Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 18, 2014 AT&T announced a takeover offer for DirecTV (the target) that valued the company at $48.50bn. In the proposal, AT&T offered cash

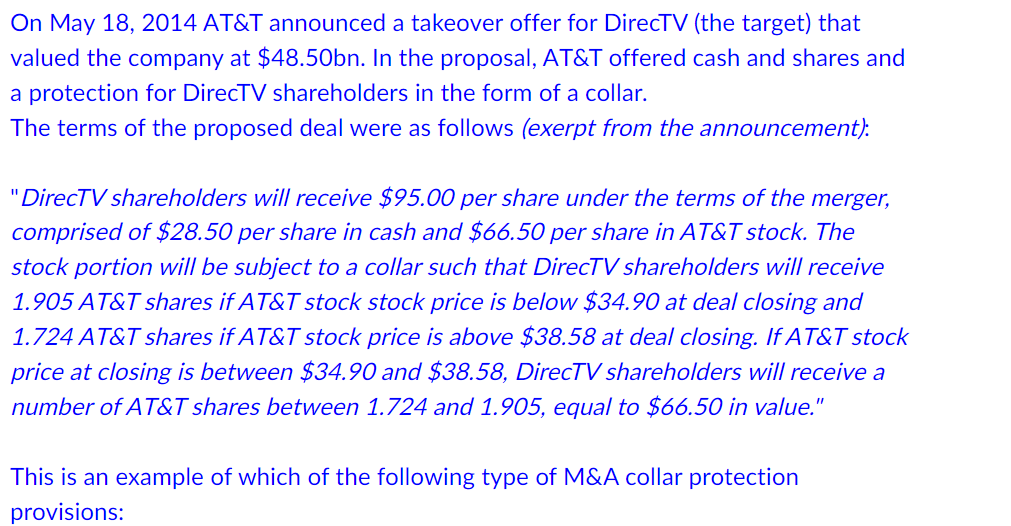

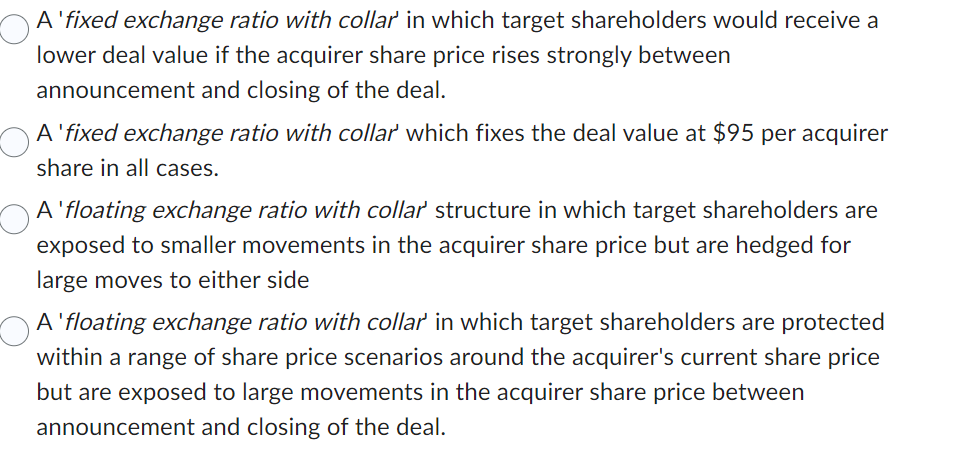

On May 18, 2014 AT\&T announced a takeover offer for DirecTV (the target) that valued the company at $48.50bn. In the proposal, AT\&T offered cash and shares and a protection for DirecTV shareholders in the form of a collar. The terms of the proposed deal were as follows (exerpt from the announcement): " DirecTV shareholders will receive $95.00 per share under the terms of the merger, comprised of $28.50 per share in cash and $66.50 per share in AT\&T stock. The stock portion will be subject to a collar such that DirecTV shareholders will receive 1.905 AT\&T shares if AT\&T stock stock price is below $34.90 at deal closing and 1.724 AT\&T shares if AT\&T stock price is above $38.58 at deal closing. If AT\&T stock price at closing is between $34.90 and $38.58, DirecTV shareholders will receive a number of AT\&T shares between 1.724 and 1.905 , equal to $66.50 in value." This is an example of which of the following type of M&A collar protection provisions: A 'fixed exchange ratio with collar' in which target shareholders would receive a lower deal value if the acquirer share price rises strongly between announcement and closing of the deal. A 'fixed exchange ratio with collar' which fixes the deal value at $95 per acquirer share in all cases. A 'floating exchange ratio with collar' structure in which target shareholders are exposed to smaller movements in the acquirer share price but are hedged for large moves to either side A 'floating exchange ratio with collar' in which target shareholders are protected within a range of share price scenarios around the acquirer's current share price but are exposed to large movements in the acquirer share price between announcement and closing of the deal

On May 18, 2014 AT\&T announced a takeover offer for DirecTV (the target) that valued the company at $48.50bn. In the proposal, AT\&T offered cash and shares and a protection for DirecTV shareholders in the form of a collar. The terms of the proposed deal were as follows (exerpt from the announcement): " DirecTV shareholders will receive $95.00 per share under the terms of the merger, comprised of $28.50 per share in cash and $66.50 per share in AT\&T stock. The stock portion will be subject to a collar such that DirecTV shareholders will receive 1.905 AT\&T shares if AT\&T stock stock price is below $34.90 at deal closing and 1.724 AT\&T shares if AT\&T stock price is above $38.58 at deal closing. If AT\&T stock price at closing is between $34.90 and $38.58, DirecTV shareholders will receive a number of AT\&T shares between 1.724 and 1.905 , equal to $66.50 in value." This is an example of which of the following type of M&A collar protection provisions: A 'fixed exchange ratio with collar' in which target shareholders would receive a lower deal value if the acquirer share price rises strongly between announcement and closing of the deal. A 'fixed exchange ratio with collar' which fixes the deal value at $95 per acquirer share in all cases. A 'floating exchange ratio with collar' structure in which target shareholders are exposed to smaller movements in the acquirer share price but are hedged for large moves to either side A 'floating exchange ratio with collar' in which target shareholders are protected within a range of share price scenarios around the acquirer's current share price but are exposed to large movements in the acquirer share price between announcement and closing of the deal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started