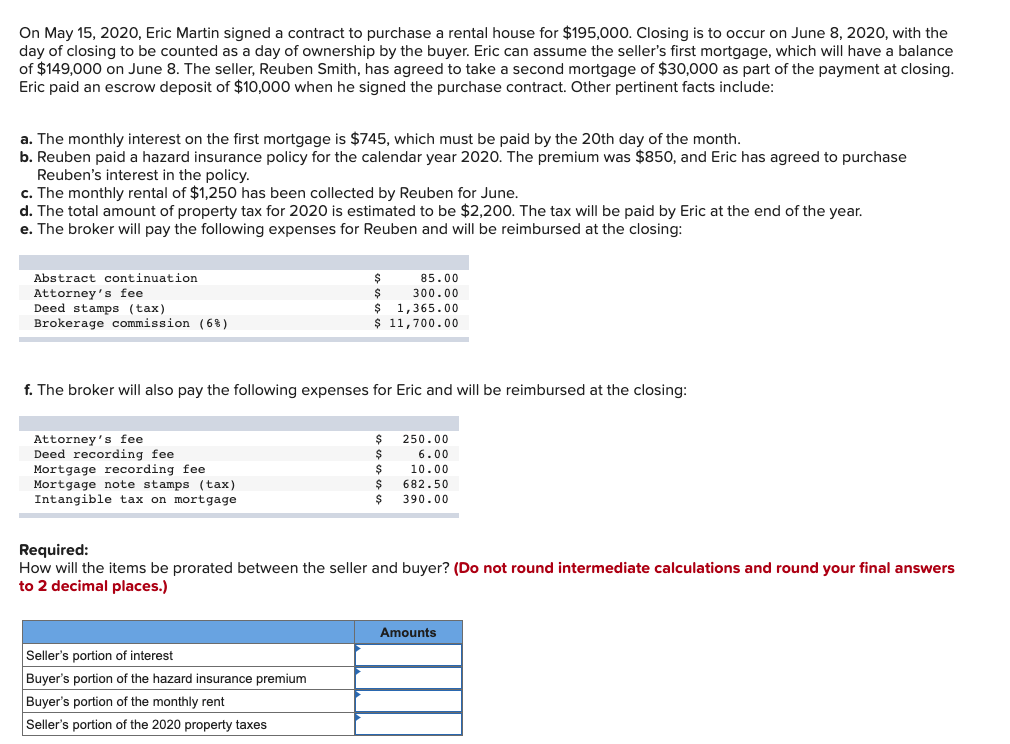

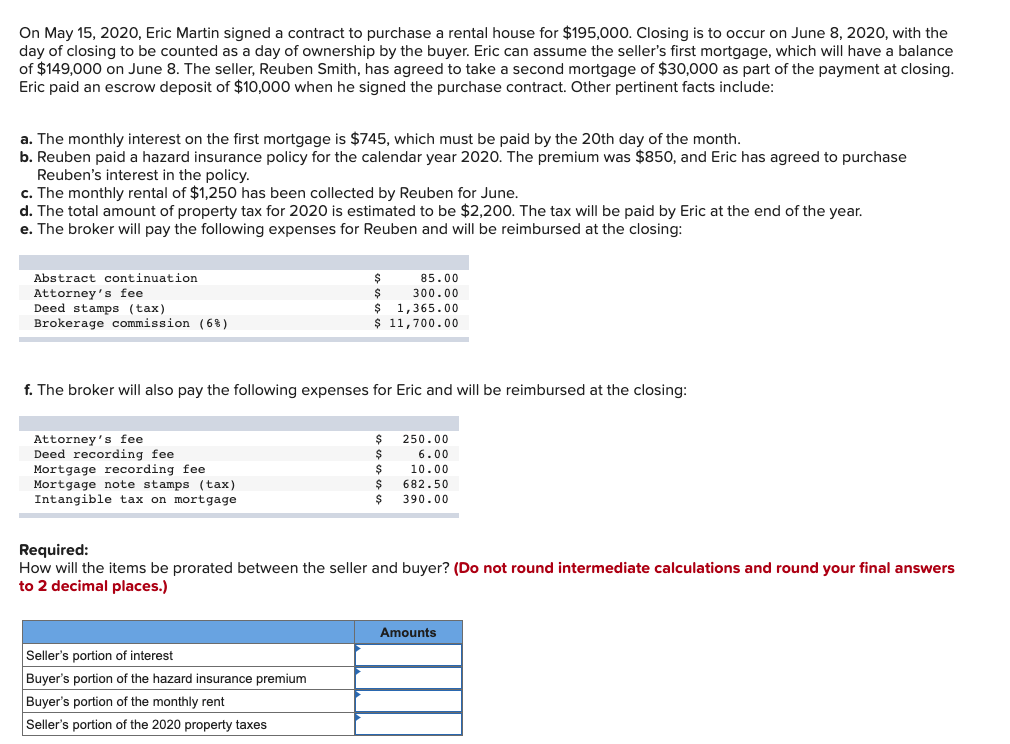

On May 15,2020 , Eric Martin signed a contract to purchase a rental house for $195,000. Closing is to occur on June 8, 2020, with the day of closing to be counted as a day of ownership by the buyer. Eric can assume the seller's first mortgage, which will have a balance of $149,000 on June 8 . The seller, Reuben Smith, has agreed to take a second mortgage of $30,000 as part of the payment at closing. Eric paid an escrow deposit of $10,000 when he signed the purchase contract. Other pertinent facts include: a. The monthly interest on the first mortgage is $745, which must be paid by the 20 th day of the month. b. Reuben paid a hazard insurance policy for the calendar year 2020 . The premium was $850, and Eric has agreed to purchase Reuben's interest in the policy. c. The monthly rental of $1,250 has been collected by Reuben for June. d. The total amount of property tax for 2020 is estimated to be $2,200. The tax will be paid by Eric at the end of the year. e. The broker will pay the following expenses for Reuben and will be reimbursed at the closing: f. The broker will also pay the following expenses for Eric and will be reimbursed at the closing: Required: How will the items be prorated between the seller and buyer? (Do not round intermediate calculations and round your final answers to 2 decimal places.) On May 15,2020 , Eric Martin signed a contract to purchase a rental house for $195,000. Closing is to occur on June 8, 2020, with the day of closing to be counted as a day of ownership by the buyer. Eric can assume the seller's first mortgage, which will have a balance of $149,000 on June 8 . The seller, Reuben Smith, has agreed to take a second mortgage of $30,000 as part of the payment at closing. Eric paid an escrow deposit of $10,000 when he signed the purchase contract. Other pertinent facts include: a. The monthly interest on the first mortgage is $745, which must be paid by the 20 th day of the month. b. Reuben paid a hazard insurance policy for the calendar year 2020 . The premium was $850, and Eric has agreed to purchase Reuben's interest in the policy. c. The monthly rental of $1,250 has been collected by Reuben for June. d. The total amount of property tax for 2020 is estimated to be $2,200. The tax will be paid by Eric at the end of the year. e. The broker will pay the following expenses for Reuben and will be reimbursed at the closing: f. The broker will also pay the following expenses for Eric and will be reimbursed at the closing: Required: How will the items be prorated between the seller and buyer? (Do not round intermediate calculations and round your final answers to 2 decimal places.)