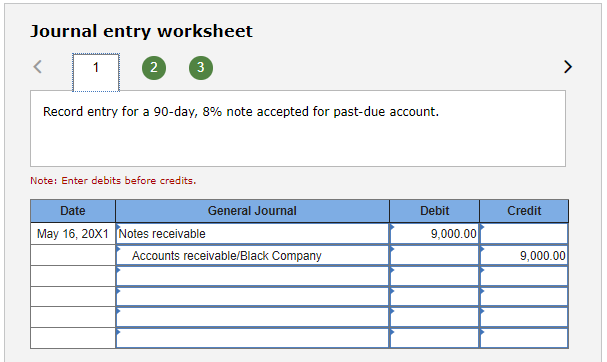

On May 16, 20X1, Safeway Company received a 90-day, 8 percent, $9,000 interest-bearing note from Black Company in settlement of Black's past-due account. On June

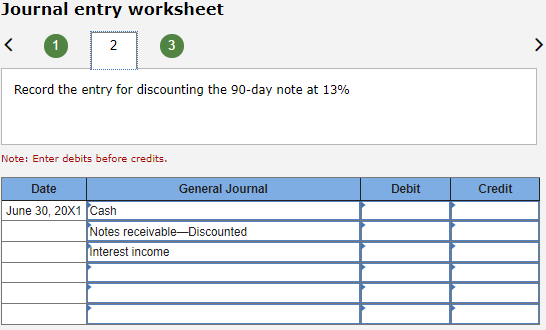

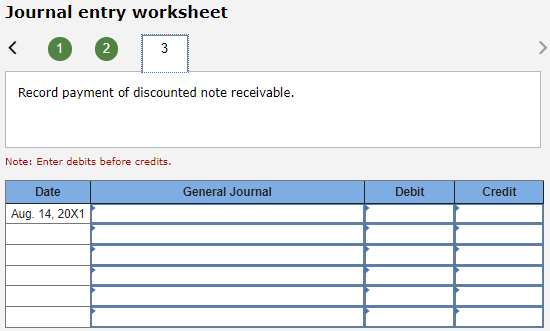

On May 16, 20X1, Safeway Company received a 90-day, 8 percent, $9,000 interest-bearing note from Black Company in settlement of Black's past-due account. On June 30, Safeway discounted this note at Fargo Bank and Trust. The bank charged a discount rate of 13 percent. On August 14, Safeway received a notice that Black had paid the note and the interest on the due date.

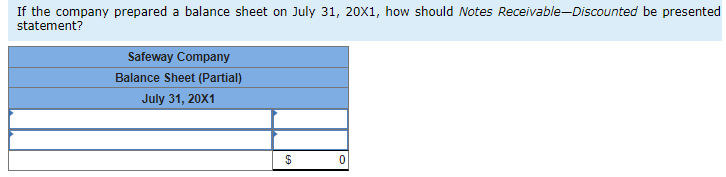

Required: Prepare the entries in general journal form to record these transactions. Analyze: If the company prepared a balance sheet on July 31, 20X1, how should Notes ReceivableDiscounted be presented on the statement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started