Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On May 30, a manufacturing facility of a medium-sized company was severely damaged by an earthquake followed by a fire. As a direct result,

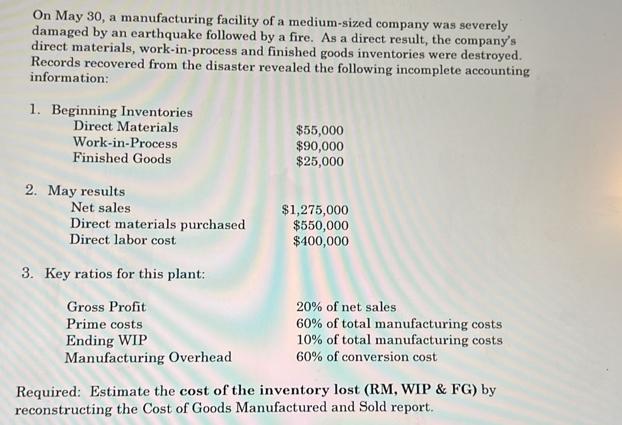

On May 30, a manufacturing facility of a medium-sized company was severely damaged by an earthquake followed by a fire. As a direct result, the company's direct materials, work-in-process and finished goods inventories were destroyed. Records recovered from the disaster revealed the following incomplete accounting information: 1. Beginning Inventories Direct Materials Work-in-Process Finished Goods 2. May results Net sales Direct materials purchased Direct labor cost 3. Key ratios for this plant: Gross Profit Prime costs Ending WIP Manufacturing Overhead $55,000 $90,000 $25,000 $1,275,000 $550,000 $400,000 20% of net sales 60% of total manufacturing costs 10% of total manufacturing costs 60% of conversion cost Required: Estimate the cost of the inventory lost (RM, WIP & FG) by reconstructing the Cost of Goods Manufactured and Sold report.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To estimate the cost of the inventory lost raw materials workinprocess and finished goods we need to reconstruct the Cost of Goods Manufactured and So...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started