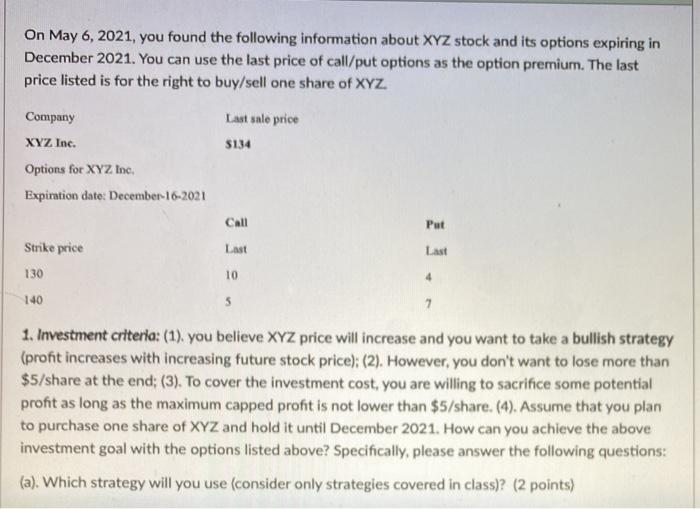

On May 6, 2021, you found the following information about XYZ stock and its options expiring in December 2021. You can use the last price of call/put options as the option premium. The last price listed is for the right to buy/sell one share of XYZ. Company Last sale price 5134 XYZ Inc. Options for XYZ Inc. Expiration date: December 16-2021 Call Put Strike price Last Last 130 10 4 140 5 7 1. Investment criteria: (1), you believe XYZ price will increase and you want to take a bullish strategy (profit increases with increasing future stock price); (2). However, you don't want to lose more than $5/share at the end; (3). To cover the investment cost, you are willing to sacrifice some potential profit as long as the maximum capped profit is not lower than $5/share. (4). Assume that you plan to purchase one share of XYZ and hold it until December 2021. How can you achieve the above investment goal with the options listed above? Specifically, please answer the following questions: (a). Which strategy will you use (consider only strategies covered in class)? (2 points) (b). How to construct the portfolio mentioned in (a) (ie. what to buy or sell to construct the portfolio)? (2 points) (c). For the strategy you choose in (a), what are the profits (expressed in formula) at different ST ?( e.g. when St

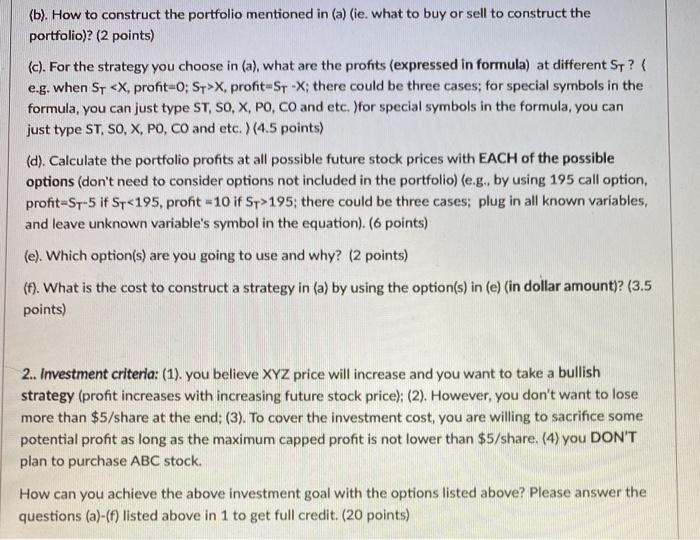

X, profit-StX; there could be three cases; for special symbols in the formula, you can just type ST, SO, X, PO, CO and etc. )for special symbols in the formula, you can just type ST, SO, X, PO, CO and etc.)(4.5 points) (d). Calculate the portfolio profits at all possible future stock prices with EACH of the possible options (don't need to consider options not included in the portfolio) (e.g., by using 195 call option, profit-St-5 if Sy195; there could be three cases; plug in all known variables, and leave unknown variable's symbol in the equation). (6 points) (e). Which option(s) are you going to use and why? (2 points) (f). What is the cost to construct a strategy in (a) by using the option(s) in (e) (in dollar amount)? (3.5 points) 2.. Investment criteria: (1). you believe XYZ price will increase and you want to take a bullish strategy (profit increases with increasing future stock price); (2). However, you don't want to lose more than $5/share at the end: (3). To cover the investment cost, you are willing to sacrifice some potential profit as long as the maximum capped profit is not lower than $5/share. (4) you DON'T plan to purchase ABC stock. How can you achieve the above investment goal with the options listed above? Please answer the questions (a)-(6) listed above in 1 to get full credit. (20 points)